2024 Global Climate Action Report

EY releases the 2024 Global Climate Action Report, aimed at summarizing the progress of companies in addressing climate change.

EY surveyed 1400 companies in 51 jurisdictions, analyzing their climate disclosure, transition plans, decarbonization actions, and the relation between climate actions and financial performance.

Related Post: World Trade Organization Releases Global Climate Action Report

Overview of Global Climate Action

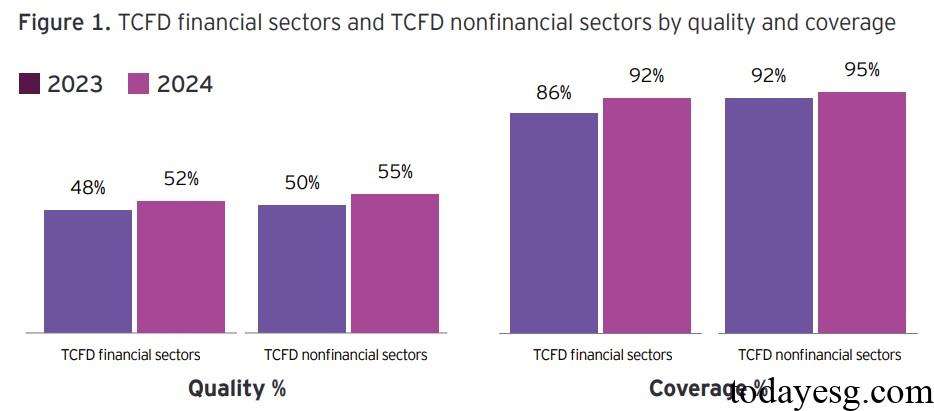

EY divides 1400 companies into 13 industries to measure their climate disclosure. In 2024, more companies disclose climate information, with the financial and non-financial sectors accounting for 92% and 95% respectively. The quality of climate information disclosure continues to improve, with quality scores of 52% and 55% for the financial and non-financial sectors. From industry perspective, mining industry (96%), transportation industry (96%), energy industry (96%), and insurance industry (96%) have the widest coverage, while the energy industry (59%), insurance industry (59%), and mining industry (58%) have the highest quality scores.

Climate scenario analysis is an important method for disclosing information, which can help companies plan for low-carbon transition. 67% of companies conduct scenario analysis in 2024, an increase of 9 percentage points compared to last year. Among the companies conducting scenario analysis, 29% only use qualitative analysis, while the rest use both qualitative and quantitative analysis. 84% of companies analyze climate risks, including common risk factors such as physical risk, transition risk, market risk, and reputation risk. 74% of companies analyze climate opportunities, with products and services, resource efficiency, and energy sources being common opportunity factors.

Climate Action and Financial Performance

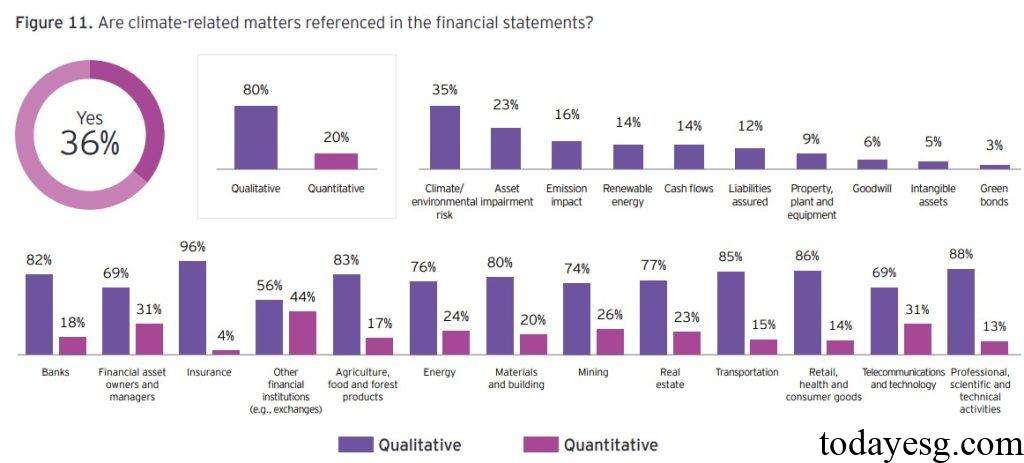

Although the coverage and quality of climate disclosure have improved, the relationship between climate risk and financial performance is not clear. 36% of companies mention climate related impacts in their financial reports, an increase of 3 percentage points compared to last year. When companies mention climate impacts, 80% use qualitative analysis and 20% provide quantitative analysis. The insurance industry (96%), technology industry (88%), and consumer industry (86%) have relatively high disclosure ratios. These data indicate that companies need to more effectively integrate climate risks and financial performance to identify, assess, and manage climate related risks and opportunities.

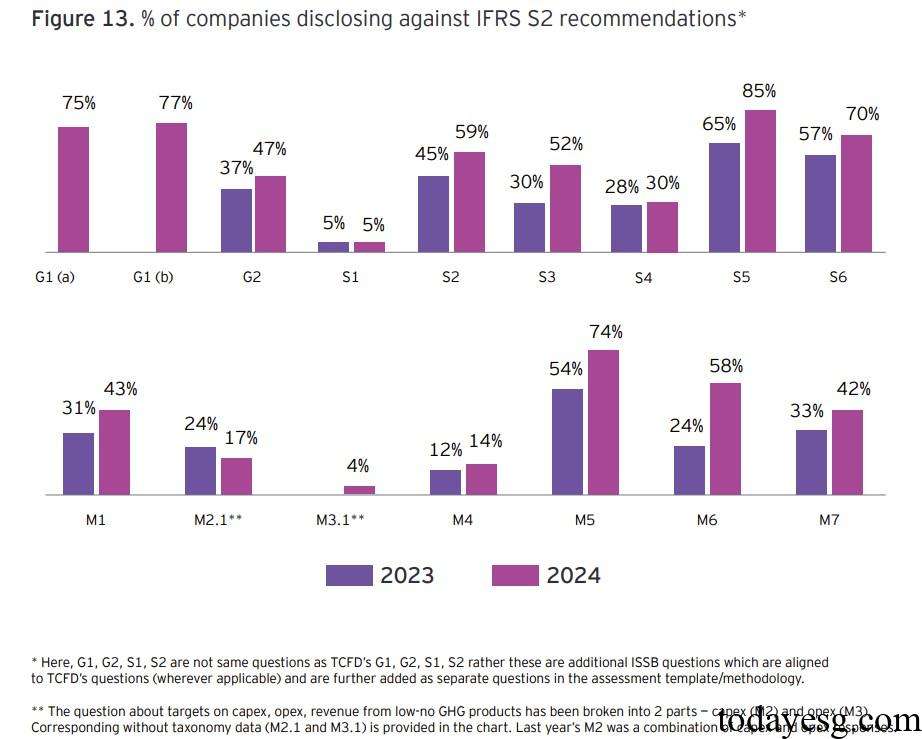

IFRS S1 and IFRS S2, released by the International Sustainability Standards Board (ISSB) in 2024, have officially come into effect, providing companies with climate related financial disclosure standards. EY finds that the number of companies using IFRS S2 for disclosure has significantly increased compared to last year, with the energy industry (57%), insurance industry (56%), and transportation industry (56%) accounting for a relatively high proportion. 85% of companies have disclosed progress on climate targets (S5), 42% of companies’ climate targets have been validated by third parties (M7), and 74% have disclosed Scope 3 carbon emissions data (M5).

Climate Action and Transition Plan

41% of companies have disclosed transition plans in 2024, and 21% of companies are currently developing transition plans. 78% of companies have already set emissions reduction targets, of which 21% involve Scope 1 and Scope 2 targets, and 50% involve Scope 1, Scope 2, and Scope 3 targets. Although 83% of companies have set short-term goals, only 51% have set long-term goals. Only 24% of the companies have set short-term and long-term goals that comply with scientific certification. These data indicate that companies need to take more action in transition plans and carbon emission targets to address the impacts of climate change.

EY finds that some common challenges may affect a company’s ability to develop transition plans, such as the belief that developing a transition plan would weaken the company’s competitiveness and impact short-term performance. Some companies have already reduced Scope 2 by shifting towards renewable energy, but achieving Scope 1 and Scope 3 goals requires more efforts. The company’s own technological costs, governance capabilities, and stakeholder engagements are also important factors affecting the transition plan.

Reference: