Nature-related Financial Disclosures Guidance

The Sustainable Stock Exchanges Initiative (SSEI) releases Nature-related Financial Disclosures Guidance, aimed at providing exchanges with recommendations on natural information disclosure for listed companies.

The Sustainable Stock Exchanges Initiative believes that exchanges can help listed companies incorporate natural related risks and opportunities into their operational and investment strategies to meet the natural information disclosure requirements of investors and regulatory agencies.

Related Post: Taskforce on Nature-related Financial Disclosures Releases 2025 Status Report

Background of Nature-related Financial Disclosures Guidance

The World Federation of Exchanges believes that exchanges need to give equal importance to natural and climate issues. The Nature-related Financial Disclosures Guidance can help listed companies identify, evaluate, disclose, and respond to natural dependencies and impacts, enhancing long-term value. The role of exchanges in natural information disclosure includes:

- Support natural disclosure, natural goals, and transformation plans of listed companies.

- Incorporate nature related considerations into the financial system to promote the development of green finance and natural finance.

- Establish infrastructure for natural related issues.

- Provide natural knowledge education to financial market participants.

- Collaborate with regulatory agencies to address the implementation of natural information disclosure.

Introduction to Nature-related Financial Disclosures Guidance

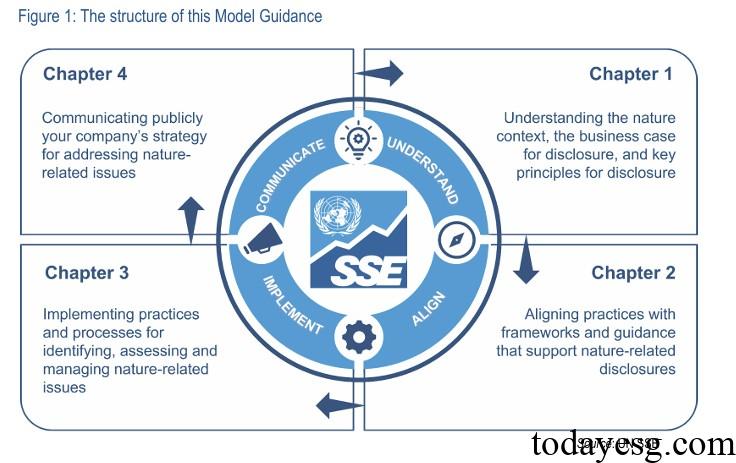

This guidance is based on the Taskforce on Nature-related Financial Disclosures (TNFD) framework and aims to assist exchanges in providing natural disclosure guidelines for listed companies. The guide is divided into the following sections:

- Understand: Introduce the role and material impact of nature on the global economy, as well as the operational, regulatory, and reputational risks that arise naturally. Most goods and services do not consider environmental costs, resulting in unsustainable use of natural resources. Enterprises need to address nature-related risks and opportunities to reduce risks and adapt to regulatory policies. Investors also need reliable natural information disclosure to evaluate the long-term resilience of their investment portfolios.

- Align: Introduce the global nature related disclosure framework and practices, as well as the resources available to listed companies. The TNFD recommendations refers to the sustainable global information disclosure framework and provides voluntary disclosure recommendations for enterprises. These recommendations apply to developed economies and emerging market economies and are consistent with the Global Biodiversity Framework. The Taskforce on Nature-related Financial Disclosures also provides a series of indicators, scenario analysis, industry guidelines, etc. to help companies improve the interoperability of information disclosure.

- Implement: Introduce methods for listed companies to identify and evaluate natural dependencies, impacts, risks, and opportunities. Listed companies can use the positioning, evaluation, measurement, and preparation methods proposed by the Taskforce on Nature-related Financial Disclosures and flexibly apply them based on their industry and geographical location. This method can help companies understand their natural issues in the business chain and value chain.

- Communicate: Introduce how listed companies incorporate nature into their sustainability reports. Investors are the core users of information disclosure in listed companies, and natural disclosure should be centered around investors, maintaining consistency, clarity, and credibility. Natural batches also need to consider other affected stakeholders, correctly assess and manage natural risks and opportunities.

Reference:

UN SSE and TNFD Launch Model Guidance on Nature-related Financial Disclosures