Impact Disclosure Taskforce

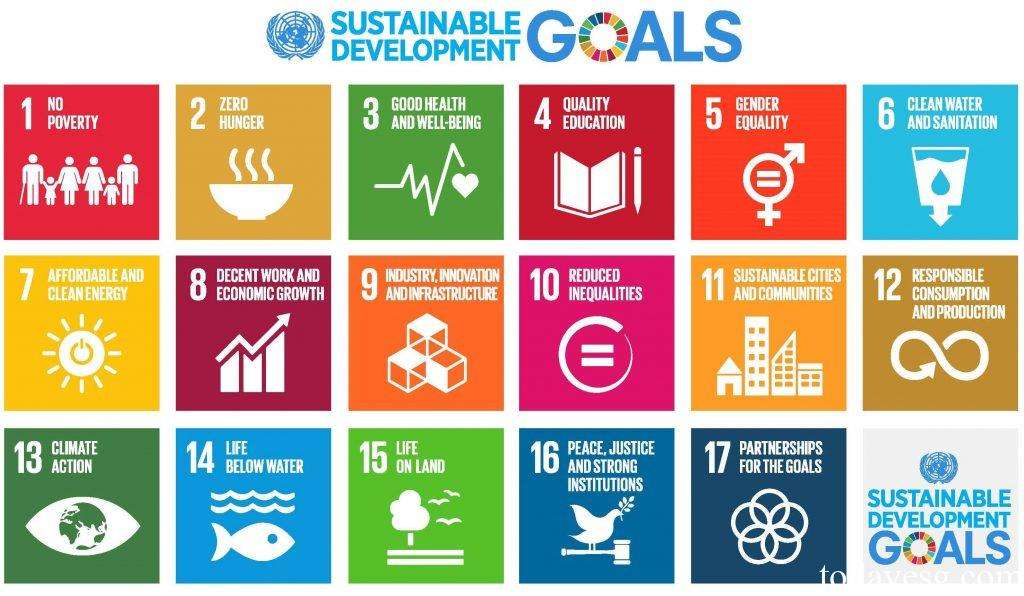

Several financial institutions around the world have jointly established the Impact Disclosure Taskforce (IDT) to promote the disclosure of impact-related information and achieve the United Nations Sustainable Development Goals (UN SDGs).

The founders of the Impact Disclosure Taskforce include financial institutions, capital market participants and industry stakeholders, and are supported by the Global Impact Investing Network (GIIN), the International Sustainability Standards Board (ISSB) and the International Capital Market Association (ICMA).

Related Post: CFA Institute Releases Definitions of Key Terms in Responsible Investing

Background of Impact Disclosure Taskforce

The global ESG and sustainable finance industries are developing rapidly, with investments related to sustainable development exceeding US$2.8 trillion, and the scale of impact investment reaching US$1.2 trillion. However, companies in emerging markets and developing economies still face challenges when obtaining these sustainable investments, such as a lack of sustainability-related disclosures and a lack of guidance from regulatory policies.

To address the challenges of sustainable financing, Impact Disclosure Taskforce will provide these companies with a set of voluntary guidelines to help them monitor and report on their sustainability disclosures and ultimately enable them to achieve attractive sustainable value.

Given that numerous jurisdictions already have mandatory sustainability disclosure regulations in place, it will primarily assist businesses in jurisdictions that do not yet have sustainability regulatory policies in place. However, entities in all jurisdictions are encouraged to consider the guidance when disclosing their intentions to address development gaps.

The guidance also recommends establishing mechanisms to disseminate and analyze entity-level impact information to promote transparency and accountability. This in turn will provide financial institutions with the factual basis they need to sustainably invest and engage in decision-making.

Work Plan of Impact Disclosure Taskforce

The Impact Disclosure Taskforce plans to work in three areas, namely formulating the Sustainable Development Impact Disclosure Guidance, establishing an Impact Data Platform, and providing impact related services.

In terms of sustainability impact disclosure guidelines, IDT plans to enhance entities’ disclosure capabilities through five steps to provide more help to impact investors. These steps include:

- Determine expected impact and related measurement indicators: IDT will draw on existing impact taxonomies and sustainability reporting standards to develop entity-related sustainability indicators.

- Prioritize the actual situation of the entity: IDT will refer to the most important impact matters based on the development of the entity.

- Set impact goals: IDT will direct entities to detail plans, timeframes, and final results for goals.

- Disclose plans to reduce negative impacts: IDT will set negative impact indicators and guide entities to reduce negative impacts.

- Develop an ex-ante disclosure and ex-post reporting framework: IDT will guide entities to complete information disclosure in the investment chain.

The Sustainability Impact Disclosure Guidelines will also supplement the standards provided by ISSB on sustainability-related risks and opportunities, helping entities and investors obtain standardized data. The Guidelines will be continuously updated to meet the development of global sustainability disclosures. This guidance will also provide investors with an important metric for judging the sustainable characteristics of entities.

In terms of the influence data platform, IDT plans to include financial institutions, investors and other stakeholders into user groups and establish an influence information disclosure platform. Companies can publish influence data on these platforms and analyze the effects of these influences, and investors can query, compare, and test the data. Third parties, such as audit firms, can promote standards for impact measurement and provide services to companies and investors.

IDT will also establish an impact service organization to help in data, analysis, technology and benchmarking. These efforts involve providing application programming interfaces (APIs), establishing impact ratings, launching new impact indexes.

Reference:

Impact Disclosure Taskforce Created to Scale Financing of the UN SDGs