2024 Impact Investment Market Report

The Global Impact Investing Network (GIIN) releases its 2024 Impact Investment Market Report, aimed at analyzing the development of the global impact investment market.

2024 marks the 15th anniversary of the establishment of the Global Impact Investing Network. Currently, over 400 investors from 60 countries have joined the GIIN, actively promoting global sustainable development.

Related Post: What is Impact Investing and How is it Different from ESG Investing

Current Situation of Global Impact Investment Market

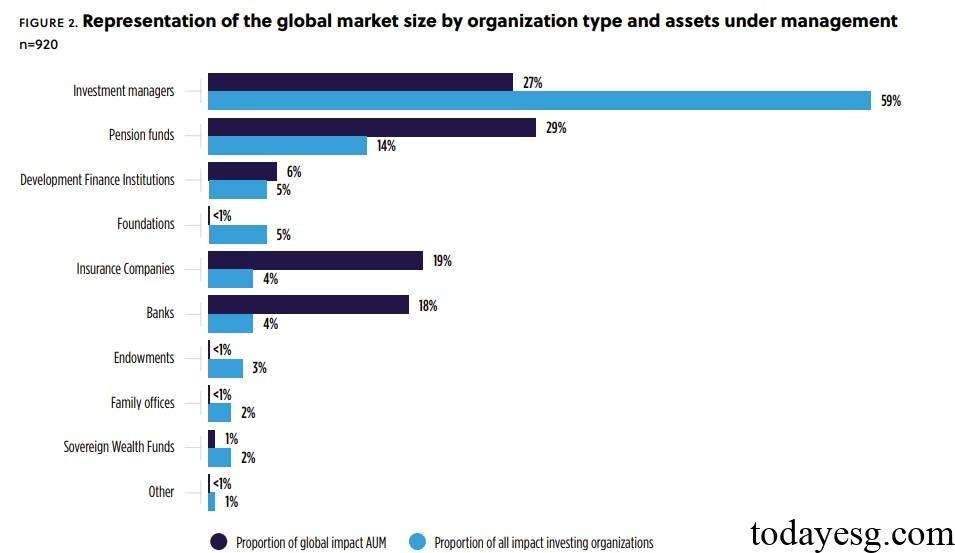

The Global Impact Investing Network estimates that the current global impact investment market size is $1.57 trillion, involving 1593 institutions. The average AUM of each institution is 986 million USD, with a median of 42 million USD, indicating that large institutions are in a leading position in the global impact investment market. A sampling survey shows that pension funds (29%), asset management companies (27%), insurance companies (19%), and banks (18%) have the highest market size proportions.

The vast majority of impact investments are located in developed markets, with Europe (53%), the United States, and Canada (35%) accounting for a relatively high proportion. Developed market impact investment institutions account for 95% of the global AUM, while emerging markets only account for 5%. Although the impact investment market in East Asia (6%) and Africa (2%) is rapidly developing, there is still significant financing gaps.

Development Factors of Global Impact Investment Market

The Global Impact Investing Network believes that the development of the impact investment market mainly depends on two factors, namely:

Institutional asset owners: Institutional asset owners include pension funds, insurance companies, and sovereign wealth funds, which are making impact investing an important strategy for portfolio management. Institutional asset owners manage over $80 trillion worldwide and are an important source of long-term financing for the market. To achieve the United Nations Sustainable Development Goals (SDGs), an additional $4.2 trillion needs to be invested globally each year. Institutional asset owners can play a key role in sustainable development investment through their management scale advantages.

Impact investment policy: Macro market development will affect the priority of impact investment, and 83% of investors believe that regulatory policies have been a challenge faced by impact investment in the past five years. Impact investing requires private capital to be invested in the public interest, so policy makers need to align with the direction of impact investors. The EU Sustainable Finance Disclosure Regulation is one of the most influential policies and has already had an impact on the carbon emissions of the investment portfolios of Article 8 and Article 9 funds.

Regional Impact Investment Market Development

The Global Impact Investing Network has summarized the development of some regional impact investment markets. The Global Sustainable Investment Alliance (GSIA), which finds that the global sustainable investment market has grown by 20% since 2020. The Impact Investing Institute in the UK finds that the scale of impact investment management in the UK has reached £ 7.6 billion, with a growth rate exceeding that of the UK asset management industry. European impact investment organization Impact Europe finds that the size of the European impact investment market may exceed $1 trillion by 2034, and it needs additional 813 billion EUR every year to achieve carbon goals.

The Global Impact Investing Network believes that with the increasing urgency of addressing environmental and social issues, the global impact investment market is accelerating its development. Although the current asset allocation is still insufficient to achieve sustainable development goals, investors can continue to expand their impact solutions, making impact investing an effective investment strategy that generates positive and measurable environmental and social impacts while earning financial returns.

Reference: