COP30 Global Net Zero Report

The London Stock Exchange (LSEG) releases COP30 Global Net Zero Report, aimed at analyzing the G20’s Nationally Determined Contribution (NDCs) and net zero risk.

The Nationally Determined Contributions 3.0 will determine the global emission trajectory for 2035 and beyond. The London Stock Exchange Group measures its transition and physical risks based on sovereign climate assessments, implicit warming indicators, and regional analysis methods.

Related Post: Accenture Releases Global Net Zero Progress Report

Development of Nationally Determined Contributions

The 2015 Paris Agreement made nationally determined contributions to the core mechanism, aiming to keep global warming below 2 degrees Celsius and strive to keep it below 1.5 degrees Celsius. 195 contracting parties have submitted preliminary emission reduction targets for 2030, namely Nationally Determined Contributions 1.0. Subsequently, 174 contracting parties revised their 2030 emission reduction targets, namely Nationally Determined Contributions 2.0. The National Independent Contribution 1.0 aims to control carbon emissions by 2030 to 70% of 1990 levels, while the 2.0 aims to control carbon emissions by 2030 to 50% of 1990 levels.

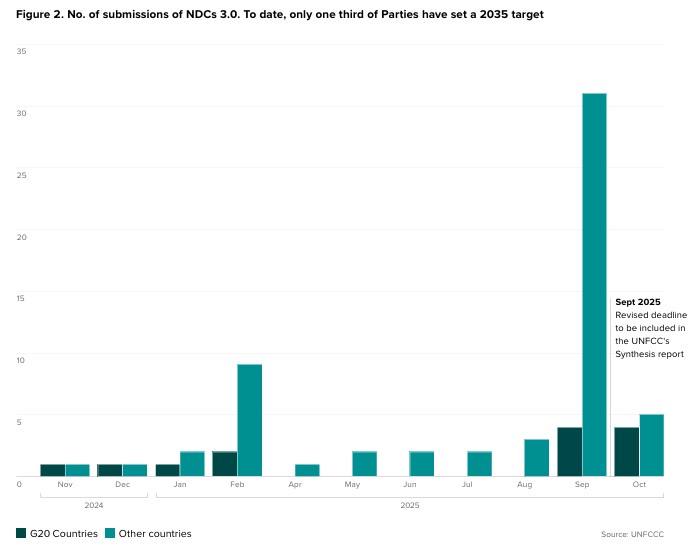

Under the five-year review process required by the Paris Agreement, countries need to develop new Nationally Determined Contributions (NDCs), namely NDCs 3.0. The new commitment for the first time requires countries to clarify their greenhouse gas emission reduction paths for the next decade, sending policy signals to businesses and investors. Currently, over 70 jurisdictions worldwide have submitted their Nationally Determined Contributions 3.0, accounting for one-third of the parties to the Paris Agreement.

G20 Nationally Determined Contributions Analysis

This report collects the Nationally Determined Contributions (NDCs) of 15 G20 members, accounting for 71% of the total G20 carbon emissions. Compared to version 2.0, version 3.0 reduces carbon emissions by an additional 3.3Gt to 4.4Gt, equivalent to an additional reduction of 13% to 18%. The National Independent Contribution 3.0 is in line with the long-term carbon reduction path committed by all countries, corresponding to a global warming of 2.2 to 2.3 degrees Celsius (the 2.0 version has a warming range of 2.4 degrees Celsius). In terms of commitment quality, most countries’ voluntary contributions 3.0 cover all greenhouse gases, cover the entire economic scope, and express carbon emission reduction quotas in absolute terms.

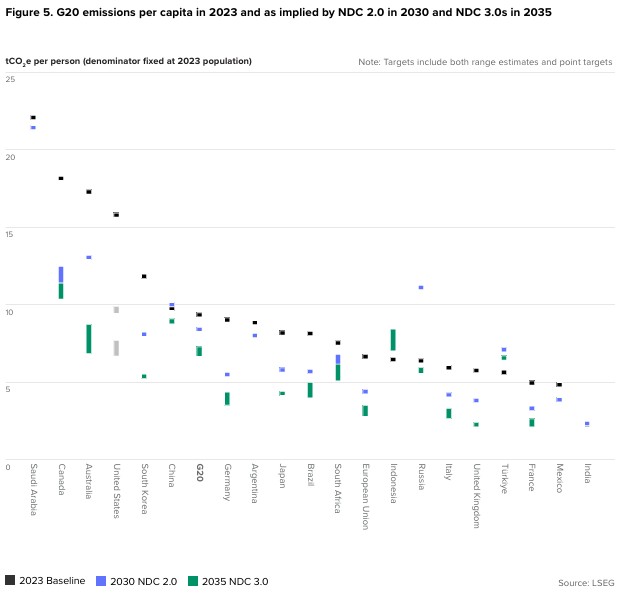

The average annual emission reduction of G20 from 2023 to 2030 will reach 0.5% to 0.7%, and the average annual emission reduction from 2030 to 2035 will reach 2.6% to 3.5%. The reason for this growth is that carbon emissions from some emerging economies will peak by 2030. Using per capita carbon emissions as an indicator, some jurisdictions are expected to see a decrease in carbon emissions in 2035 and 2030 after implementing decarbonization policies, while others are expected to continue to increase due to industrialization and economic growth.

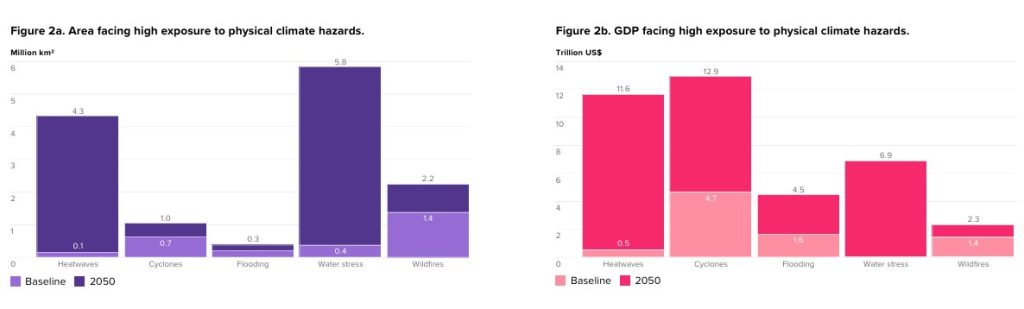

G20 Net Zero Physical Risk Analysis

The London Stock Exchange Group analyzes the physical risks in over 4400 regions across 8 jurisdictions in the G20 and finds that 155 million people and $7.8 trillion in GDP are currently at high-risk exposure, accounting for 7% and 12% of the sample, respectively. By 2050, 839 million people and $2.83 trillion in GDP will be at high risk of exposure, increasing fivefold and fourfold respectively. These climate risks can have complex impacts on investors, such as the location of investment portfolios, supply chain disruptions, insurance market pressures, and so on.

Although a single extreme weather event cannot be fully attributed to climate change, climate models show that these events reflect sustained and widespread transformations and exacerbate physical risks. However, accurately determining the degree of risk exposure requires overlaying detailed disaster maps with local socio-economic data, which remains the main challenge in measuring climate risks.

Reference: