Investor ESG Data Report

The UK Sustainable Investment and Finance Association (UKSIF) releases an investor ESG data report, aimed at understanding their use of sustainable data.

The respondents of this report are mainly large asset management companies (80%), asset owners (10%), and wealth management companies (10%), with total asset management scale of approximately £ 4.5 trillion.

Related Post: Bloomberg Releases 2024 ESG Data Survey Report

Role of ESG Data in Investment

Respondents rate the importance of non-ESG data (such as financial statements and economic indicators) and ESG data used in investments. The results show that financial statements receive the highest score of 9.6, company strategy documents receive 8.5, followed by corporate governance information with 8.3 and climate risk data with 8.1. The ratings of market data and seller research are both less than 8 points, indicating that financial fundamentals are still the most important in investment, but the importance of ESG data is also higher than commonly used data.

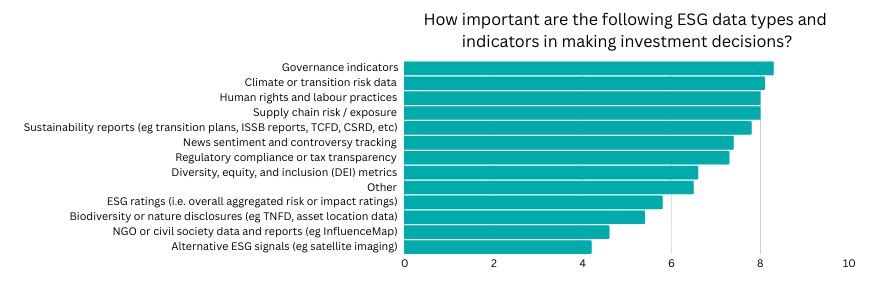

Research shows that there are significant differences in the ratings obtained from different categories of ESG data. The ratings for governance, climate, and supply chain related ESG data are 8.3, 8.1, and 7.9, while the ratings for ESG ratings and biodiversity related ESG data are 5.8 and 5.4, respectively. The overall rating of the sustainable development report is 7.8, while the overall rating of the ISSB Report is 7.3. Some respondents indicate that the main application of ESG data is using raw data points, therefore the importance of ESG ratings is relatively low.

Challenge of Using ESG Data

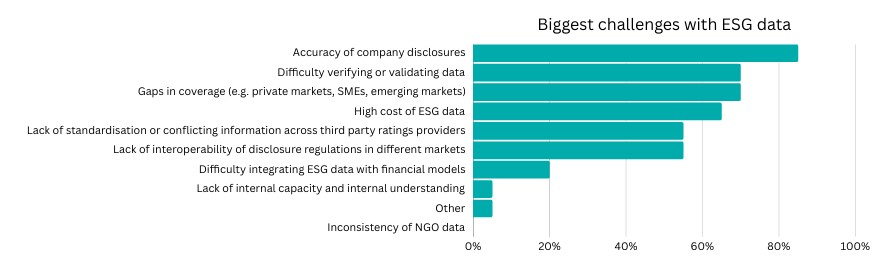

85% of respondents believe that the biggest challenge for ESG data is the accuracy of information disclosure, such as lack of professional knowledge in disclosure, lack of auditing, and inaccurate estimation data. For financial data, investors use audited one, but audited ESG data is limited, and respondents need to perform data cleaning and validation. 70% of respondents believe that it is difficult for them to independently verify or validate ESG data, and another 70% of respondents say that ESG data has insufficient coverage in the private equity market and small companies.

The overall quality evaluation of ESG data by respondents is average (65%). Some respondents believe that consistent standards can improve data quality. Regulatory agencies can consider setting up 10-15 ESG data items for different industries to reduce data that is less helpful for investment decisions. For the data provided by third-party data providers, respondents believe that they need to clearly record the sources and methods of the data and consider providing audit assurance for this data. The company can develop a transformation plan and provide more forward-looking data.

Reference: