Sustainability Disclosure Requirements Report

The UK Sustainable Investment and Finance Association (UKSIF) releases the Sustainability Disclosure Requirements report, which aims to summarize the development of sustainability disclosure requirements in the UK.

The Sustainability Disclosure Requirements are developed by the UK Financial Conduct Authority to promote the development of the sustainable investment industry and support net zero transition.

Related Post: UK Financial Conduct Authority Plans to Revise Sustainability Disclosure Requirements

Introduction to Sustainability Disclosure Requirements

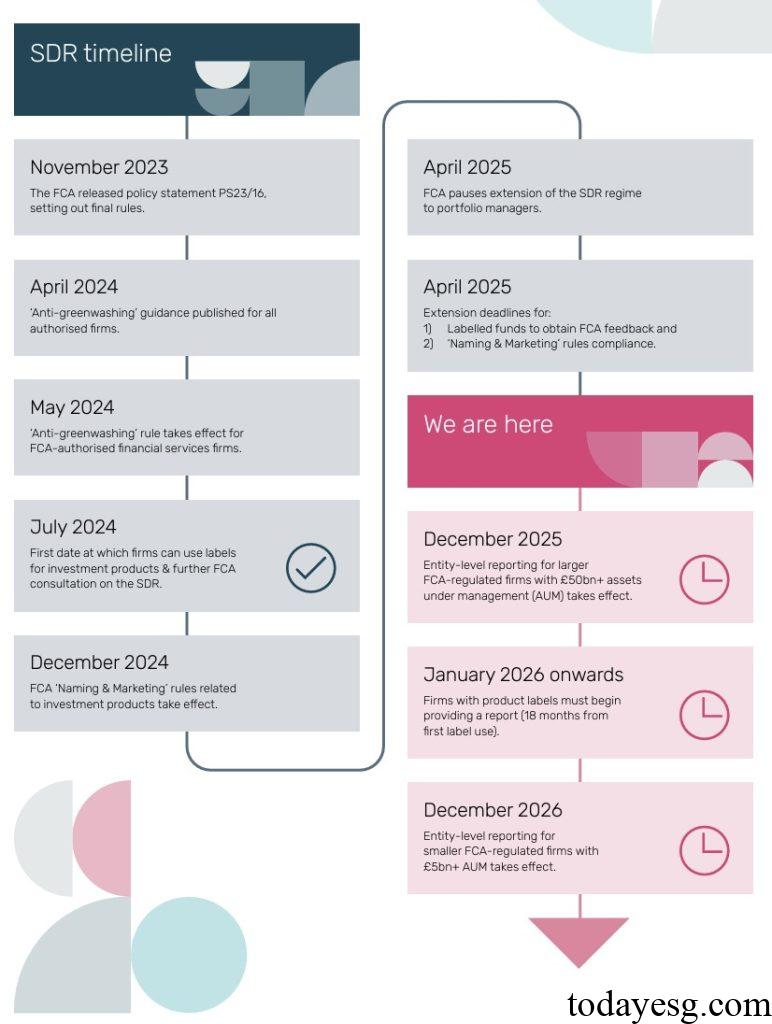

In November 2023, the UK Financial Conduct Authority released Sustainability Disclosure Requirements and investment labeling systems, requiring asset management companies managing sustainable funds to disclose sustainable information and establish sustainable fund investment labels to standardize the naming and marketing terminology of these funds. Starting from July 2024, asset management companies can apply for sustainable fund investment labels, and sustainable funds need to comply with regulatory policies by April 2025 at the latest.

Considering the company’s readiness, the UK Financial Conduct Authority has postponed the application of Sustainability Disclosure Requirements to reduce industry compliance costs. Based on delaying regulatory policies, the requirements that the sustainable investment industry needs to comply with include:

- December 2025: Large asset management companies (with a management scale of over £ 50 billion) are required to disclose sustainability information at the company level.

- January 2026: The first batch of funds with sustainable investment labels are required to disclose sustainable information at the product level. After obtaining investment labels in July 2024, these funds are required to comply with an 18-month disclosure requirement.

- December 2026: Medium sized asset management companies (with a management scale of over £ 5 billion) are required to disclose sustainability information at the company level.

Application of Sustainability Disclosure Requirements

UKSIF surveys large UK asset management companies with a management scale of £ 1.9 trillion. Respondents believe that Sustainability Disclosure Requirements face challenges in their initial implementation. For example, regulatory policies require sustainable funds to provide robust, evidence-based standards for measuring sustainable outcomes, which may involve portfolio level decisions and increase costs for fund managers. In addition, the lack of widely recognized sustainable standards in the industry makes information disclosure more complex.

When dealing with multiple assets such as sovereign bonds and emerging market securities, obtaining sustainable data is difficult. Some respondents believe that funds that meet the label of sustainable investment may narrow their investment scope in practical operations, leading to an increase in fund concentration risk and conflicting with regulatory objectives of diversification. Strict sustainability standards will make investors tend to hold similar assets, increasing the risk of the green industry. Fund managers need to consider balancing sustainability and industry distribution.

In terms of the cost of applying Sustainability Disclosure Requirements, 23% of respondents have exceeded regulatory expectations in compliance expenditures without applying for investment labels. Some funds also need to comply with the EU Sustainable Finance Disclosure Regulation (SFDR), which may result in duplicate disclosures. Respondents also need to redesign their investment list or key performance indicators, putting pressure on departments such as data, compliance, and legal.

The respondents suggested that the UK Financial Conduct Authority consider the current market size and level of asset management companies, implement Sustainability Disclosure Requirements in stages, prioritize long-term investments, and improve the interoperability of regulatory policies with international sustainable information disclosure standards.

Reference: