Principles for Sustainable Trade Finance

The International Chamber of Commerce (ICC) releases its second edition of principles for sustainable trade finance, aimed at providing guidance for trade financing activities that promote environmental and social goals.

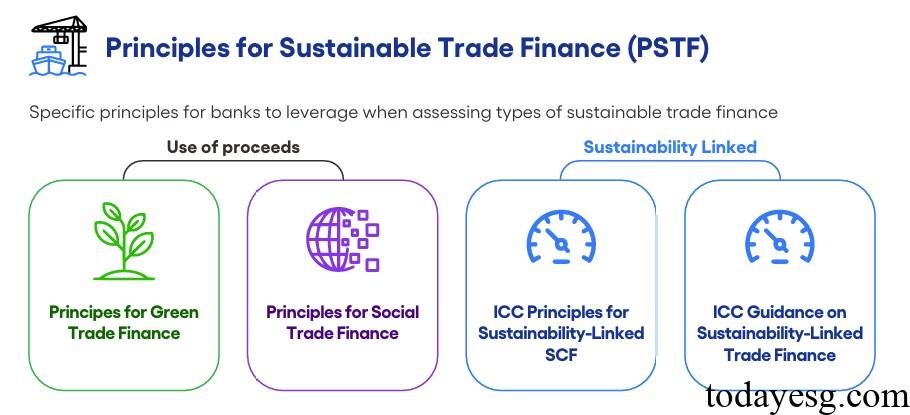

The International Chamber of Commerce believes that the principles can enhance information disclosures, reduce greenwashing risks, and promote global sustainable trade financing. The principles for sustainable trade financing can be divided into the following categories:

Related Post: International Chamber of Commerce Releases Principles for Sustainable Trade

Principles for Green Trade Financing

The Principles for Green Trade Finance aim to provide clear and transparent green trade guidelines for trade banks and clients, supplementing and supporting the Green Loan Principles published by the Loan Market Association. The funding for green trade is clearly and verifiably allocated to green activities and green goods. Customers can use the green activity list provided by the International Chamber of Commerce and confirm that these products will not cause significant harm. Green trade also requires standardized disclosure of information to ensure transparency and comparability.

Principles for Social Trade Financing

The Principles for Social Trade Finance aim to increase the amount of trade financing that produces positive results for society and refer to the Social Loan Principles published by the Credit Market Association and the Social Bond Principles published by the International Capital Market Association (ICMA). The funds from social trade financing are used for goods that can significantly bring social benefits and support specific groups of people. The data, disclosure, and verification methods of social trade financing principles are like those of green trade financing principles.

Principles for Sustainability-Linked Supply Chain Finance

The Principles for Sustainability-Linked Supply Chain Finance aim to incorporate environmental and social goals into supply chain financing and incentivize suppliers to improve sustainable practices. This principle is consistent with the Sustainability Linked Loan Principles published by the Credit Market Association (ICMA) and validated through Key Performance Indicators and Sustainability Performance Targets. After the customer achieves the set goals, as a reward, financing costs may decrease.

Guidance on Sustainability-Linked Trade Finance

The Guidance on Sustainability-Linked Trade Finance aims to measure the improvement of key performance indicators or sustainability performance indicators. Customers can choose key performance indicators and then set sustainable performance indicators. Although the latter may not be completed, trade banks can still set it as a sustainable development linked loan. For short-term trade financing, indicator information should be disclosed at least once a year, and customers can choose to provide external verification.

Reference: