Corporate Sustainability Report

The Harvard Law School Forum on Corporate Governance releases 2025 Corporate Sustainability Report, which aims to summarize the practices of corporate sustainability structure and integration.

This report surveyed 70 sustainability and ESG executives from global multinational corporations.

Related Post: Harvard University Releases 2025 Global ESG Summary

Corporate Sustainability Development Structure

71% of respondents consider a hybrid model in sustainable development structure, which combines teams responsible for governance, strategy, and standards with sustainable development departments. This approach is more balanced and does not require excessive resources. 19% of respondents choose the centralized model, which incorporates sustainable features throughout the entire organization, which may slow down the decision-making speed of business departments. 9% of respondents choose a decentralized model, which involves incorporating departments as the core into a sustainable structure.

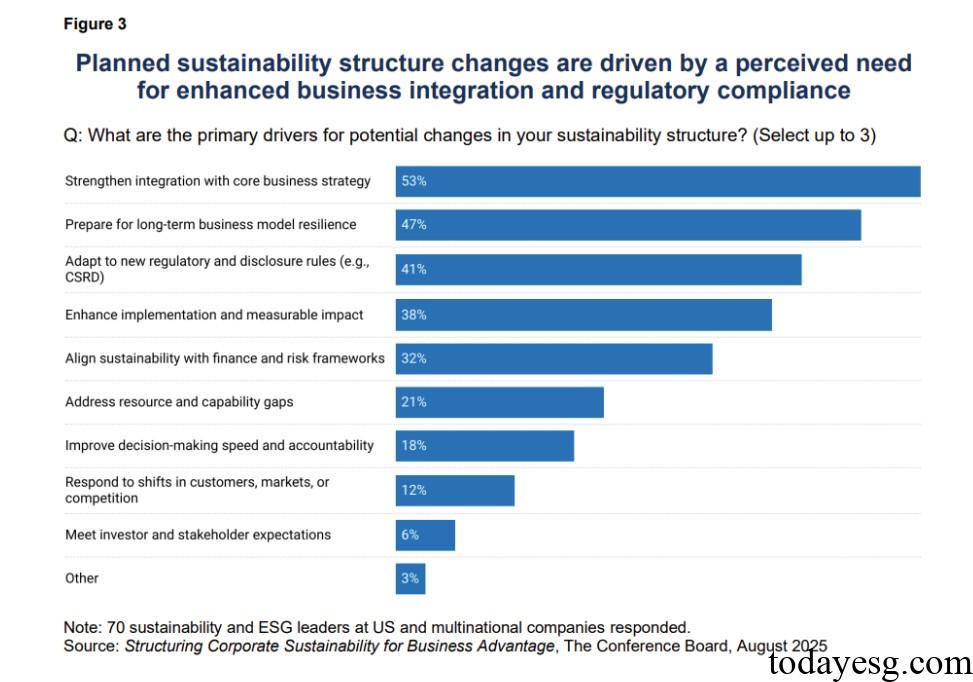

The sustainable development structure of corporates is still being continuously updated, with over half of the respondents planning to adjust the structure in the next two years, with 16% expecting substantial changes. Corporate actions include:

- Strengthen cross functional sustainable development cooperation: 68%. Corporates believe that the achievement of sustainable development goals depends on the cooperation between business departments and functional departments, with the overall team setting the direction and the rest responsible for implementation.

- Integrate sustainability into risk and finance departments: 56%. Incorporate sustainable factors into corporate risk management, asset allocation, and financial reporting to meet regulatory disclosure and investor review requirements.

- Integrate sustainability into core strategies and operations: 56%. Sustainable factors will become a core component in competition, operation, and long-term value creation.

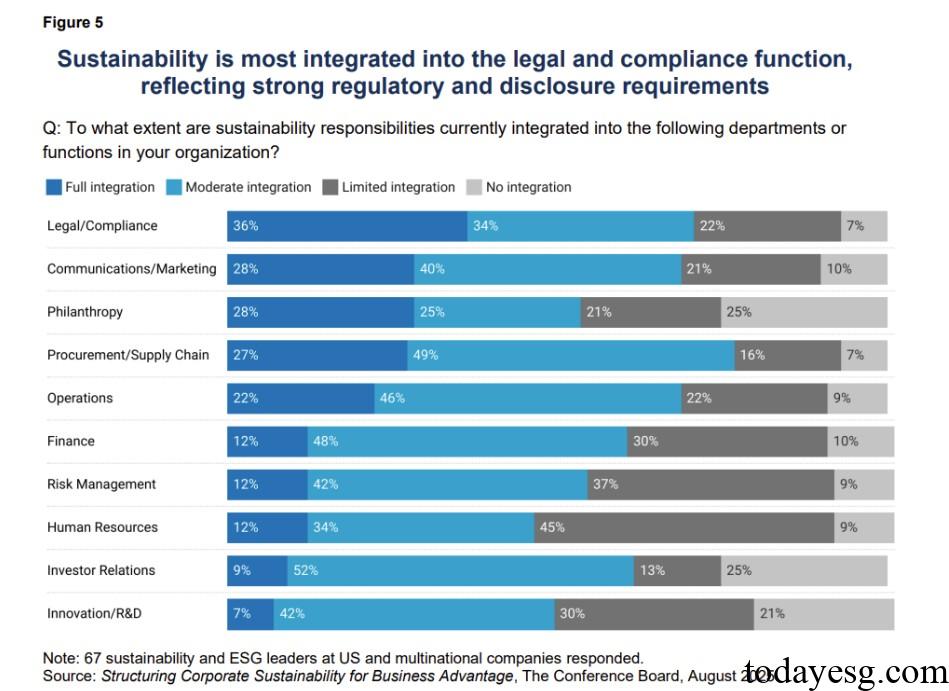

Corporate Sustainability Development Integration

66% of respondents believe that sustainability has been moderately integrated into their business, 23% believe it is in the early stages of integration, and 7% believe that sustainability has been fully integrated into their business. There are significant differences in the integration of sustainable development among different departments, with departments such as legal, marketing, and procurement making faster progress, while departments such as innovation and human resources making slower progress. Corporates still have great potential for sustainable business development in product design, talent management, and capital allocation.

The report suggests that common ways for companies to integrate sustainable development include:

- Establish a cross functional Sustainable Development Committee: 59%. This action can improve the effectiveness of corporate sustainability plans.

- Link Sustainable Development Goals with Financial and Operational Key Performance Indicators: 41%. This action can help finance, operations, and sustainable development departments work based on common benchmarks.

- Incorporate sustainability into performance indicators and incentive measures: 35%. This action can increase motivation but faces challenges due to stakeholder review.

Reference: