Report on Physical Climate Risk Assessment Methodology

The Institutional Investors Group on Climate Change (IIGCC) releases a report on Physical Climate Risk Assessment Methodology (PCRAM), aimed at summarizing the practical application of physical climate risk assessment methods in the investment industry.

The IIGCC believes that investors are aware of the long-term impact of physical climate risk on asset value, but the market still lacks a standardized measurement method to measure the risk. Physical Climate Risk Assessment Methodology can fill this gap and provide investors with cross industry guidelines for assessing and managing climate risks.

Related Post: The Relationship between Climate Change and Financial Stability

Introduction to Physical Climate Risk Assessment Method

The Physical Climate Risk Assessment Methodology was initially developed by the Coalition for Climate Resilient Investment and received support from banks, climate data providers, credit institutions, and academic institutions. In 2023, the Climate Change Institutional Investor Group took over the method and continued to expand its application scope.

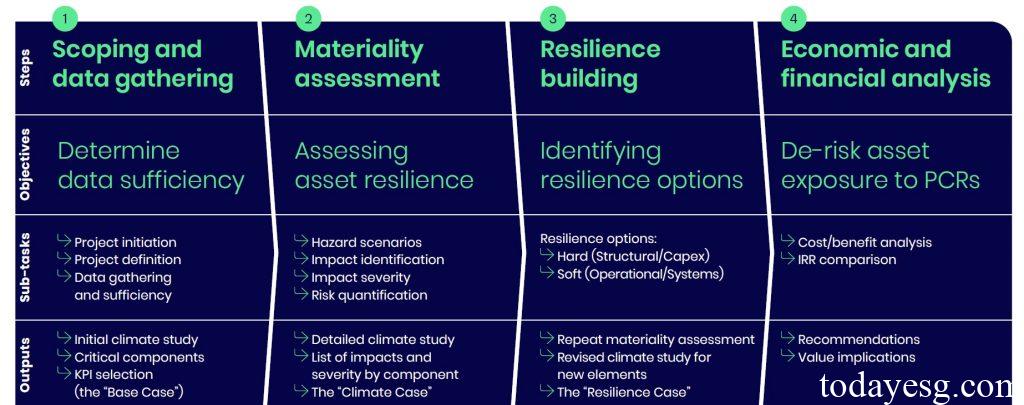

The Physical Climate Risk Assessment Methodology is a dynamic process that allows market participants to evaluate the operational, commercial, and financial materiality of physical climate risks in assets, thereby incorporating climate risks into investment decisions. The physical climate risk assessment methods include the following aspects:

- Scoping and data gathering: Determine the scope of data and fully collect them, including project initiation, definition, and data collection processes, in order to conduct preliminary climate research and identify key physical climate risk measurement indicators.

- Materiality assessment: Conduct a detailed climate assessment to confirm whether assets face material climate physical risks. This section includes scenario analysis, impact identification, impact analysis, and risk quantification.

- Resilience building: Confirm the climate resilience of assets, identify the existence of climate resilience options, and adjust some parameters in climate assessment.

- Economic and financial analysis: Reduce the physical climate risks faced by assets, such as conducting cost-benefit analysis or comparing the internal rate of return of assets.

The Physical Climate Risk Assessment Methodology transforms climate risk analysis into commonly used indicators in investment through the above steps. This method is applicable to assets with different locations, financing methods, and ownership, and demonstrates to stakeholders how to assess and mitigate physical climate risks robustly and standardly.

Application of Physical Climate Risk Assessment Methodology

The IIGCC believes that physical climate risk assessment methods have the following advantages:

- Quantitatively optimize the cost of asset holding cycle: Investors can use this method to predict the cash flow of assets, in order to demonstrate that investing in asset climate resilience can increase asset value and reflect the monetary returns brought by climate resilience.

- Assist stakeholders in allocating investment costs: In the initial investment to reduce the physical climate risk of assets, different stakeholders bear different costs due to differences in asset ownership and financing models. This method can confirm the proportion of costs borne by these stakeholders, in order to facilitate cooperation among multiple parties.

- Provide flexible climate risk indicator selections: Investors can choose different climate risk indicators, such as financial indicators such as internal rate of return and investment return rate, or environmental indicators such as carbon emissions and energy use.

- Reduce the development cost of high-quality assets: Physical climate risk assessment methods can promote the market’s pursuit of more climate resilient assets, thereby reducing the cost of credit and improving the credit quality of asset issuers.

The Institutional Investors Group on Climate Change plans to launch version 2.0 of Physical Climate Risk Assessment Methodology, collaborating with investors, credit rating agencies, and regulatory agencies to enhance the visibility and integrate it into credit and investment processes.

Reference:

PCRAM in Practice: Outputs and Insights from Climate Resilience in Action