Clean Energy Equity Investment Report

The Glasgow Financial Alliance for Net Zero (GFANZ) releases a report on clean energy equity investment, aiming to estimate the scale of clean energy transition financing, and provides recommendations for clean energy equity investment development.

The Glasgow Net Zero Financial Alliance believes that equity is an important tool in clean energy financing, which can bear early investment risks and mobilize more private funds.

Related Post: International Energy Agency Releases Emerging Market Clean Energy Report

The Importance of Equity Investment

Equity investors, through early investment, take on risks and lead transactions, help companies smoothly navigate through development stages and enhance financial stability during periods of uncertain cash flow. Participants in clean energy financing projects, such as institutional investors, impact investors, sovereign wealth funds, multilateral development banks, etc., all engage in equity investments. Other investors, such as debt investors, typically intervene after equity investments are completed and assume relatively lower risks.

Because most equity investors need to provide financing support throughout various economic and credit cycles, these investors have high requirements for their balance sheets (many institutions need to maintain AAA ratings), which may limit their ability to raise equity investments. For example, according to climate financing data from multilateral development banks in 2023, 85% of financing is debt financing, while the rest 15% is equity financing, grants, and guarantees. In addition to investor restrictions, equity investment requires good regulatory policies and financial markets to enhance its ability to attract private investment.

Clean Energy Equity Investment Prediction

The total investment of global investors in the clean energy sector in 2024 is $1.99 trillion, of which $319 billion is from emerging markets and developing economies. Of the total investment of 319 billion US dollars, equity investment accounts for approximately 100 billion US dollars, or 31%.

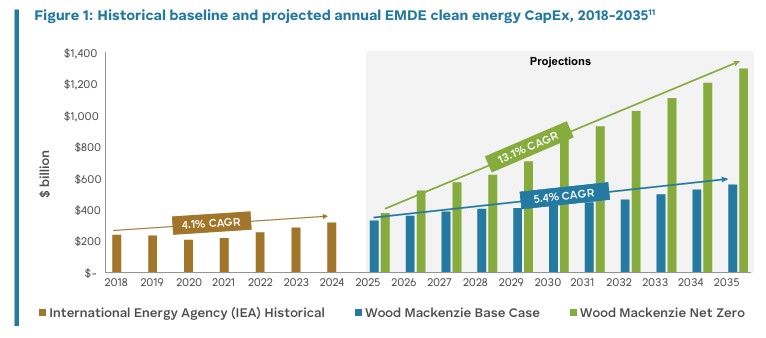

If we follow the current trend of energy transition (2.5 degrees Celsius warming by 2100), equity investment needs to grow at an annual growth rate of 5.4% before 2035, and reach $160 billion by 2035, achieving a financing scale of $560 billion in the clean energy sector. If we follow the trend of net zero transition by 2050, the annual growth rate before 2035 needs to reach 13.1%, and reach $375 billion by 2035, achieving a financing scale of $1.3 trillion in the clean energy sector.

For emerging markets and developing economies, based on the trend towards net zero emissions, the equity investment gap will be $15 billion in 2025 and $215 billion in 2035. Narrowing the equity investment gap as soon as possible can help emerging markets and developing economies achieve their net zero goals.

How to Accelerate Clean Energy Equity Investment

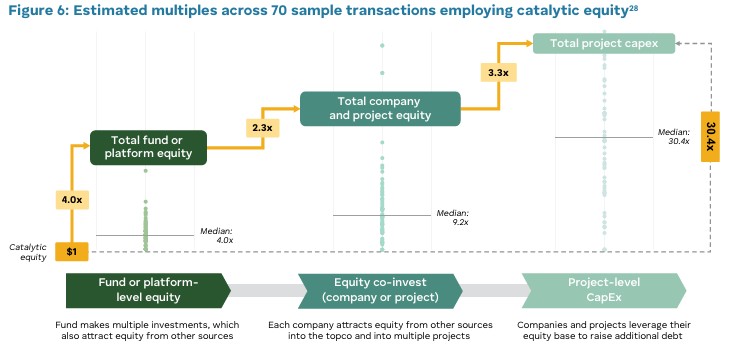

The GFANZ believes that catalytic equity is an important tool for investing in clean energy equity. Catalytic equity refers to mobilizing investments from other investors by reducing risk or increasing returns. It can help investors initiate previously unachievable business projects, shorten trading times, and enhance investor confidence. A recent study of 70 emerging market equity investment transactions shows that 1 unit of catalytic equity can mobilize 9 units of equity investment and 30 units of total project cycle investment. The total size of global catalytic equity in 2023 is $650 million, which is less than 1% of the total equity size.

To accelerate equity investment in clean energy, GFANZ proposes the following recommendations:

- Increase overall equity investment to reach $375 billion by 2035 and use performance data to increase investors’ willingness.

- Release more catalytic equity, reaching $12 billion to $25 billion by 2035, and explore deployment opportunities for catalytic equity and impact investment.

- Promote data sharing, collect, evaluate, and share equity investment performance and impact, and reduce barriers to equity investment.

Reference: