Corporate Climate Disclosure Requirements

The Singapore Exchange (SGX) revises corporate climate disclosure requirements with the aim of extending compliance time and reducing the burden on enterprises.

The Singapore Exchange believes that regulatory agencies need to consider the resources and preparedness of different companies, and some companies (such as small, listed companies) need more time to establish disclosure processes. At the same time, this modification still requires companies to disclose Scope 1 and Scope 2 according to the scheduled time, because these data are key information for tracking the decarbonization process.

Related Post: Singapore Introduces Mandatory Climate Disclosures

Updated Corporate Climate Disclosure Requirements

This modification is divided into listed companies and large non-listed companies, and the modification will take effect from the release of the document.

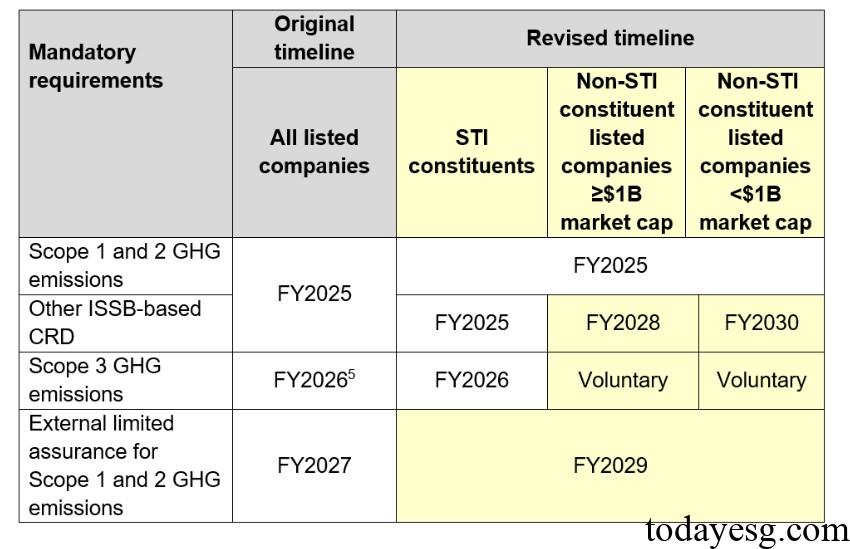

Listed Companies

The Singapore Exchange categorizes listed companies into three types, namely:

- Category 1: Component stocks of the Straits Times Index.

- Category 2: Non STI stocks with a total market value of $1 billion or more.

- Category 3: Non STI stocks with a total market value of less than 1 billion US dollars.

For carbon emission disclosure, all listed companies are required to disclose Scope 1 and Scope 2 starting from fiscal year 2025, and Scope 3 is mandatory for the first category of listed companies starting from fiscal year 2026. Second and third category companies can voluntarily disclose Scope 3. Starting from the fiscal year 2029, all listed companies are required to conduct external assurances on Scope 1 and Scope 2.

For other climate disclosures, mandatory disclosure is required for the first category of companies starting from fiscal year 2025, for the second category of companies starting from fiscal year 2028, and for the third category of companies starting from fiscal year 2030.

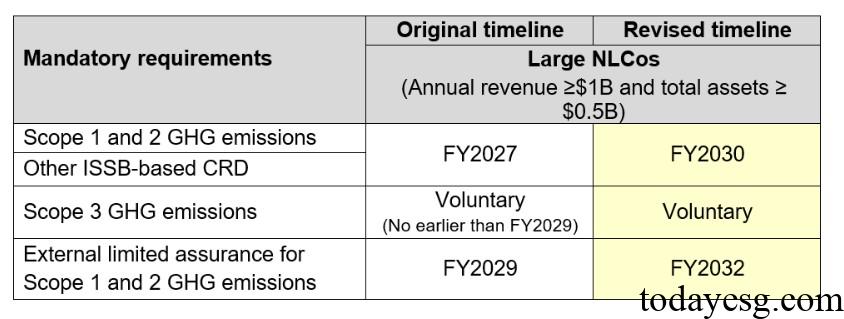

Large Non-listed Companies

The disclosure requirements for large non-listed companies (with annual revenue greater than SGD 1 billion and total assets greater than SGD 500 million) will be later than those for listed companies. For carbon emission information disclosure, these companies are required to make mandatory disclosure starting from the fiscal year 2030. For Scope 1 and Scope 2, these companies need to conduct external assurances starting from the 2032 fiscal year. For Scope 3, these companies can voluntarily disclose.

Reference:

Extended Timelines for Most Climate Reporting Requirements to Support Companies