Global Nature-related Litigation Report

The Network for Greening the Financial System (NGFS) releases a global report on nature-related litigation, aimed at analyzing the financial risks of nature litigation and providing guidance for central banks and regulatory agencies.

The NGFS believes that the number of nature-related lawsuits on topics such as deforestation, ocean degradation, and plastic pollution is constantly increasing. Both nature-related lawsuits and climate-related lawsuits will have an impact on the financial system, and nature-related litigations have become important tools for parties to influence regulations and change social behaviors.

Related Post: UNEP Releases Report on Global Climate Litigation

Introduction to Nature-related Litigation

The NGFS defines nature-related litigation as all litigation cases submitted to judicial institutions, with a focus on climate, biodiversity loss, and ecosystem service degradation. Natural related litigation can be divided into two categories, namely:

Litigations against public entities: Lawsuits against public entities are primarily based on human rights related to nature, and litigants may argue that the activities of public entities affect the right to a healthy environment, the rights of indigenous communities, and the rights of nature. There are also some lawsuits based on the relationship between climate and nature, which involve climate protection laws to mitigate and adapt to the impacts of climate change.

Litigations against enterprises: The number of lawsuits against enterprises accounts for a relatively small proportion but is rapidly increasing. The litigants may believe that the company’s activities violate sustainable due diligence legislation or other laws, as well as negative natural related actions that affect shareholder rights. Some lawsuits are based on OECD National Contact Points, which are used to resolve cases of non-compliance with the OECD Guidelines for Multinational Enterprises on Responsible Business Conduct.

Nature-related litigation is closely related to global regulatory policies and legislation in various jurisdictions. The 1992 Convention on Biological Diversity provided a reference for nature-related litigation, and the 2022 Kunming-Montreal Global Biodiversity Framework established nature-related goals. The Task Force on Nature-related Financial Disclosures in 2023 has issued recommendations to include nature-related risks and opportunities in the disclosure framework. In 2024, the European Union officially passed the Corporate Sustainability Due Diligence Directive, which requires companies to reduce the impact of their business activities on the environment.

Nature-related Litigation and Financial Risks

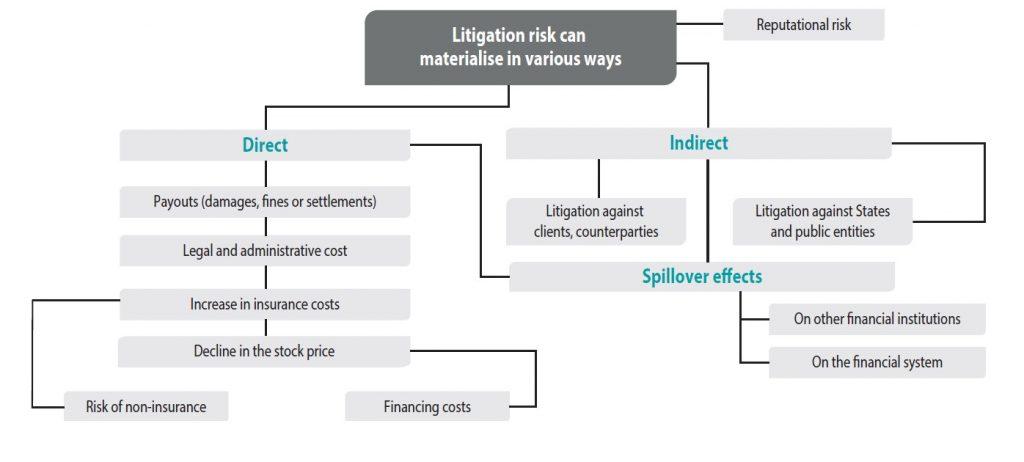

The NGFS believes that nature-related litigation can generate financial risks through various channels. Lawsuits against public institutions may prompt the release of new natural regulatory policies, increasing compliance costs in the market. Lawsuits against enterprises can directly generate financial risks, such as legal fees, damages, fines, and reputation risks.

Besides impact on a single case, natural related litigation may also have spillover effects on other companies in the same industry. Based on the connections between various enterprises in the financial system, these risks may continue to propagate within the industry and generate credit risk, operational risk, and liquidity risk. NGFS finds that financial institutions have become direct targets of nature-related litigation, with three nature-related lawsuits against financial institutions in 2023.

Development of Nature-related Litigation

Although nature-related litigation is still in its early stages, with the development of climate litigation and market awareness of natural risks, these lawsuits may continue to grow in the future. The development of international law and natural information disclosure may enable litigants to use cross-border networks to file lawsuits in different jurisdictions. The deepening of the relationship between climate and nature may lead to the joint filing of climate-related lawsuits and nature-related lawsuits, strengthening their synergistic impact.

Although quantifying climate related litigation risks are still in early stage, based on the impact of climate-related litigation on corporate value, it is likely that similar outcomes will arise. The NGFS recommends that central banks and regulatory agencies closely monitor the development of nature-related litigation and measure the impact faced by the financial system.

Reference:

Nature-related Litigation: Emerging Trends and Lessons Learned from Climate-related Litigation