2025 Q2 Global Sustainable Finance Report

Fitch releases 2025 Q2 Global Sustainable Finance Report, which aims to summarize the development of sustainable bond data, ratings, and regulatory policies.

Fitch Ratings believes that global sustainable finance policies are changing in the second quarter, such as the EU simplifying the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD).

Related Post: European Commission Released a Proposal to Simplify Multiple Sustainable Regulations

Public Institutions Sustainable Bond Development

Sovereign countries, supranational institutions, and local institutions have a high proportion in the ESG bond market, accounting for over half of 2024 and 60% in the first half of 2025. The sustainable bonds issued by these institutions are driving global market innovation, such as the sustainable development linked bonds issued by sovereign countries, which adjust their coupon rates based on forest coverage.

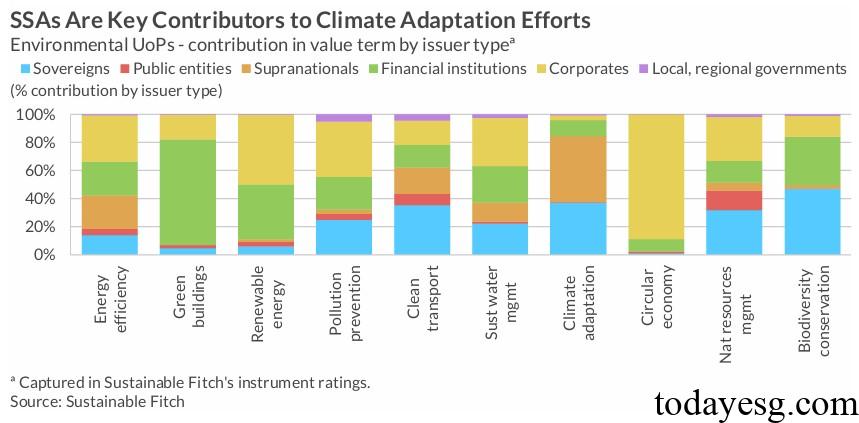

Sustainable bonds issued by public institutions are different from those issued by enterprises, where 40% of the profits are distributed to social public service institutions, while the proportion of the latter is only 9%. In terms of climate change adaptation, the former accounts for 85% of the global sustainable bond scale, while the latter accounts for only 3%. Fitch’s sustainable finance framework score shows that public institution sustainable bonds score is consistently higher than corporate bonds.

Sustainable Bond Development in Emerging and Developed Markets

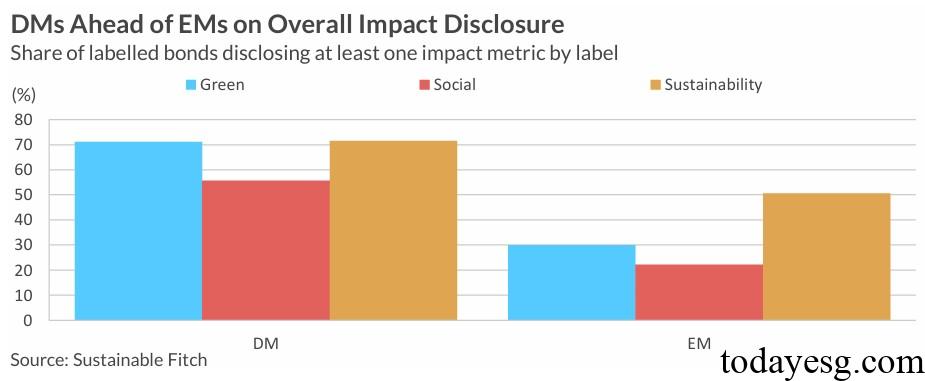

Emerging markets and developed markets have different preferences for sustainable bonds, with emerging markets having the highest proportion of sustainable development bonds (43%) and developed markets having the highest proportion of green bonds (66%), indicating that emerging markets are more concerned with the social and environmental aspects of the relationship. The information disclosure of emerging markets lags that of developed markets, with public institutions, enterprises, and financial institutions accounting for 48%, 36%, and 28% of information disclosure, respectively, with sustainability disclosure and environmental disclosure accounting for higher proportions.

The role of sustainable bonds in carbon reduction in emerging markets is higher than that in developed markets. Green bonds in emerging markets avoid an average of 1582 tons of carbon dioxide emissions, while those in developed markets avoid 1100 tons of carbon dioxide emissions. The issuers of green bonds in emerging markets are in the power and financial industries, while in developed markets they are in the chemical and automotive industries.

Sustainable Regulatory Policies Development

The EU has launched a proposal to simplify sustainable regulatory policies, which will come into effect in December 2026. In May 2025, the European Union issued a directive extending the deadline for companies to submit sustainability reports and EU Taxonomy reports by two years. The EU also plans to simplify the disclosure requirements of the European Sustainability Reporting Standards (ESRS) by the end of November 2025 and provide voluntary disclosure standards for sustainable information for non-listed small and medium-sized enterprises.

The UK released a draft of Sustainability Reporting Standards in the second quarter, referencing IFRS S1 and IFRS S2 issued by the International Sustainability Standards Board (ISSB), and reducing the burden on companies to disclose thematic sustainability information. The UK also plans to establish rules for sustainable reporting audit institutions and consider whether to require companies to disclose their transition plans.

Reference: