2024 Q3 Global Sustainable Fund Report

Morningstar releases 2024 Q3 Global Sustainable Fund Report, which aims to summarize sustainable fund development globally and in key regions.

In 2024 Q3, the net inflow of global sustainable funds was $10.4 billion, an increase of $4.1 billion compared to the previous quarter. The inflow of funds was mainly due to the slowdown of sustainable fund outflows from the United States, Japan, and Canada.

Related Post: Morningstar Releases 2023 Q3 Global Sustainable Fund Report

Global Sustainable Fund Development

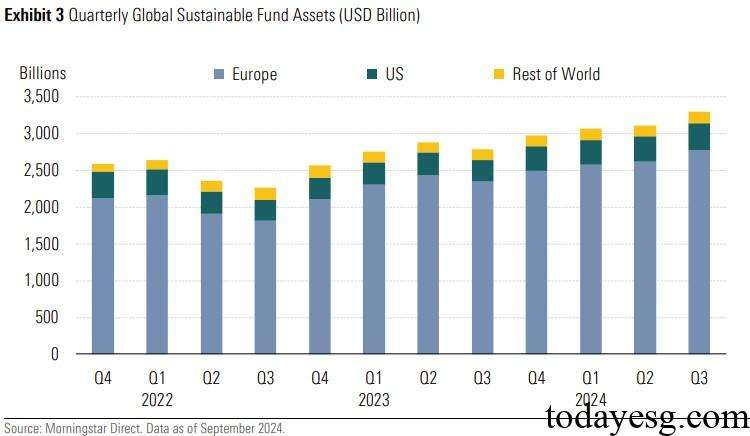

As of September 2024, there are a total of 7609 global sustainable funds with total assets reaching $3.3 trillion. Europe has the highest number of sustainable funds (72%) and the largest asset management scale (84%). The European sustainable fund attracted $10.3 billion in funding inflows in the third quarter, a slight decrease from $11.1 billion in the second quarter. The net outflow of sustainable funds in the third quarter of the United States was $2.3 billion, an improvement from the net outflow of $4.7 billion in the second quarter.

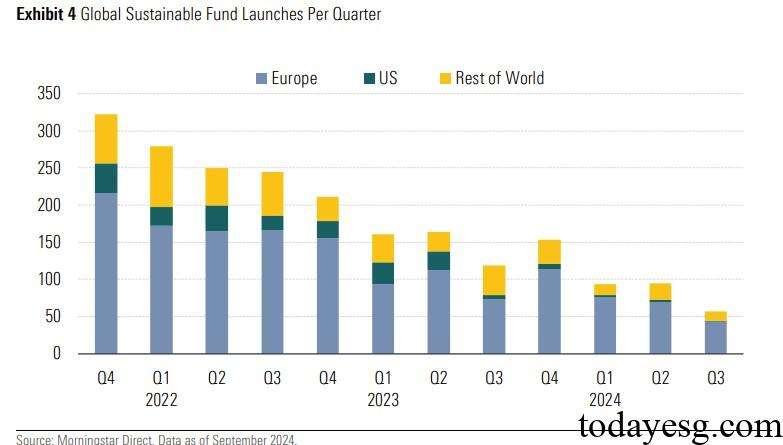

The total assets of the global sustainable fund ($3.3 trillion) increased by 6% compared to the second quarter ($3.1 trillion), slightly slower than the growth rate of the Morningstar Global Market Index (6.6%) and the Morningstar Global Core Bond Index (6.9%). In the third quarter, 57 new sustainable funds were issued globally, and a total of 257 sustainable funds were issued in the first three quarters of 2024. Asset management companies are slowing down their product launch speed.

Sustainable Fund Development in Europe

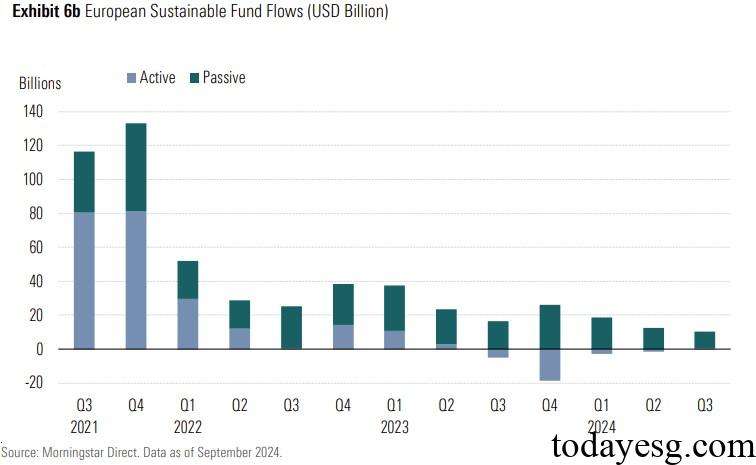

In the first three quarters of 2024, the inflow of funds from the European Sustainable Fund was $37 billion, a decrease of $36 billion compared to the first three quarters of last year. Actively managed sustainable funds have seen a net inflow of funds for the first time since the third quarter of 2023, with a quantity of $580 million. The net inflow of passive managed sustainable funds reached a historic low of $10 billion. However, quarterly data from the past three years shows that the flow of funds from passive managed funds is still significantly higher than that from actively managed funds.

From the perspective of sustainable fund types, fixed income sustainable funds had the highest inflow of funds in the third quarter, reaching $13.4 billion, followed by equity sustainable funds ($3.2 billion). The total assets of the European sustainable fund reached $2.8 trillion, an increase of 6% compared to the previous quarter. 43 new sustainable funds were issued in Europe in the third quarter, lower than the same period last year (76) and the previous quarter (70), possibly due to tightened regulatory policies. Morningstar expects companies to modify fund names in accordance with the ESG fund naming rules issued by the European Securities and Markets Authority.

Sustainable Fund Development in US

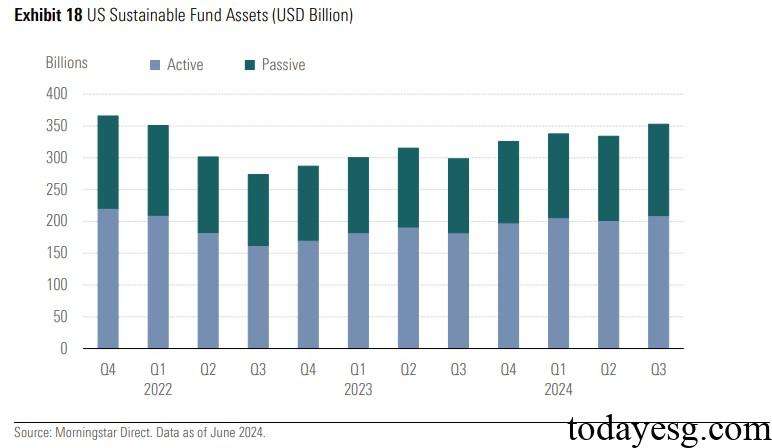

The net outflow of funds from the US Sustainable Fund in the third quarter of 2024 was $2.3 billion, marking the eighth consecutive quarter of outflows since 2022 Q4. The outflow of funds from actively managed sustainable funds was $3.6 billion, while the inflow of funds from passively managed sustainable funds was $1.3 billion. The net inflow of funds from sustainable fixed income funds was $700 million, an increase of $600 million compared to the previous quarter. Due to the overall upward trend in the market, the total assets of sustainable funds in US increased from $333 billion in the previous quarter to $352 billion in this quarter, with a growth rate of 5.6%.

In the third quarter, the United States issued one sustainable fund, which is a passive managed fund investing in sustainable investment grade corporate bonds. In the third quarter, 12 sustainable funds were liquidated, and currently the total number of sustainable funds in the United States is 595.

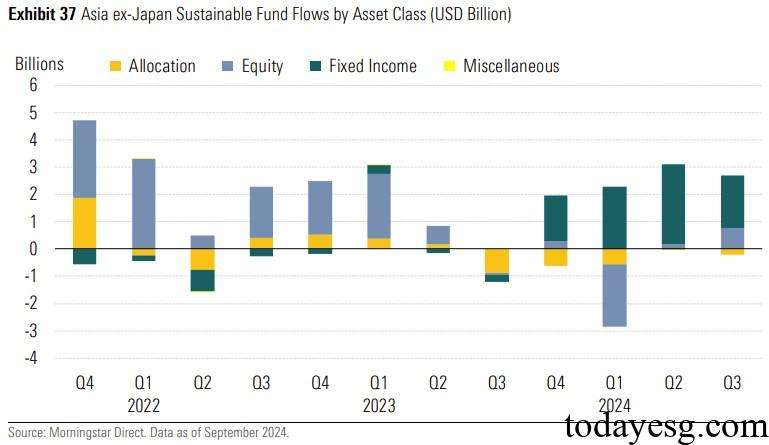

Sustainable Fund Development in Asia

The net inflow of Asia sustainable fund in the third quarter was $3.1 billion, a decrease of $500 million compared to the second quarter. The total size of Asian sustainable funds increased by 6%, with equity funds accounting for the highest proportion (61%), followed by fixed income funds (20%). The proportion of passive managed funds is 55%, an increase of 11 percentage points compared to last year.

In the third quarter, Asia issued 9 sustainable funds, including 4 fixed income funds, 3 equity funds, and 2 allocation funds. Multiple jurisdictions in Asia have released regulatory policies in the third quarter to incorporate ISSB standards into their sustainability reporting rules.

Reference: