European Sustainability Reporting Standards Q&A

The Global Reporting Initiative (GRI) releases European Sustainability Reporting Standards Q&A aimed at explaining the connection between the GRI standard and ESRS to market participants.

The Global Reporting Initiative is collaborating with regulatory agencies in various jurisdictions worldwide to enhance the interoperability of sustainable information disclosure standards. Previously, GRI and the International Financial Reporting Standards Foundation (IFRS) announced strengthened collaboration on sustainable disclosure standards interoperability.

Related Post: IFRS and GRI Announce Enhanced Cooperation on Sustainable Disclosure Interoperability

Relationship between GRI Standards and ESRS

The European Financial Reporting Advisory Group (EFRAG) is the standard setter for sustainable development reporting in Europe. In 2021, the Global Reporting Initiative and the European Financial Reporting Advisory Group signed the first Memorandum of Understanding to collaborate on the development of European Sustainability Reporting Standards. The European Financial Reporting Advisory Group referred to the definitions, concepts, and disclosure rules of the Global Reporting Initiative.

The GRI standard and ESRS have achieved a high degree of consistency, and entities that disclose information based on ESRS can publish the GRI Content Index as a reference for information disclosure, thereby improving the relevance of their reports and expanding their scope of use. Most large companies in the European Union have already disclosed information in accordance with the GRI standard, so they do not need to incur additional costs when reporting based on ESRS.

Strengthen Interoperability between GRI Standards and ESRS

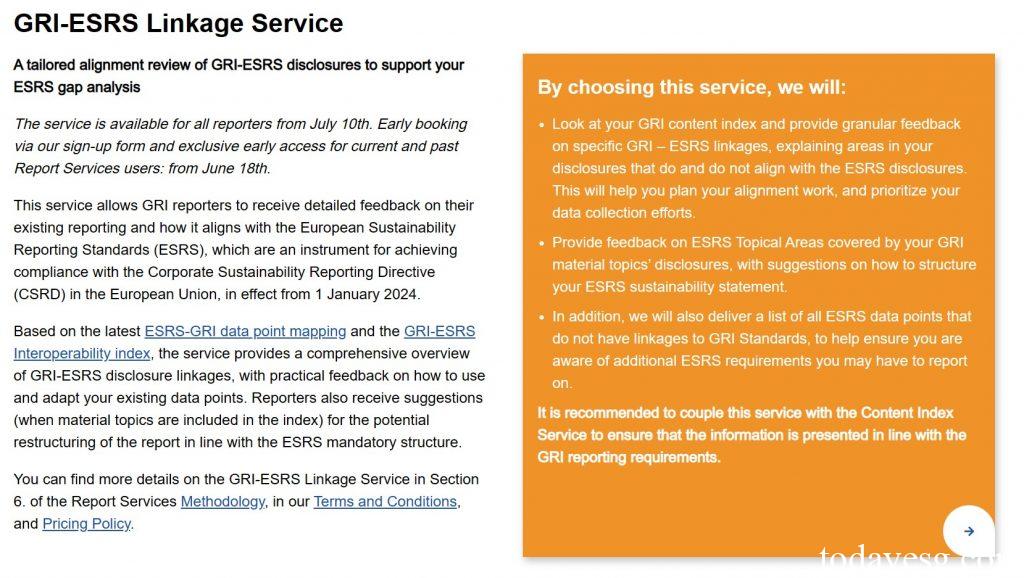

To assist entities in writing their first ESRS report, the Global Reporting Initiative has launched interoperability and mapping tools to measure the relevance of disclosure standards. The GRI Academy has also launched related courses to provide professional training for entities. In March of this year, the Global Reporting Initiative released the Corporate Sustainability Reporting Directive Essentials, which provides a detailed explanation of the core contents of Corporate Sustainability Reporting Directive. In June, the Global Reporting Initiative launched the GRI-ESRS Linkage Service to provide advice and feedback to entities.

The Global Reporting Initiative plans to continue implementing a series of measures to provide training to entities. In addition to the existing training courses at GRI Academy, the Global Reporting Initiative will launch the ESRS Certification Program. In addition, the Global Reporting Initiative and the European Financial Reporting Advisory Group are collaborating to develop an Extensible Business Reporting Language (XBRL) digital classification system, linking the data points involved in GRI standards and ESRS to reduce the burden on entities processing data. Entities only need to collect data based on the GRI standard, and use them in various disclosures.

The Future of GRI Standard and ESRS

At present, there are 40 GRI standards, including universal standards, sector standards, and topic standards. ESRS currently has 2 universal standards and 10 topic standards. Although both the GRI standard and ESRS focus on the impact of entities on the outside world, ESRS also focuses on how sustainability themes affect a company’s financial performance. At present, the European Financial Reporting Advisory Group is still implementing other ESRS standards, and when entities need to disclose substantive matters, the GRI standard can be used to fill the gap.

The Global Reporting Initiative is also involved in the development of ESRS standards, such as setting disclosure requirements for EU subsidiaries of non EU companies. The EU plans to develop at least 8 sector disclosure standards by June 2026, all of which will be based on existing GRI sector standards. In 2028, EU subsidiaries of non EU companies are required to comply with the requirements of the Corporate Sustainability Reporting Directive. Therefore, adopting the GRI standard now can prepare for future compliance requirements in the future.

Reference: