2025 Global Corporate ESG Assurance Report

KPMG releases 2025 Global Corporate ESG Assurance Report, aimed at analyzing the development of corporate ESG assurances and providing recommendations.

KPMG surveys over 1300 ESG disclosure and assurance professionals worldwide and established an ESG assurance maturity index from five perspectives: governance, skills, data management, digital technology, and value chain.

Related Post: KPMG Releases Global ESG Assurance Report

Global Corporate ESG Assurance Development

The Global Corporate ESG Assurance Maturity Index for 2025 is 46.9, a decrease of 0.8 compared to last year, due to stricter ESG regulatory policies. From a regional perspective, North America (49.01), Europe (48.87), and Asia (46.7) occupy the top three positions. KPMG finds that large enterprises perform better in ESG assurance than small and medium-sized enterprises. For example, companies with annual revenue exceeding $10 billion have an index of 52.80, while companies with annual revenue ranging from $1 billion to $5 billion have an index of 42.13. This is because large enterprises are more likely to be included in information disclosure rules and required to conduct third-party assurances of sustainability reports.

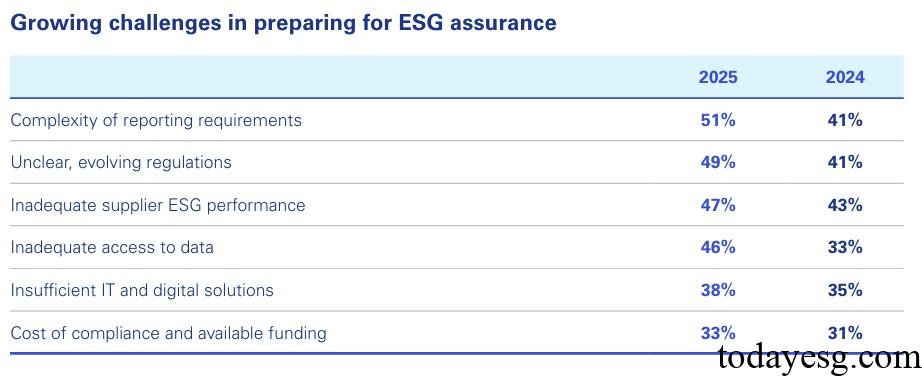

From an industry perspective, the maturity index of the energy industry (48.86), communication industry (48.51), and technology industry (48.17) ranks among the top three, like previous years. The average index for leaders in the ESG assurance industry is 65.21, while for beginners it is 30.54. Compared to last year, this gap has not narrowed, indicating that novice companies have not developed rapidly in ESG assurance. Enterprises believe that the main obstacles to ESG assurance include complex reporting requirements (51%), changing regulatory policies (49%), and suppliers with poor ESG performance (47%). The International Assurance and Assurance Standards Board (IAASB) has released the Sustainable Assurance International Standard ISSA 5000, and corporate ESG assurance will continue to develop in the future.

Global Corporate ESG Assurance Analysis

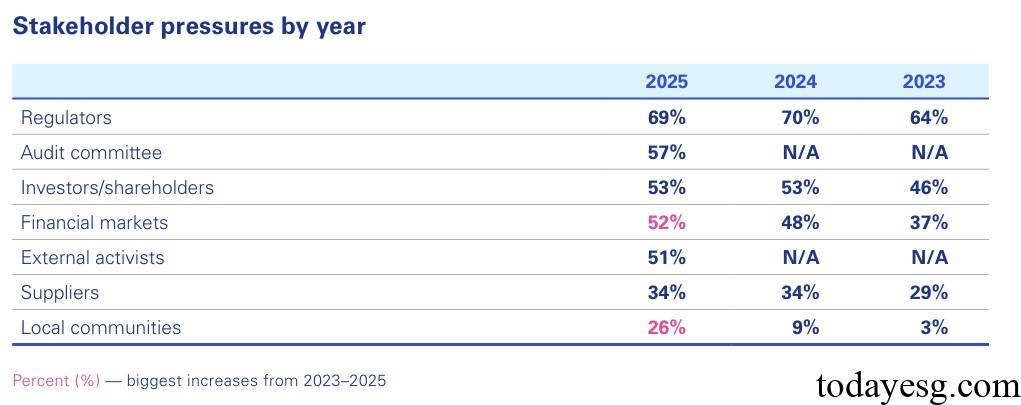

In terms of stakeholder pressures faced by corporates, regulatory agencies (69%), audit committees (57%), and investors (53%) rank high. The guidelines of the International Sustainability Standards Board (ISSB) and the Corporate Sustainability Reporting Standard (CSRD) mention the assurance of greenhouse gas emission data or the assurance of the entire sustainability report. Investors begin to incorporate ESG factors into their investment strategies and provide low-cost funding support to companies with good sustainable performance.

Taking the Corporate Sustainability Reporting Directive as an example, the EU plans to simplify the directive by limiting mandatory sustainability disclosure to large enterprises by 2025. 41% of companies state that they will continue to carry out ESG assurance actions, 33% plan to conduct formal assurances under mandatory requirements, and 26% plan to postpone ESG assurance plans. Enterprises believe that the challenges of writing reports based on instructions lie in complex standards (25%), difficult data collection (20%), and materiality evaluation (17%).

Global Corporate ESG Assurance Recommendations

KPMG provides recommendations to promote the development of corporate ESG assurance from five perspectives:

- Governance: The board of directors needs to fully participate in ESG issues, understand ESG information disclosure and assurance methods.

- Skills: Enterprises need to establish a clear ESG skills training system to provide employees with material thematic ESG training.

- Data management: Enterprises need to consider the granularity of ESG data and monitor ESG performance indicators.

- Digital technology: Enterprises need to use digital technology to improve data management and consider emerging solutions.

- Value chain: Enterprises need to communicate ESG requirements with other companies upstream and downstream in the value chain to improve their compliance.

Reference: