2024H2 Global Sustainable Fund Report

Morgan Stanley Institute for Sustainable Investing releases 2024H2 global sustainable fund report, aimed at summarizing the development of global sustainable funds.

Morgan Stanley Institute for Sustainable Investment uses the Morningstar database to track the size, fund flows, and performance of sustainable funds, and regularly releases sustainable fund reports.

Related Post: Morgan Stanley Releases 2024 H1 Global Sustainable Fund Report

2024H2 Global Sustainable Fund Overview

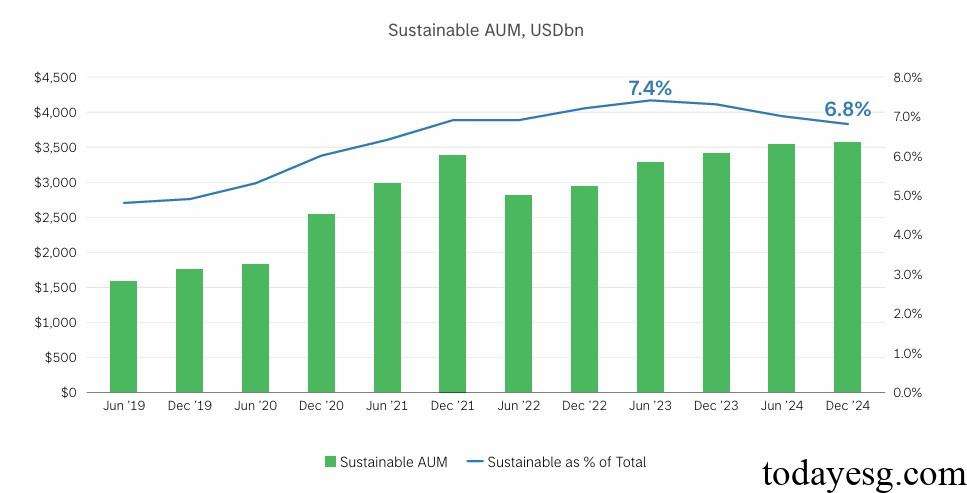

As of December 2024, the global sustainable fund AUM is $3.56 trillion, an increase of 4.8% compared to December 2023 and 0.9% compared to June 2024. From the analysis of the proportion of sustainable funds, the proportion of sustainable funds in December 2024 was 6.8%, a decrease of 0.6 percentage points compared to December 2023. Sustainable asset sizes in Europe, North America, and Asia account for 87%, 10%, and 3%, respectively.

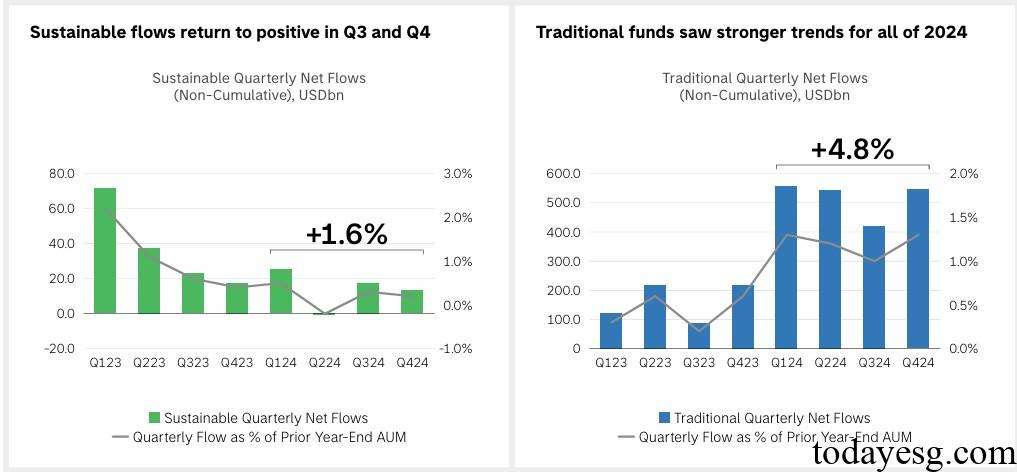

The total inflow of global sustainable funds in 2024H2 is 30.6 billion USD, and the total inflow of sustainable funds for the whole year of 2024 is 54.7 billion USD, which is 1.6% of the total AUM in 2023. Since the first quarter of 2023, sustainable funds have only recorded outflows of $1 billion in the second quarter of this year. From a regional perspective, the European Sustainable Fund inflows amounted to 32.3 billion USD, the Asian Sustainable Fund outflows amounted to 4.5 billion USD, and the North American Sustainable Fund outflows amounted to 6.3 billion USD.

From the perspective of fund investment, Latin America (14.5 billion USD), the world (7.3 billion USD), and Europe (5.8 billion USD) are the main investment regions for sustainable funds in 2024H2. Based on European Sustainable Finance Disclosure Regulation (SFDR), Article 8 funds had a total inflow of $389 billion in 2024, while Article 9 funds had a total outflow of $22 billion in 2024.

2024H2 Global Sustainable Fund Performance

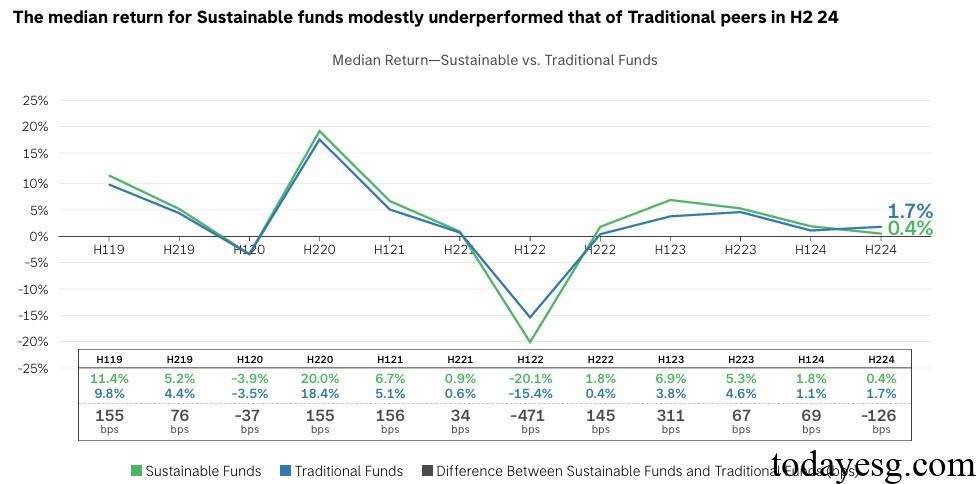

The median return of global sustainable funds in 2024H2 is 0.4%, which is lower than that of non-sustainable funds (1.7%). The best performance of sustainable funds was in the first quarter of 2023, at 6.9%. Sustainable funds investing in the Americas and Asia performed the best, with median returns of 5.3% and 3.2%, both higher than non-sustainable funds. The median return of sustainable funds investing in Europe is -1.8%, which is lower than that of non-sustainable funds. Because the proportion of sustainable funds investing in Europe is 24%, higher than that of non-sustainable funds (13%), the overall return is also lower than that of non-sustainable funds.

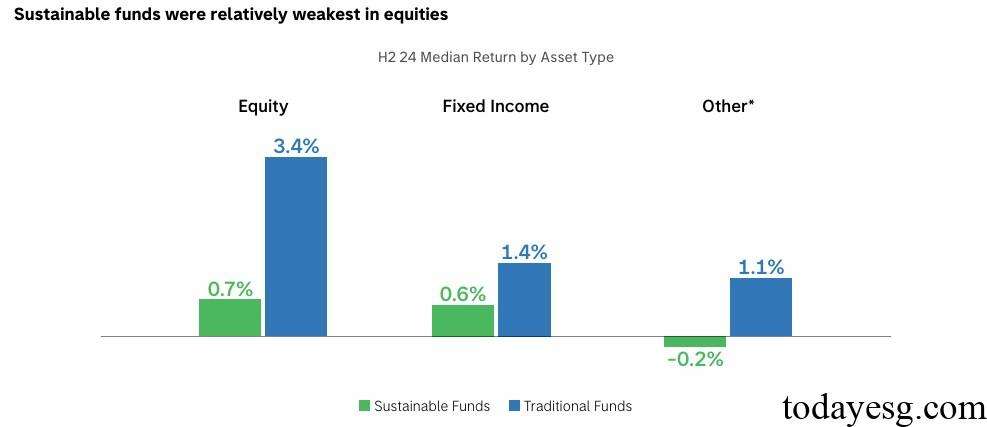

If investing $100 from 2019, the net asset value of sustainable funds will be $136 and the net asset value of non-sustainable funds will be $131 by the end of 2024. From an asset class analysis, the median returns of sustainable funds in stocks and bonds are 0.7% and 0.6%, both lower than non-sustainable funds (3.4% and 1.4%). In other categories such as multi asset, real estate, commodities, etc., the return rate of sustainable funds (-0.2%) is also lower than that of non-sustainable funds (1.1%). 56% of sustainable funds will have returns greater than zero, while 68% of non-sustainable funds will have returns greater than zero.

2024H2 Global Sustainable Fund Regulation

Morgan Stanley focuses on the sustainable fund naming guidelines released by the European Securities and Markets Authority (ESMA), which require funds to standardize the use of ESG or sustainable terms starting from May 2025. Currently, 2% of Article 8 funds and 75% of Article 9 funds use these terms.

Since October 2013, 140 funds have changed their names, accounting for 3% of the total number of funds using these terms. 90% of funds have completely removed sustainability related terms, while the remaining funds have modified their terminology.

Reference: