Sustainable Board Compensation Report

KPMG releases a sustainable board compensation report, aimed at analyzing the application of sustainability standards in corporate board compensation and providing relevant recommendations.

KPMG believes that board compensation is an important part of identifying and managing sustainable risks and opportunities for enterprises, and linking corporate sustainable development goals to board compensation is a key focus for investors and other stakeholders.

Related Post: EY Releases Executive Sustainability and ESG Survey Report

Board Compensation and Sustainable Development

Board compensation aims to motivate board members to align their actions with the company’s long-term goals, and a sound board compensation system can promote good governance. The Principles of Corporate Governance issued by the OECD provide a benchmark for transparency and consistency in compensation systems. Some jurisdictions, such as the European Union, have issued Shareholder Rights Directive requiring companies to disclose detailed information on board compensation.

The International Sustainability Standards Board (ISSB) requires companies to link sustainable development goals to board compensation in IFRS S1 to incentivize board members to fulfill their sustainability responsibilities. The EU Corporate Sustainability Reporting Directive (CSRD) also establishes similar requirements. These policies establish the relationship between compensation and sustainable development, requiring companies to disclose information at the governance level.

Sustainable Board Compensation Analysis

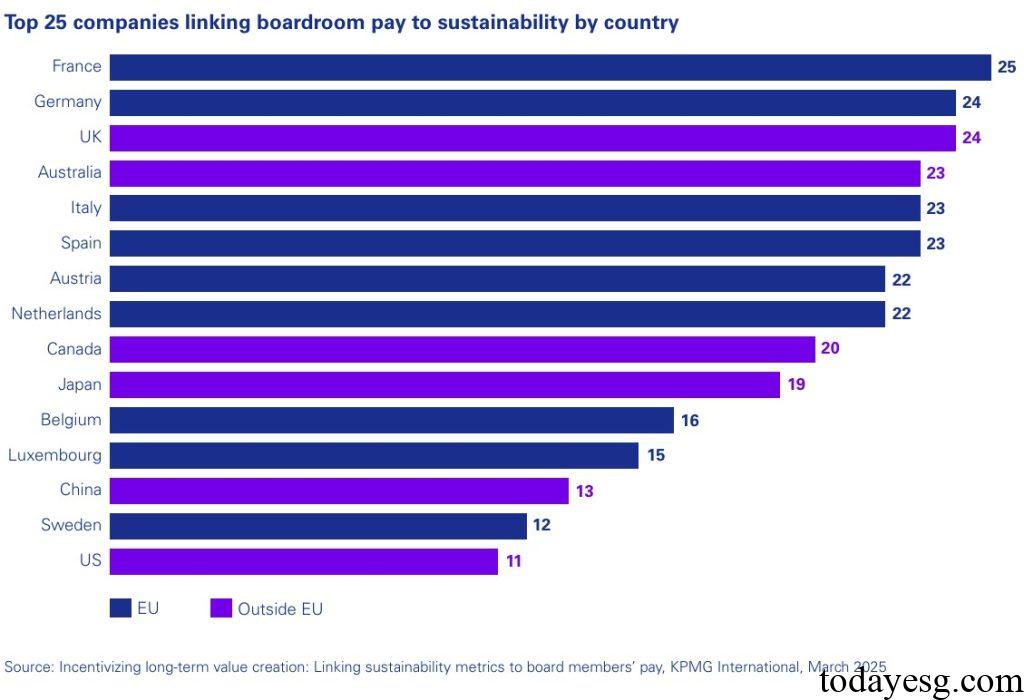

KPMG studies 375 large corporations from 15 jurisdictions worldwide, extracting board compensation related sustainability information from corporate sustainability reports, compensation reports, and websites. Each enterprise is in the top 25 by market value in the jurisdiction and complies with the regulatory scope of the EU CSRD.

From the analysis of the linkage between board compensation and sustainable development, there are 25 companies in France, 24 companies in Germany, and 24 companies in the UK that consider sustainable factors in board compensation. There are a total of 277 eligible companies, with an average of 20.2 companies in EU member states and 18.3 companies in non-EU member states. This indicates that enterprises in EU member states have made more progress in responding to sustainable regulatory policies. 88% of companies link board compensation to material sustainability themes to reflect the impact of sustainability issues on their business operations.

Among all sustainable themes, climate change (26%), labor force (23.1%), and business conduct (12.2%) account for a relatively high proportion, reflecting the substantial impact of these sustainable themes on enterprises and the mandatory requirements of regulatory policies. In terms of sustainable goals, German companies have set the highest number of sustainable goals (108), while French, Australian, and Dutch companies have a total of over 80 sustainable goals, but there are differences in the emphasis on sustainable goals in different jurisdictions. The most common environmental, social, and governance goals are reducing greenhouse gas emissions, employee engagement, and cybersecurity, respectively.

In terms of the deadline for sustainable goals, 40% of companies only use short-term sustainable goals, 23% of companies only use long-term sustainable goals, and 37% of companies adopt both short-term and long-term goals. On average, 9.3 companies in EU member states adopt both objectives, while 3.2 companies in non-EU member states adopt both objectives simultaneously.

How to Incorporate Sustainability into Board Compensation

KPMG believes that companies can incorporate sustainability factors into board compensation through the following steps:

- Selecting key performance indicators from corporate strategy: Selecting indicators from corporate strategy can promote long-term business development and avoid significant risks faced by business activities.

- Using relevant, appropriate, and reliable data: These data can serve as the foundation for sustainable performance indicators, improving data availability.

- Setting the share and scope of the compensation system: Enterprises can determine the share of sustainable compensation in short-term and long-term goals.

- Improving the transparency of salary information: Disclosing more sustainable information can help third-party auditors to complete sustainability assurance.

Reference: