Net Zero Investment Fund Consultation Document

The Institutional Investors Group on Climate Change (IIGCC) releases a consultation document for net zero investment funds, aimed at soliciting market participants’ suggestions on setting and implementing net zero investment targets for funds.

The Institutional Investors Group on Climate Change believes that this document is suitable for institutional investors with smaller AUM who need to allocate external funds during the investment process to achieve the net zero investment portfolio goal.

Related Post: Institutional Investors Group on Climate Change Releases Net Zero Investment Framework 2.0

Background of Net Zero Investment Fund Consultation Document

The Net Zero Investment Framework aims to guide investors in developing net zero strategies, goals, and transition plans to reduce greenhouse gas emissions. Market participants using the net zero investment framework believe that there is a lack of methods and resources to measure the net zero of funds when allocating external funds, and the role of these participants in the financial value chain may be overlooked.

Based on Net Zero Investment Framework 2.0, the IIGCC modifies the framework structure based on participant feedback, adding external fund roles in stakeholder and market engagement, and adding Fund Alignment next to Asset Alignment. Through fund screening and engagement, it promotes information exchange between asset owners and asset managers.

Net Zero Investment Fund Alignment Measurement

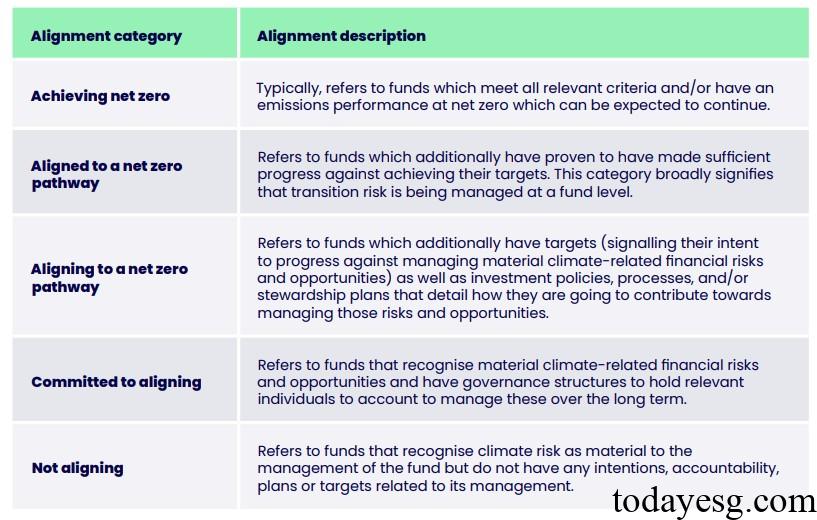

The improved net zero investment framework provides the following alignment categories for net zero investment funds:

- Achieving net zero emissions: Funds that meet the net zero standard and are expected to maintain net zero consistently.

- Aligned to a net zero pathway: Funds that have made sufficient progress towards their net zero goals and have managed their transition risks.

- Aligning to a net zero pathway: Funds that intend to manage climate related financial risks and opportunities and provide detailed explanations of their net zero investment policies, processes, and plans.

- Committed to aligning: Funds that can identify climate related financial risks and opportunities and make progress in the long term.

- Not aligned: Funds that do not include net zero and climate change in their management.

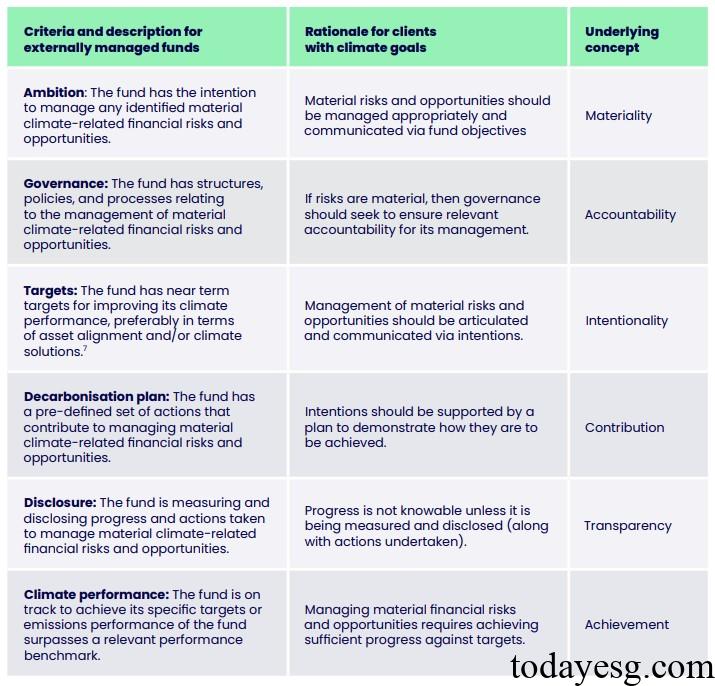

For asset owners, the standards for measuring the net zero alignment of external funds include:

- Ambition: Management of material climate-related financial risks and opportunities.

- Governance: Net zero related structure, policies, and processes.

- Targets: Objectives at the asset allocation or climate solution level.

- Decarbonization plan: Predetermined plans by the fund to reduce carbon emissions.

- Disclosure: Measures taken by funds to measure and disclose net zero actions.

- Climate performance: Emission performance criteria determined by the fund.

The IIGCC recommends that investors use the above criteria to measure the net zero consistency of external funds and determine the alignment category of the fund. Funds that meet the net zero target for investors can be included in the investment portfolio.

Reference: