2025 Progress Report

The Principles for Responsible Banking (PRB) releases 2025 progress report, aiming to outline the sustainable transition actions of banks.

This report is the third progress report released after the establishment of PRB, involving 350 banks from 87 countries, accounting for 50% of the total global banking scale (totaling $98 trillion).

Related Post: Climate Policy Initiative Releases 2025 Global Green Bank Report

Introduction to 2025 Progress Report

The members of Principles for Responsible Banking take the following actions in terms of various principles:

- Alignment: All members have incorporated sustainability as part of the bank’s strategy.

- Impact and target setting: Members account for 99%, 80%, 91%, and 65% respectively in analyzing impacts, setting goals, and focusing on climate and financial inclusion.

- Clients and customers: 71% have developed proactive management measures for clients, and 26% are implementing proactive management.

- Stakeholders: 79% have established processes for collaborating with stakeholders.

- Governance and culture: 99% incorporate various principles into the banking governance system.

- Transparency and accountability: 86% have released their first report on responsible banking principles, and 56% have established third-party sustainable auditing mechanisms.

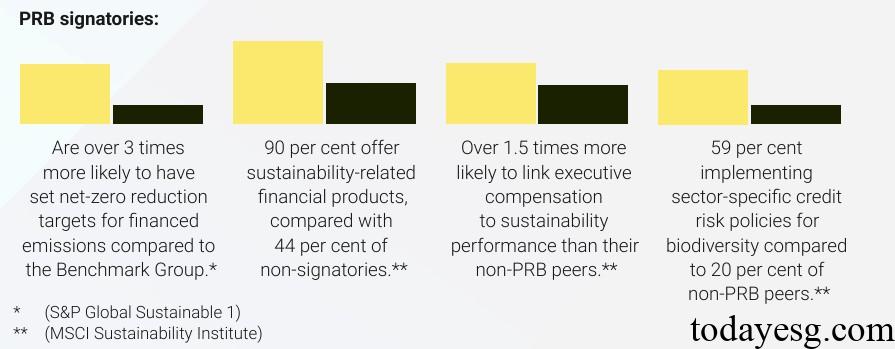

Members who join the Principles for Responsible Banking have shown significantly better performance in sustainable actions than the average, such as setting a net zero target three times higher than the average, 90% of members providing sustainable products (average of 44%), and 59% developing biodiversity industry policies (average of 20%). The main focus of members in the field of sustainability is climate change adaptation and a healthy and inclusive economy, with reduced attention to issues such as nature and circular economy.

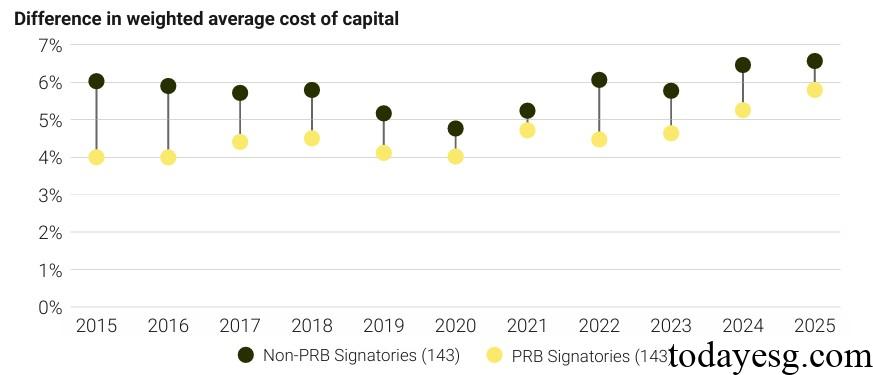

Members of Principles for Responsible Banking benefit from lower funding costs. According to a report released by the MSCI Sustainability Institute, members’ funding costs in equity and debt financing are one percentage point lower than non-members, and this trend has been ongoing for ten years. With the application of global sustainable taxonomy and information disclosure policies, members’ advantages in sustainable financing are likely to continue.

Although the Principles for Responsible Banking has made significant progress in the industry, the practical challenges of climate change and natural loss still need to be considered. The measures proposed in the report include:

- Focus on economic development: Promote and accelerate customer adaptation and transformation.

- Coordinate stakeholders: Collaborate with regulatory agencies, social and industry organizations to create a responsible business and financial environment.

- Strengthen customer engagement: Support customers in achieving transformation plans and climate goals through consulting, financing, and other means.

- Maintain Sustainable Action: Integrate sustainability into governance, strategy, risk management, financing, and investment portfolios, balancing long-term value and short-term returns.

Reference:

Principles for Responsible Banking Third Biennial Progress Report