Hong Kong Impact Investing Report

The Hong Kong Financial Services Development Council (FSDC) releases Hong Kong Impact Investing Report, which aims to summarize the development of Hong Kong impact investing market.

The Hong Kong FSDC released three policy documents in 2024, focusing on carbon markets, transition finance, and impact investing in sustainable investment practices.

Related Post: Hong Kong FSDC Releases ESG Brief Report

Global Impact Investing Development

The global impact investing market has grown from $715 billion in 2020 to $1.57 trillion in 2024 over the past five years, with an average annual growth rate of 14%. The Global Impact Investing Network (GIIN) believes that there are currently over 3900 institutions worldwide involved in impact investing, with North America (47%) and Europe (23%) accounting for a relatively high proportion.

In 2024, the scale of impact investing in Asia is approximately $40.9 billion, with market participants mainly consisting of small and medium-sized impact investing institutions with management scales ranging from $2 million to $500 million and large institutions with asset management scales exceeding $65 billion. Small institutional impact investment focuses on environmental and social areas, including climate change mitigation, education, healthcare, food security, and inclusive finance. Large institutions adopt a more macro systematic investment strategy, focusing on sustainable food systems, climate resilience, and infrastructure development.

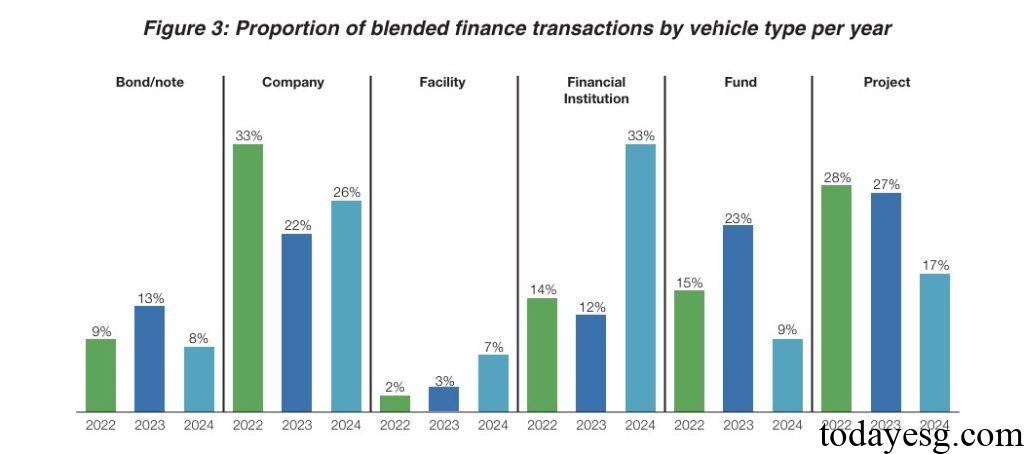

Blended financing has become an important tool for impact investing development, as it can combine public and private capital to support sustainable development goals. According to a report released by Convergence, the median size of blended financing transactions has increased from $38 million in 2020 to $65 million in 2024, with financial institutions (33%) and enterprises (26%) accounting for a relatively high proportion. Asian blended financing focuses on climate change mitigation, biodiversity conservation, and community well-being.

Hong Kong Impact Investing Development

Hong Kong is a hub for impact investing in Asia, with ample funds, asset management companies, asset owners, and investors. In impact investing, the advantage of fundraising can be utilized to improve infrastructure and enhance regional and international impact. Most Hong Kong impact investing institutions are still in the early stages of business development and require more patient capital support and capacity building.

The key themes for Hong Kong’s impact investing in 2024 are food and agriculture, innovative materials for circular economy, and healthcare. The rapid growth of investment in nature-based solutions in 2025 reflects the market’s emphasis on the field of biodiversity. Hong Kong will use blended financing tools based on existing foundations in green finance, ESG, and fintech to promote the development of impact investing.

Reference: