2025 Sustainable Finance Report

The European Securities and Markets Authority (ESMA) releases 2025 Sustainable Finance Report, which aims to summarize the development of the sustainable finance industry in Europe in 2024.

The European Securities and Markets Authority believes that the uncertainty of sustainable global regulatory policies increases in the second half of 2024, and the EU plans to reduce the burden of sustainable policies on businesses and enhance market competitiveness.

Related Post: European Securities and Markets Authority Releases Sustainable Finance Report

Sustainable Financial Development in Europe

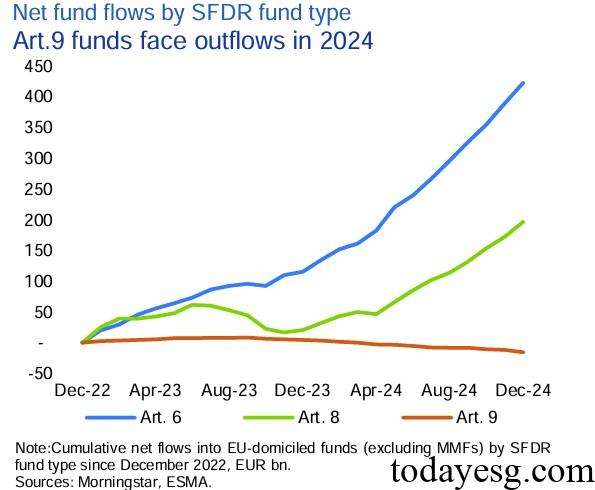

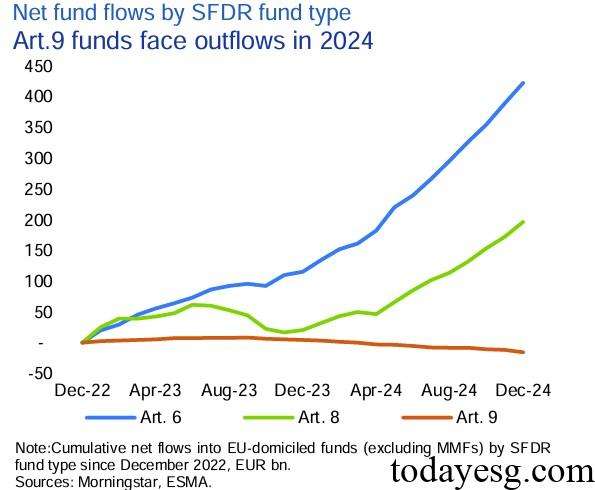

The ESG investment trend in the European region has declined in the second half of 2024. Taking the Sustainable Finance Disclosure Regulation (SFDR) as an example, Article 9 funds had a net outflow of 10 billion euros in the second half of the year, accounting for 3% of the total size. The net inflow of Article 8 fund was 111 billion euros, lower than that of Article 6 fund (183 billion euros). The total inflow into Article 8 and Article 9 funds in 2024 is 157 billion euros.

The scale of EU ESG bonds in 2024 is 2.2 trillion euros, a year-on-year increase of 17%. The EU’s green bonds are in a leading position globally, with private sector green bond issuance accounting for half of the world’s total by 2024. The share of green bonds in the financial industry has decreased from 67% in 2022 to 45%, while the issuance of green bonds in the non-financial industry has increased by 75%. In 2024, one-third of the funds raised by EU energy and utility companies in the bond market come from green bonds.

Enterprises can use green bonds to finance their green capital expenditures (CapEx). According to the EU Taxonomy, the utility sector has a consistent capital expenditure of 62%, followed by the energy industry (28%) and the real estate industry (27%). This indicates that the green transformation speed of the European public utility industry is relatively fast.

The EU Green Bond Regulation will continue to improve the transparency and consistency of green financing. The EU’s green bond regulatory policy requires external review of bonds, aimed at assessing the environmental credibility of green bonds. Second Party Opinion is the most widely used type of review, currently accounting for 65% of the total amount of private sector green bonds.

Reference: