ESG Fund Performance Report

The European Securities and Markets Authority (ESMA) releases a report on ESG fund performance during market turmoil, aiming to analyze the performance and capital flows of ESG funds in the first half of 2020.

ESMA believes that ESG funds are an important component of the sustainable investment market, and studying the performance of ESG funds during periods of market turmoil can enhance risk management capabilities and help regulatory agencies formulate policies.

Related Post: ESMA Releases Report on Sustainable Development Goals Funds

Global Epidemic and Market Turmoil

The global epidemic in the first half of 2020 had a significant impact on the financial market, and the epidemic was included in the research framework as an exogenous shock. Taking the European stock market as an example, the market fell sharply in February 2020, gradually recovered in April, and remained stable in May and June. ESMA divides this period into three stages: stress period, recovery period and stable period to analyze the performance of ESG funds and non-ESG funds at different stages.

After excluding the characteristics of passive funds that follow market changes, this study included a total of 2,581 active funds in the EU, of which 345 (accounting for 13% of the total sample) are classified as ESG funds, and 956 (accounting for the total sample) 37%) have high sustainability ratings. Since there is no Sustainable Financial Disclosure Regulation (SFDR) during the study period, its related contents are not included.

ESG Fund Performance During Market Turmoil

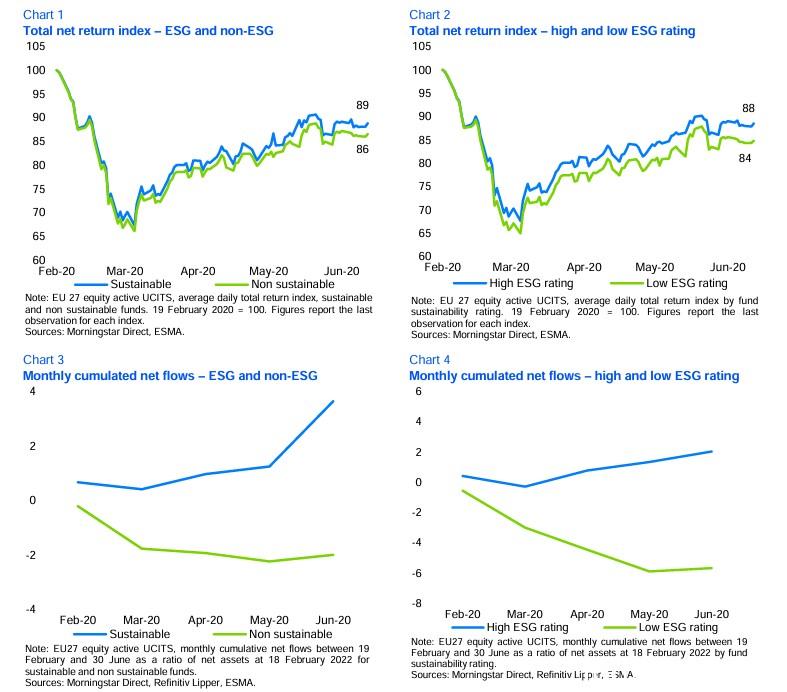

ESMA uses multiple linear regression to study the performance of ESG funds during market turmoil. During the sharp market decline in February 2020, both ESG funds and non-ESG funds experienced significant drop, with an average decline of 30%. However, the overall performance of ESG funds is slightly higher than that of non-ESG funds. From the beginning of the stress period to the end of the stable period, ESG funds draw back an average of 11%, and non-ESG funds draw back an average of 14%. Furthermore, high-rated ESG funds performed better than low-rated ESG funds, both during the downturn and the recovery phase.

In terms of capital flows, both ESG funds and non-ESG funds recorded capital outflows when they fell, but ESG funds subsequently recorded capital inflows, and the gap with the previous capital flows of non-ESG funds continued to widen. High-rated ESG funds also perform better than low-rated ESG funds in terms of capital flows. ESMA believes that investors may view sustainability as a hedge against volatile markets and therefore invest more money in ESG funds.

ESMA plans to include more factors such as fund risk exposure and historical performance in subsequent studies to conduct a more in-depth analysis of the performance and driving factors of ESG funds, and obtain more robust results.

Reference: