2025Q4 Global Transition Finance Report

MSCI releases 2025Q4 global transition finance report, aimed at summarizing transition finance development.

This report not only focuses on corporate carbon emissions and climate goals but also explores investors’ concerns about renewable energy related carbon emissions and the proportion of low-carbon energy in portfolios.

Related Post: CDP Releases Global Corporate Transition Finance Report

Global Carbon Emissions and Climate Targets

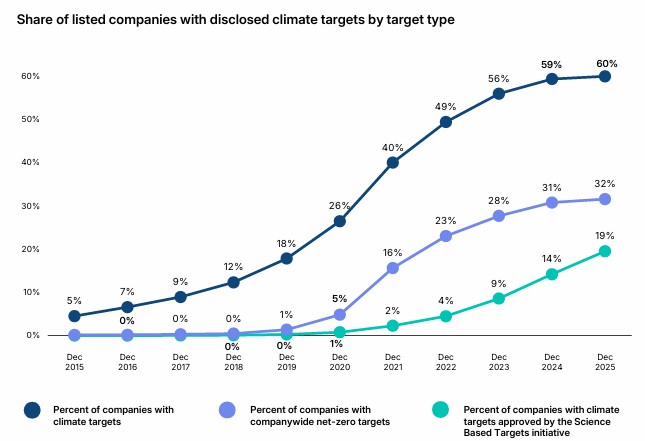

By the fourth quarter of 2025, 60% of listed companies worldwide have set climate targets, an increase of 1 percentage point year-on-year. 32% of companies have set an overall net zero target, and 19% of companies have obtained certification from the Science Based Target Initiative for their climate goals. In terms of carbon emissions, 79% of listed companies have disclosed Scope 1 and Scope 2 carbon emissions, up from 76% a year ago. 56% of listed companies have disclosed Scope 3 carbon emissions, up from 51% a year ago. Due to the difficulty for companies to quantify their value chain emissions, their Scope 3 carbon emission reporting rate is relatively low.

MSCI analyzes the implied temperature rise based on current corporate emissions, carbon budget, and climate targets. By the end of this century, global temperatures will rise by 3 degrees Celsius compared to preindustrial levels, with 12% of listed companies meeting the 1.5-degree Celsius warming target, 26% of listed companies experiencing temperatures between 1.5 and 2 degrees Celsius, and 26% of listed companies experiencing temperatures above 3.2 degrees Celsius.

2025Q4 Global Transition Finance Development

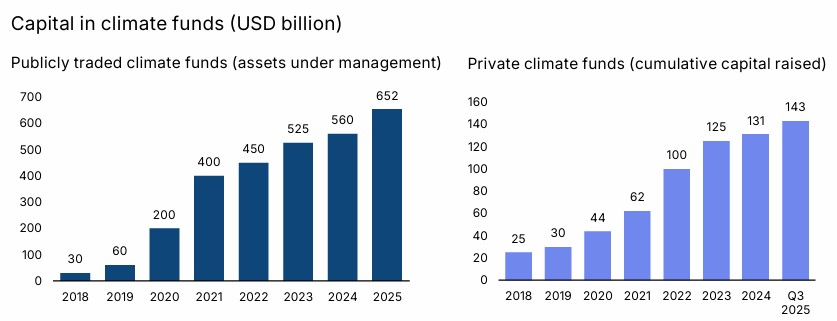

Despite reduced climate policy support from global regulations, investors’ support for technologies such as alternative energy, energy efficiency, and smart grids remains strong. The median return rate of climate funds in 2025 is 12.2%, higher than 5.2% in 2024. The asset size of climate themed funds reaches 652 billion US dollars by 2025, an increase of 16.4% compared to 2024. In addition to publicly traded funds, there are nearly 230 climate named private equity funds worldwide, including private equity, private credit, infrastructure funds, and venture capital funds, with a total asset size of approximately 143 billion US dollars.

To reduce carbon emissions from fossil fuels, companies typically purchase renewable energy sources to lower Scope 2 carbon emissions. The Global Green Partnership requires Scope 2 carbon emissions to be linked to the actual location and time of electricity production, ensuring that carbon emissions accurately reflect the decline in grid emissions. In this situation, the carbon emissions reduction generated using renewable energy by enterprises may decrease.

To study the investment situation of bond investors in low-carbon energy and traditional energy, MSCI studies the ratio of low-carbon energy income to traditional energy income in the investment portfolio, where ratio 1 represents that the total low-carbon business income is equal to the total fossil fuel business income. As of the end of 2025, the ratio of MSCI Emerging Markets Corporate Bond Index is the lowest at 0.03. The MSCI USD Paris Aligned Corporate Bonde Index has the highest ratio at 2.57.

Reference: