Sustainable Bond Rating Method

ISS ESG, the sustainable investment division of Institutional Shareholder Services (ISS), releases a new sustainable bond rating method aimed at providing investors with an assessment of the impact and risk of sustainable bond.

ISS ESG believes that the size and complexity of the bond market have been rapidly developing in recent years, and a new sustainable bond rating method can provide investors with comprehensive analysis of sustainable risks and opportunities.

Related Post: Introduction to Low Carbon Transition Rating by Sustainalytics

Introduction to Sustainable Bond Rating Method

The ISS ESG sustainable bond rating method aims to evaluate the environmental, social, and governance performance of green, social, sustainable development, and sustainable development linked bonds, helping investors’ investment decisions. The evaluation method has referred to the guidelines published by the International Capital Market Authority (ICMA) and is consistent with the United Nations Sustainable Development Goals (UN SDGs).

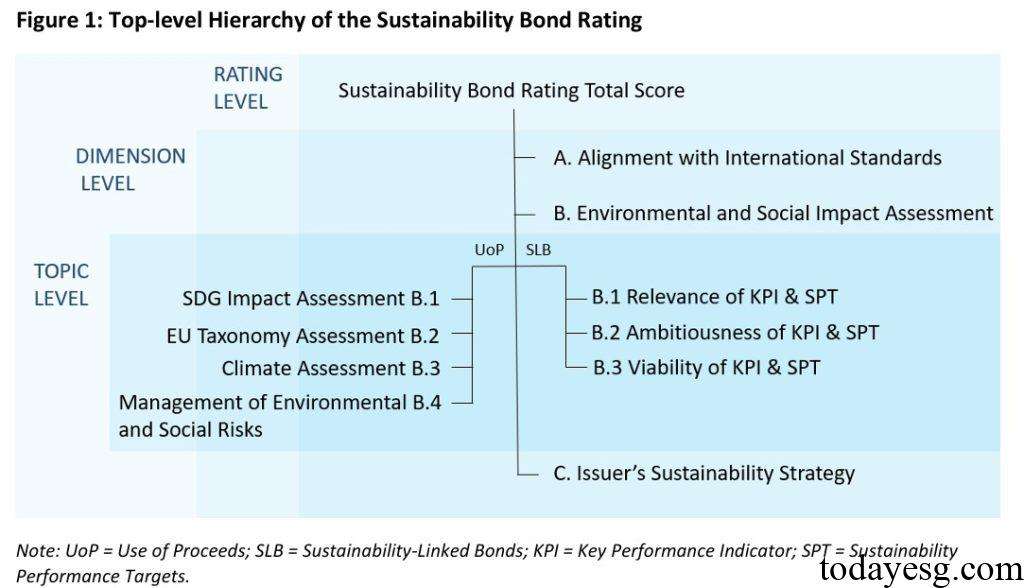

The ISS ESG sustainable bond rating method is divided into twelve categories, with A+ being the highest and D- being the lowest. This rating method applies to both Use of Proceeds Bonds and Sustainability Linked Bonds. The rating method is divided into three dimensions, each containing different indicators:

- Rating Level: The total score and category of sustainable bond ratings.

- Dimension Level: Whether the bond meets international sustainable bond standards, as well as an assessment of the bond’s environmental and social impact.

- Topic Level: Divided into two parts, namely the bond section and the issuer section. The bond section applies two sets of indicators based on the different types of bonds. The issuer’s part is its sustainable strategy.

For different levels, ISS ESG has designed approximately 400 indicators, with an average of 150 indicators per bond. The specific steps of the sustainable bond rating method are:

- Data collection: Analysts collect and analyze data based on the application guidelines for each indicator.

- Information source: The rating is based on publicly available information sources, as well as data disclosed by the issuer and third-party opinion providers.

- Quality assurance: Senior analysts review and evaluate the data to ensure high quality.

- Data update: Ratings are updated annually to reflect new information added after bond issuance.

- Final report: The report is sent to the client through a dedicated method.

In the absence of precise data, ISS ESG may use estimated data, such as estimating the fund allocation of Use of Proceeds bonds based on the fund allocation information in the bond framework. ISS ESG may also use industry information for estimation, and all estimates will be based on clear calculation guidelines.

Reference: