Energy Transition Investment Outlook

KPMG releases Energy Transition Investment Outlook, aimed at analyzing the development trends of global energy transition investment, as well as the impact of regulatory policies, technological progress, and financial innovation on future energy transition investment.

KPMG believes that as global energy transition accelerates, the demand for expanding renewable energy capacity, improving energy efficiency, and upgrading energy infrastructure is growing rapidly.

Related Post: World Economic Forum Releases Global Energy Transition Report

Current Status of Global Energy Transition Investment

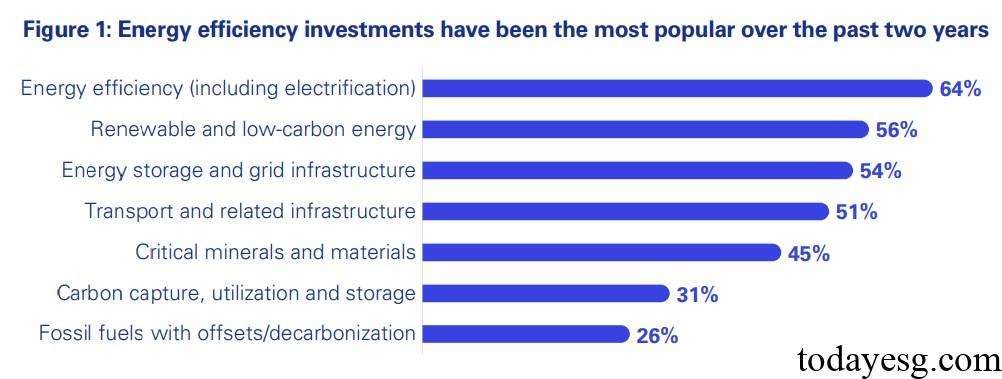

KPMG surveys 1400 energy transition investors worldwide, and 72% of them believe that energy transition investment is rapidly developing. By 2024, global energy investment will reach $3 trillion, of which $2 trillion will be used for clean energy technologies, which is twice the amount invested in fossil fuels. Energy saving technology (64%), renewable energy (56%), and energy infrastructure (54%) are the main investment directions. In the past decade, the growth of global energy demand has almost covered the growth of renewable energy capacity, which is also the reason why energy efficiency is highly valued by investors. The signatories of COP28 plan to double global energy efficiency by 2030.

From the perspective of energy transition investment regions, East Asia (54%), Europe (52%), and North America (52%) are the most closely considered, providing investors with various favorable conditions. Investors have relatively less investment in emerging market economies other than China, despite having 67% of the world’s population, with only 15% of investment. Investors believe that policy and market uncertainty are the main obstacles to investment, while local infrastructure also has an impact on investment.

In terms of fossil fuel investment, geopolitical risks have led investors to refocus on energy security and continue to increase their investment in fossil fuels. It is expected that global fossil fuel investment will exceed $1.1 trillion by 2024. At present, fossil fuels account for 82% of the global energy structure, and investing in transitional energy such as natural gas can reduce the risk of energy shortages.

Views of Energy Transition Investors

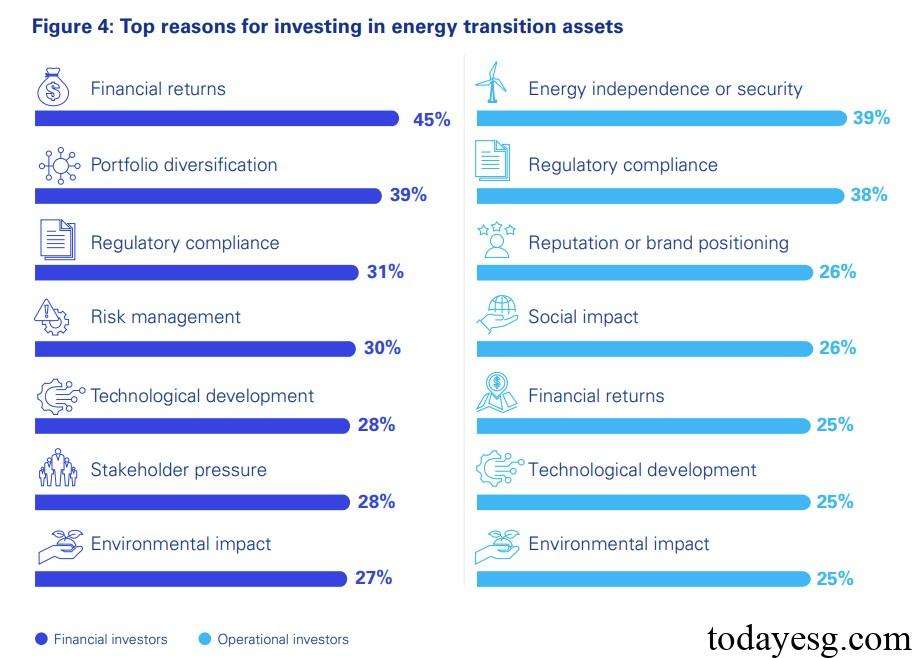

Different energy transition investors have different backgrounds, goals, and risk profiles. KPMG focuses on financial investors (banks, asset management companies, private equity investments, etc.) and operational investors (energy, utilities, fossil fuel companies, etc.). For financial investors, financial returns (45%) and portfolio diversification (39%) are the main reasons for investment. For operational investors, energy security (39%) and regulatory compliance (38%) are the main reasons for investment.

Some energy intensive companies are investing in energy transition projects, with 72% of CEOs of energy, chemical, and natural resource companies stating that ESG factors have been incorporated into their business activities. Enterprises are also using financial instruments such as transition bonds and carbon credits to enable investors to assess investment risks and shift towards green assets.

Challenges of Energy Transition Investment

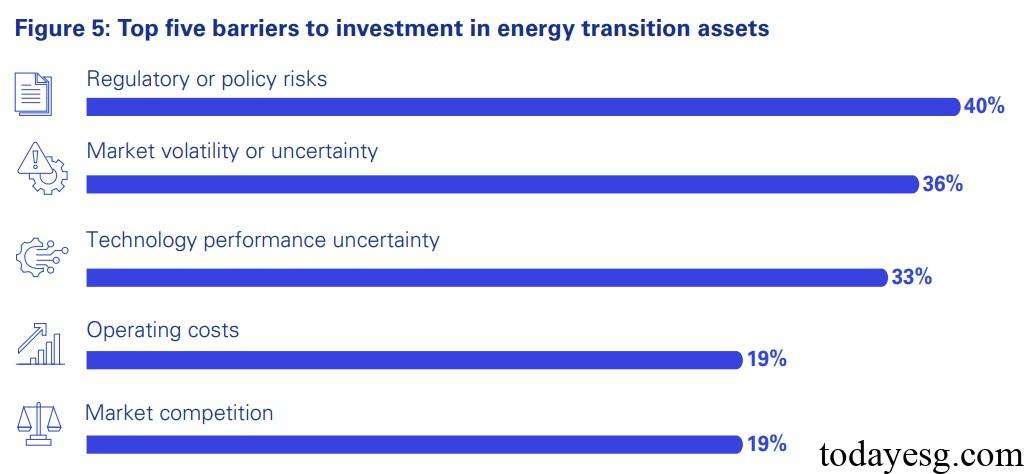

Energy transition investment has a long-term nature, and investors believe that there are some obstacles in investment, among which regulatory risk (40%), market volatility (36%), and technological uncertainty (33%) account for a relatively high proportion. Many obstacles are difficult to manage risks, so investors need higher returns as risk compensation. Energy transition investment is also widely influenced by policies, such as subsidies for renewable energy and authorization for clean energy use, which can reduce investment risks and attract market funds.

43% of investors believe that Feed-in tariffs are the most important policy to drive energy transition investments, as they can directly provide funding for renewable energy power supply and ensure long-term income. Currently, some countries are turning to renewable energy auctions to provide more cost-effective support policies. Regulatory support (35%) and tax incentives (34%) are also key factors that investors are concerned about.

Reference: