Sustainable Finance Development Report 2025

The European Securities and Markets Authority (ESMA) releases 2025 Sustainable Finance Development Report, which aims to provide a summary of the development of sustainable finance markets in Europe.

This report primarily focuses on the ESG fund market and regulatory policies, while also analyzing ESG bonds.

Related Post: Fitch Releases 2025 Q2 Global Sustainable Finance Report

European ESG Fund Industry Development

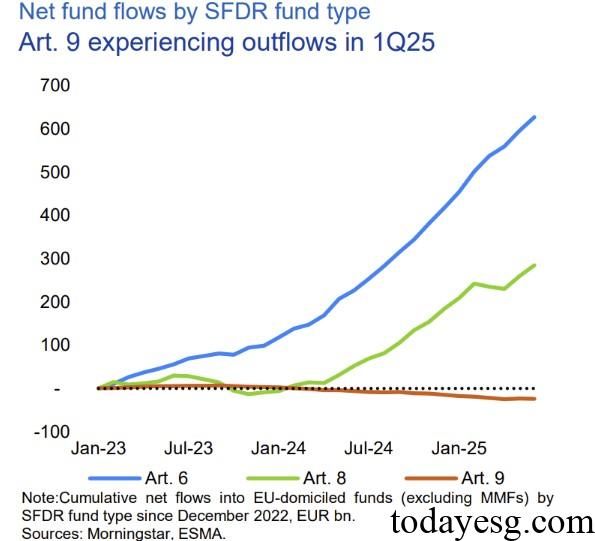

In the first quarter of 2025, European ESG funds experienced a net outflow of €3.8 billion, marking the first quarterly outflow since 2018. However, in the second quarter, there was a net inflow of €1.8 billion, reversing the trend. As the primary market for global ESG funds, European ESG funds have seen an asset size eight times that of the United States. Since the fourth quarter of 2022, they have experienced a cumulative inflow of €198 billion, accounting for 11% of their total size. Meanwhile, US ESG funds have seen a cumulative outflow of €20 billion during the same period, with nearly €4.5 billion outflow in the first half of this year.

The European Sustainable Finance Disclosure Regulation (SFDR) divides sustainable funds into Article 8 funds and Article 9 funds. In the first half of 2025, Article 8 funds received an inflow of 100 billion euros, accounting for 2% of the total. Article 9 funds saw an outflow of 9 billion euros, accounting for 3% of the total. Analyzing by asset class, Article 9 funds saw a net outflow in stock funds and a net inflow in fixed income funds. This may be due to the lower redemption pressure on fixed income funds. This is also reflected in the European ESG bond market, where the total size of green bonds has increased by 12% in the past year.

European ESG Fund Regulations Development

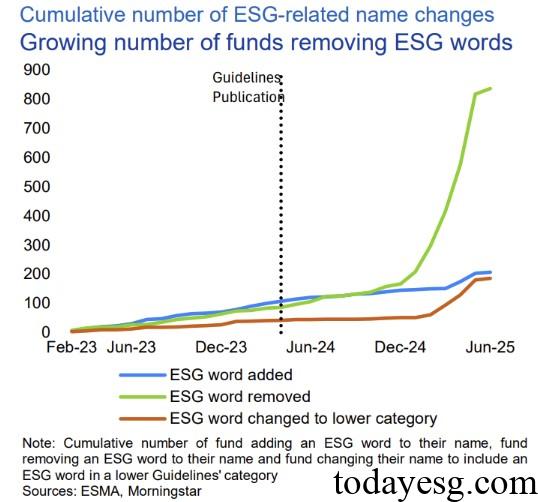

The European Securities and Markets Authority has issued ESG fund naming rules to standardize the use of sustainability terminology in ESG funds, and the new rules officially came into effect in May this year. To meet compliance requirements, adjustments to the names of ESG funds have seen rapid growth since the fourth quarter of last year. Since the first quarter of 2023, 207 funds have added ESG terminology to their names, 836 funds have removed terminology, and 186 funds have replaced terminology.

In addition to changing the name of the fund, some ESG funds have updated their investment policies, such as adjusting the minimum portfolio threshold or adding exclusion clauses related to low-carbon benchmarks. Regulators believe that ESG fund naming conventions can provide investors with clearer sustainable expectations, help reduce the risk of greenwashing, and enhance market confidence.

European ESG Bonds Development

The total size of European ESG bonds continued to grow in the first half of the year, with a relatively high proportion of green bonds. In the second quarter of 2025, the green bond issuance exceeded 80 billion euros, with the public sector accounting for one-third. The premium rate of green bonds continued to be higher than that of traditional bonds, with a difference of about 5 basis points.

Reference: