Climate Adaptation Report in Financial Industry

The UK Financial Conduct Authority (FCA) releases a report on climate adaptation in financial industry, aimed at analyzing the climate adaptation challenges faced by financial industry and providing recommendations.

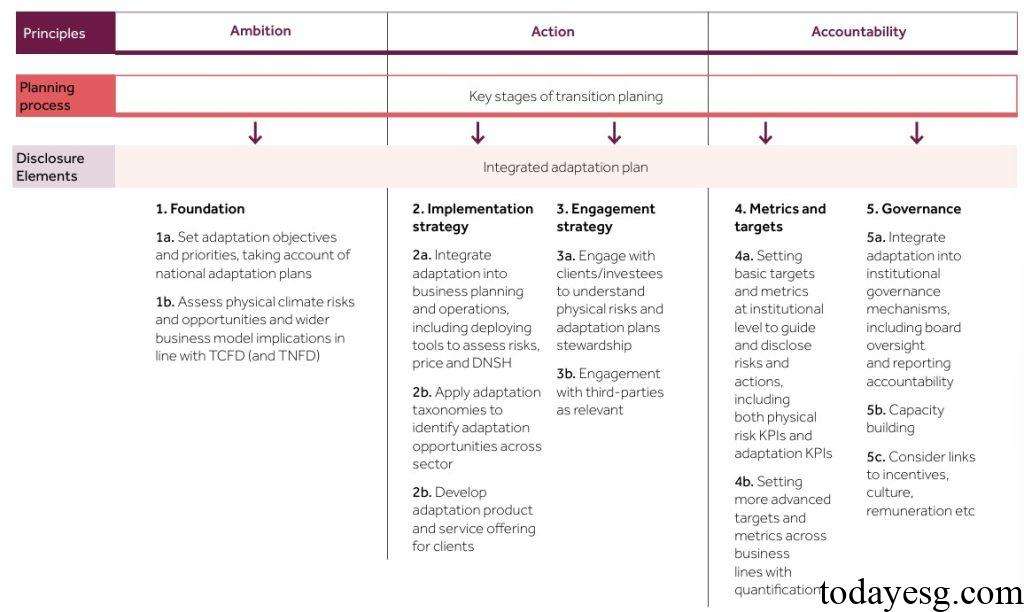

The UK Financial Conduct Authority believes that for the banking, insurance, and investment sectors in the financial industry, climate adaptation includes responding to observed climate change and preparing for future climate change.

Related Post: GIC Releases Report on Climate Adaptation and Physical Risk Model

Climate Adaptation Responsibilities of Regulatory Authority

The Financial Services and Markets Act of 2000 stipulates that the strategic goal of the UK FCA is to ensure the normal functioning of the market. The three objectives of the regulatory authority are to protect consumers, enhance the integrity of the financial system, and promote effective competition. The 2008 Climate Change Act and the 2021 Environment Act require regulatory agencies to incorporate net zero and environmental targets into their regulatory considerations.

The UK FCA believes that climate change adaptation may pose risks to financial markets. Enterprises may suffer losses due to mispricing climate risks, which can affect investors and consumers. Addressing climate change adaptation issues in financial markets can help achieve net zero goals, such as the application of transformation plans providing opportunities for businesses. The financial industry needs to constantly assess changing climate risks, improve climate adaptation capabilities, and adjust business strategies.

Climate Adaptation Risks in Financial Industry

The UK FCA analyzes the climate adaptation risks faced by the banking, insurance, and investment sectors:

- Banking: Long term climate change may increase banking business risks, such as bank customers using physical assets as collateral. Climate risk may lead to asset impairment and affect the cash flow generated by assets. Some climate risks may also lead to reduced consumer spending, affecting loan default rates.

- Insurance: Climate risk may lead to an increase in insurance claims and result in changes in some historical data. Some climate related risks cannot be insured or have limited insurance coverage, resulting in inaccurate measurement of corresponding risks in insurance and reinsurance activities. Changes in the affordability and availability of insurance may result in consumers reducing their insurance expenses.

- Investment: Asset management companies are usually shareholders or creditors of the enterprise, and the impact of climate risk on the enterprise will result in direct losses for the asset management company and its clients and may lead to investors withdrawing their investments. Blended financing mechanisms and sustainable financing frameworks can help investment sectors reduce the climate adaptation risks they face.

How to Manage Climate Adaptation Risks in Financial Industry

To manage climate adaptation risks in the financial industry, the UK FCA proposes the following recommendations:

- Use data and models: The financial industry requires high-quality climate related data and models to accurately assess and price climate risks. The financial industry can collaborate with the technology industry to convert climate information into financial information and ultimately obtain comprehensive financial models, providing a basis for decision-making.

- Develop new products: Innovative financial solutions can reduce potential losses from climate risks. For example, catastrophe bonds can transfer climate risks faced by insurance companies to bond investors. The application scope of these new financial instruments may continue to expand in the future, providing new risk return mechanisms for traditional financial markets.

- Increase climate adaptation investment: Research shows that the investment return rate of the climate adaptation industry is 16.3% higher than the market benchmark, and these investments are mainly provided by the financial industry. The financial industry can use adaptation measures as a condition for providing financial services, providing low-cost financing for risk improvement, thereby reducing financing risks.

Reference: