2025 Progress Report

The Net-Zero Asset Owner Alliance (NZAOA) releases its 2025 progress report, aimed at summarizing the progress of climate action by asset owners.

As of September 2025, the Net-Zero Asset Owner Alliance has 87 signatories, with a total asset size of $9.2 trillion.

Related Post: Net-Zero Asset Owner Alliance Releases 2024 Progress Report

Introduction to the 2025 Progress Report

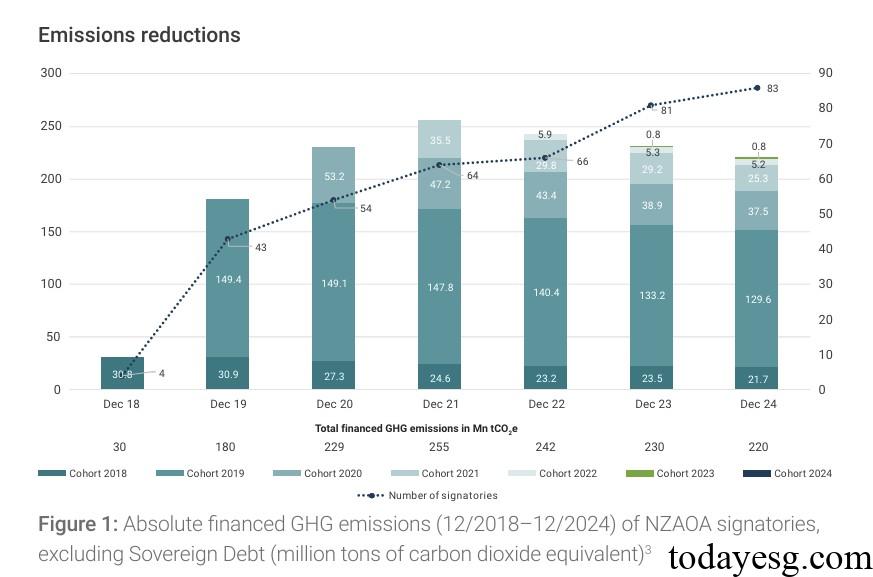

In 2024, the greenhouse gas emissions financed by members of the Net-Zero Asset Owner Alliance amounted to 220 million tons of carbon dioxide, a decrease from 230 million tons in 2023. Despite the continuous increase in the number of signatories (from 64 in 2021 to 81 in 2024), the overall greenhouse gas emissions financed by these members continued to decline. Analyzing the decarbonization data of financial assets held by members, it was observed that the carbon emission intensity of listed company stocks decreased from 86 tons per $1 million in 2022 to 55 tons per $1 million in 2024. Similarly, the carbon emission intensity of corporate bonds reduced from 79 tons per $1 million to 61 tons per $1 million.

In 2024, 60 signatories set science-based portfolio targets with an asset size of $2.5 trillion. These targets encompassed both individual asset classes and portfolio-level objectives. Among these portfolio targets, 88% have been fully achieved, representing an asset size of $2.2 trillion, while the remaining 12% have been partially achieved. In terms of industry targets, 15% of signatories have set specific industry-specific goals. However, due to members typically considering specific asset classes and benchmarks for investment, progress in the industry sector has been relatively slow. The Net-Zero Asset Owner Alliance continues to refer to the Net Zero Investment Framework to develop future industry transition financing guidelines, encouraging members to allocate funds to high-carbon emitting companies and assets.

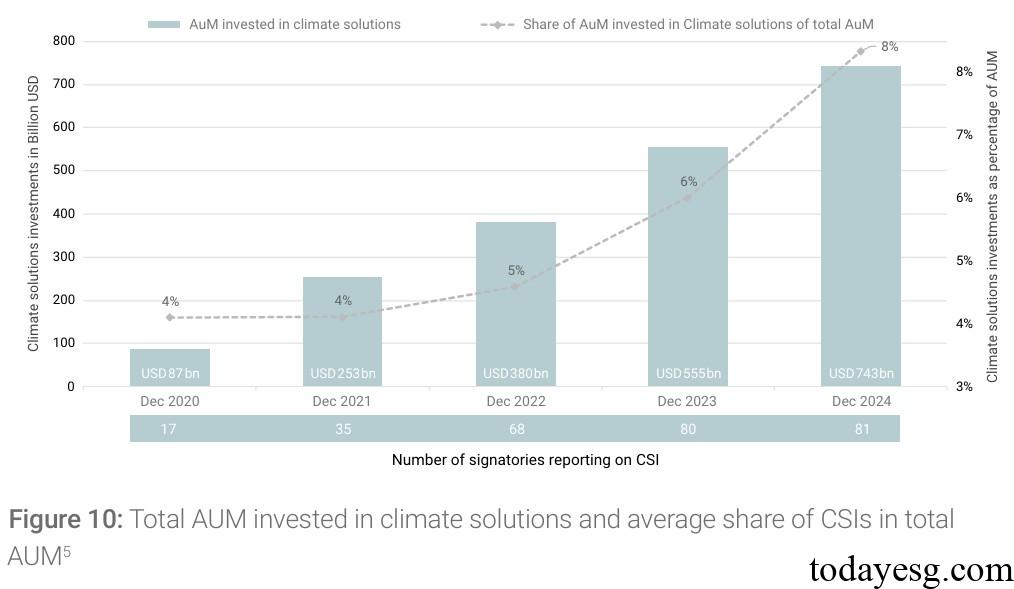

Climate solutions are a key factor in addressing long-term climate risks. Over the past few years, members’ investment in climate solutions has continued to increase, reaching a total of $743 billion in 2024, accounting for 8% of the total managed assets. The number of signatories has grown from 17 in 2020 to 81 in 2024. Analyzing by asset category, listed company stocks (31%), corporate bonds (26%), and real estate (18%) account for a relatively high proportion. The Net-Zero Asset Owner Alliance plans to expand investment in areas such as energy transition, sustainable bonds, carbon removal, natural solutions, and blended finance.

In terms of engagement, members are adopting responsible investment practices to address climate risks and achieve long-term returns. By the end of 2024, members had achieved 78% of their engagement targets. These engagement targets are either collaborated with enterprises or entrusted through asset management companies. The Net-Zero Asset Owner Alliance plans to continue enhancing the efficiency of asset management companies’ engagement, with a special focus on members’ actions in private climate investment and promoting collaboration between members and multilateral financial institutions.

Reference: