Global Responsible Investment Trends Report

The United Nations Principles for Responsible Investment (UNPRI) releases a report on global responsible investment trends, aimed at summarizing responsible investment progress.

The United Nations Principles for Responsible Investment analyzes information submitted by over 3000 investors through the PRI reporting framework and compared it with information from previous years to understand the development of global responsible investment trends.

Related Post: CFA Institute Releases Responsible Investment Funds Report

Global Responsible Investment Signatories

In 2024, the United Nations Principles for Responsible Investment has a total of 3048 signatories with a cumulative asset management scale of $89.3 trillion. These signatories come from 88 countries around the world, with Europe (54%), North America (23%), and Asia (10%) accounting for a relatively high proportion. 77% of the signatories have asset management scale of less than 1 billion US dollars. In terms of asset classes held by the signatories, fixed income (39%), listed company stocks (32%), private equity (8%), and real estate (6%) account for a relatively high proportion.

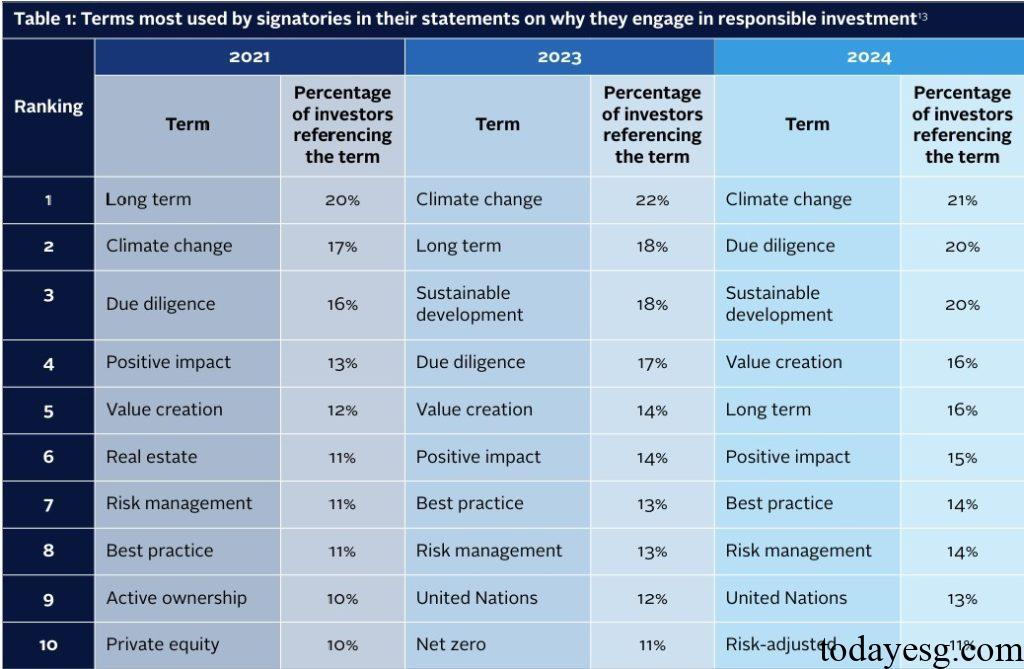

As part of the PRI reporting framework, signatories need to articulate their attitudes and priorities towards responsible investment. In the documents released by the signatories in 2024, climate change (21%), due diligence (20%), and sustainable development (20%) are mentioned more frequently. In addition, 20% of the signatories mention the United Nations Sustainable Development Goals, and 10% mention the net zero target of the Paris Agreement.

Global Responsible Investment Trends Analysis

The United Nations Principles for Responsible Investment analyzes the trend of responsible investment from the following perspectives:

Policies and Governance

In 2024, over 99% of signatories have formulated responsible investment policies, of which 86% have publicly disclosed these policies, and 60% have clearly defined the relationship between responsible investment activities and entrusted responsibilities in the policies. 93% of the signatories have officially designated board members and senior management personnel responsible for responsible investment.

Investment Analysis and Decision Making

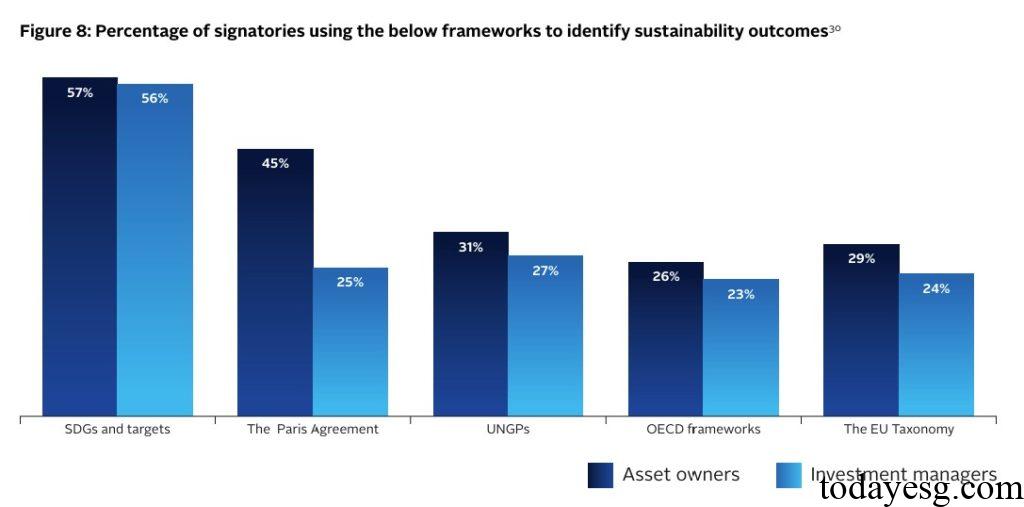

90% of signatories have established processes for incorporating ESG factors into investment decisions and have adopted sustainable development outcomes such as the United Nations Sustainable Development Goals (57%), Paris Agreement (45%), EU Taxonomy (29%), and OECD framework (26%). In terms of action reasons, sustainable risk return (44%) and regulatory requirements (30%) account for a relatively high proportion.

Stewardship with Investees and Assets

81% of the signatories manage fixed income investments, 60% have formulated proxy voting policies for listed company stocks, and 26% have publicly disclosed all proxy voting decisions. 20% of the signatories have submitted shareholder resolutions in the past three years. In terms of physical assets, 80% of the signatories have fulfilled their management responsibilities.

Participation in Collaborative Initiatives

48% of asset owners and 19% of asset managers prioritize participating in collaborative initiatives, while 29% of emerging market signatories and 22% of developed market signatories prioritize collaborative initiatives.

Policy Maker Engagement

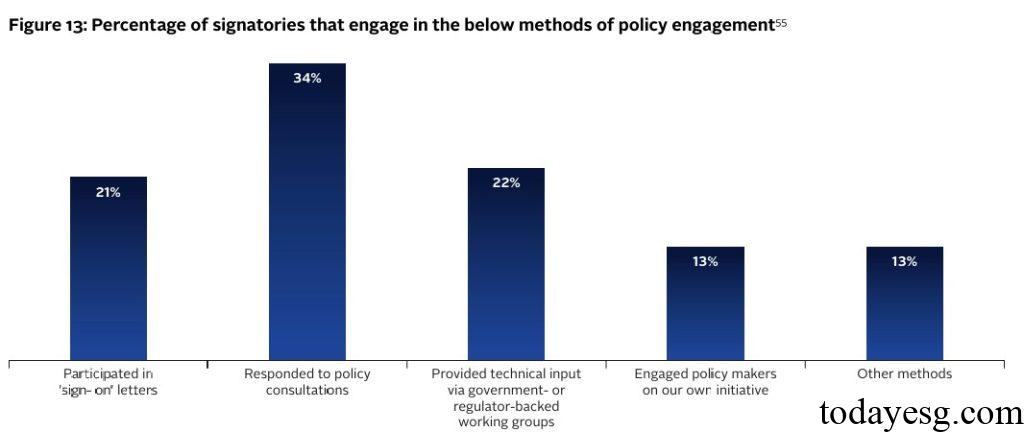

63% of signatories collaborate with policy makers, with responding to policy documents (34%), joining working groups (22%), and issuing public letters (21%) being the most important ways of participation.

External Manager Selection, Appointment, and Monitoring

91% of asset owners hire external investment managers to manage their assets, and ESG factors (98%), responsible investment terms (81%), and proxy voting procedures (81%) are important references for asset owners in the selection process.

Disclosure

When the signatories publicly disclose information, changes in responsible investment procedures (72%), changes in responsible investment regulatory policies (67%), climate related commitments (56%), and management related commitments (55%) account for a relatively high proportion.

Reference: