Position Paper on Governmental Carbon Pricing

The Net Zero Asset Owner Alliance (NZAOA) releases a position paper on governmental carbon pricing, aimed at analyzing the development of global carbon pricing tools and providing recommendations for regulatory agencies on carbon pricing design.

The Net Zero Asset Owner Alliance believes that carbon pricing is an important climate policy tool to achieve the Paris Agreement, which can provide incentives for decarbonization activities and promote cost-effective carbon reduction. The NZAOA manages over $9.5 trillion, and carbon pricing will help it establish a net zero investment portfolio by 2050.

Related Post: WEF Releases Voluntary Carbon Market Report

What is Carbon Pricing

Carbon pricing refers to the clear pricing of greenhouse gas emissions, forcing companies to internalize the cost of carbon emissions. It promotes enterprises to reduce emissions or transit from high emission production to low emission production by increasing the cost of carbon emissions. Enterprises may transfer some of the costs generated by carbon pricing to consumers, thereby increasing the prices of products and services. Consumers are motivated to choose low-carbon emission products and services while bearing high costs, thereby reducing the demand for high carbon emission products and services.

Carbon pricing is an effective incentive for emission reduction, which can use market supply and demand to regulate corporate carbon emissions and reduce the impact of direct regulatory intervention. There are two most important carbon pricing methods globally, namely the Emission Trading System and Carbon Taxes. The emissions trading system sets a cap on carbon emissions within the industry and distributes emission permits to enterprises. Enterprises can choose to reduce carbon emissions or purchase emission permits in the market. The carbon tax requires companies to pay a fixed price for their carbon emissions, and its cost is relatively stable and easy to predict.

In addition to the two carbon pricing methods mentioned above, hybrid carbon pricing tools are also rapidly developing. This type of tool is mainly based on the emission trading system, but sets price limits and thresholds, and combines the characteristics of the emission trading system and carbon tax. In addition, some jurisdictions have allowed companies to use carbon credits instead of carbon taxes. According to World Bank, there are currently 73 carbon pricing tools and plans worldwide, covering 23% of global carbon emissions. EU research shows that since 2005, the EU Emissions Trading System has reduced carbon emissions by 37%.

Suggestions for Designing Governmental Carbon Pricing Tools

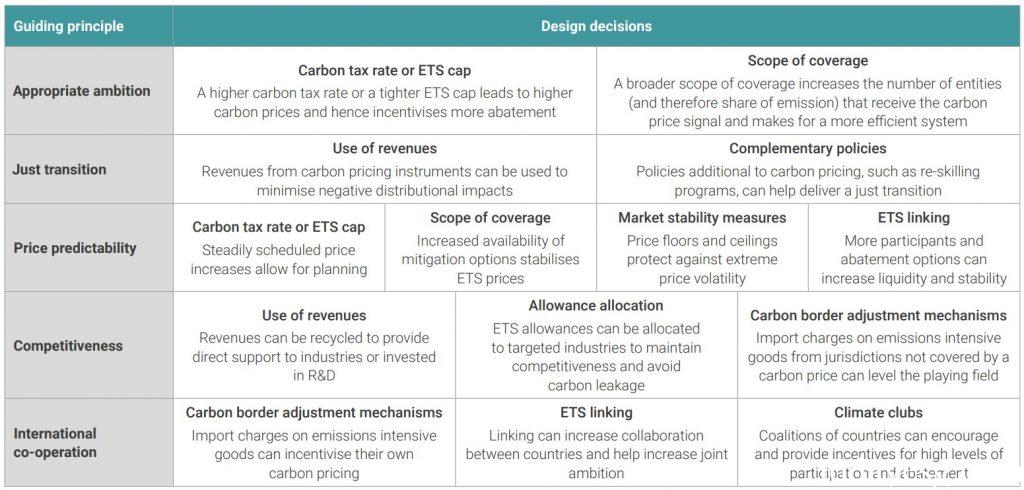

The Net Zero Asset Owner Alliance believes that each jurisdiction needs to design governmental carbon pricing tools based on the following principles:

- Ensure appropriate coverage and ambition: The two important factors affecting carbon pricing tools are their coverage and ambition. Currently, most carbon pricing tools include the industrial, power, and construction industries, with a few covering the aviation and transportation industries. According to the global warming target, the current carbon pricing is significantly lower than the warming paths of 2 degrees Celsius and 1.5 degrees Celsius. In OECD countries, 90% of carbon prices are below $37 per ton, and to achieve net zero, carbon prices need to reach $147 per ton by 2030.

- Deliver a just transition for society: Although carbon pricing tools can create new investment opportunities, they may lead to greater negative impacts on carbon intensive industries and regions. Therefore, the income generated by carbon pricing tools should achieve fair social transformation. At present, the global carbon pricing revenue is about 95 billion US dollars per year, of which 40% is used for green spending and 10% is used for direct transfer payments.

- Provide a predictable price signal: A predictable carbon price can help businesses plan and invest in low-carbon technologies, achieve effective capital allocation, and long-term incentives. For example, regulatory agencies can set a gradually increasing carbon tax to provide stakeholders with adjustment time. Regulatory agencies can also establish price corridors in the emissions trading system to reduce excessive fluctuations in carbon prices.

- Minimize competitive distortions for firms: Although carbon pricing may encourage high carbon emitting companies to reduce emissions, it may also lead to carbon leakage, where high carbon emitting companies shift production to jurisdictions with lower carbon prices. Regulatory agencies need to consider how to reduce such risks, such as the Carbon Border Adjustment Mechanisms designed by the European Union, which can reduce the risk of carbon leakage and promote carbon emission activities in the international market.

- Promote international cooperation: Various jurisdictions can engage in international cooperation to jointly develop carbon pricing tools. For example, the United Nations Framework Convention on Climate Change is an important channel for international cooperation and has also contributed to the Paris Agreement.

Reference:

Net-Zero Asset Owner Alliance’s Updated Position on Governmental Carbon Pricing