Global Sustainable Fund Report

Morningstar has released its Q3 2025 Global Sustainable Fund Report, which aims to summarize the progress of sustainable fund asset size and fund flow.

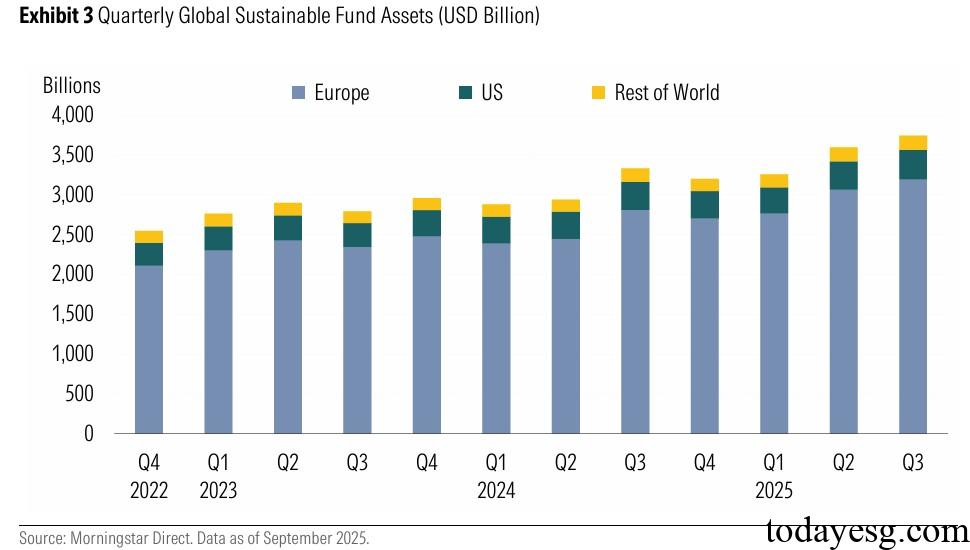

As of September 2025, the total size of global sustainable funds is $3.7 trillion, an increase of 4% compared to June 2025.

Related Post: Morningstar Releases 2025 Q2 Global Sustainable Fund Report

Global Sustainable Fund Development

In the third quarter of 2025, the global sustainable fund recorded a capital outflow of $55 billion, mainly from the European region ($51 billion). The scale of sustainable funds has reached 3.7 trillion US dollars, with three consecutive quarters of growth. Europe (85%) and the United States (10%) have relatively large proportions. The European sustainable fund accounts for 19% of traditional funds, while the United States accounts for 1%. In the third quarter, a total of 26 sustainable funds were issued globally, a decrease from the second quarter (92 funds), with 20 funds issued in Europe.

European Sustainable Fund Development

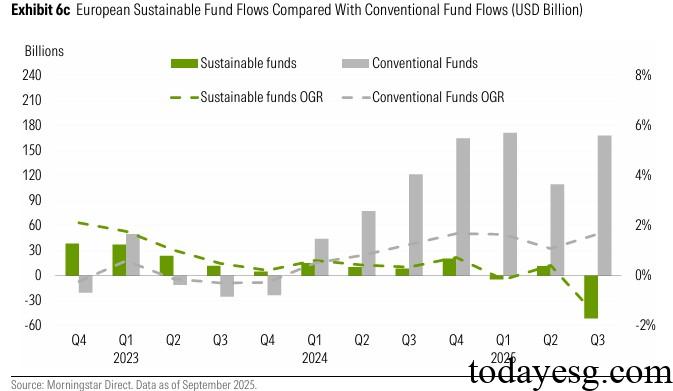

In the third quarter of 2025, Europe recorded a sustainable outflow of $51 billion, with an inflow of $11.3 billion in the second quarter. Traditional European funds recorded a capital inflow of $168 billion, an increase of $58 billion compared to the second quarter. From an asset class analysis, the net inflow of sustainable bond funds was $8.6 billion, and the net outflow of stock funds was $55 billion. The total asset size of the European sustainable fund in the third quarter was $3.2 trillion, an increase of $100 billion compared to the second quarter, with a high proportion of equity funds (63%) and bond funds (24%). In the third quarter, 20 sustainable funds were issued in Europe, a decrease of half compared to the second quarter.

After the European Securities and Markets Authority (ESMA) released naming rules for ESG funds and they officially came into effect in May 2025, a total of 118 funds changed their names in the third quarter, with over half of them removing ESG terminology. Starting from January 2024, over $1 trillion of European ESG funds have been renamed, with over 1500 of them accounting for 28% of the total.

United States Sustainable Fund Development

In the third quarter of 2025, sustainable funds in the United States recorded a net outflow of $5.2 billion, followed by an outflow of $5.9 billion in the second quarter, of which $5 billion was from actively managed funds. Traditional funds in the United States recorded a net inflow of $236 billion, an increase of over $150 billion compared to the second quarter. From the perspective of asset classes, sustainable stock funds flowed out $6 billion and bond funds flowed out $1.1 billion. The total size of sustainable funds in the third quarter was $367 billion, an increase of 3.8% compared to the second quarter. Among them, actively managed funds and passively managed funds accounted for 55% and 45% respectively, with stocks (83%) and bonds (15%) accounting for a relatively high proportion.

Reference: