ESG Fund Naming Rules Impact Report

The European Securities and Markets Authority (ESMA) releases ESG fund naming rules impact report, aiming to summarize the influence of ESG fund naming rules on EU fund market.

In May 2024, the European Securities and Markets Authority released naming rules for ESG funds, proposing standards for funds to use ESG or sustainable development terms in their names. This report is based on nearly 1000 shareholder notices from the 25 largest asset management companies in EU, which include changes to fund names and investment policies.

Related Post: European Securities and Markets Authority Releases Guidelines on ESG Fund Names

Background of ESG Fund Naming Rules

According to a study by the European Securities and Markets Authority, the proportion of funds using ESG terminology has increased from 5% in 2019 to 15% in 2024, and funds using ESG terminology can attract more capital inflows. To ensure that the fund name is fair, clear and not misleading, in May 2024, the regulator issued the ESG fund naming rules and required the fund to adjust its name and investment policy before May 2025, to strengthen the reputation of the EU sustainable financial market.

In addition to the requirements for fund names and investment thresholds, ESG fund naming rules also require compliance with some benchmarks in the EU Benchmarks Regulation:

- Climate Transition Benchmarks: Exclude companies that violate the United Nations Global Compact (UNGC) principles or the OECD Guidelines for Multinational Enterprises.

- Paris-Aligned Benchmarks: Exclude companies that generate specific revenue from the fossil fuel industry, subject to meeting climate transition benchmarks.

Although the Climate Transition Benchmarks and the Paris-Aligned Benchmarks have established negative screening criteria, there is no clear list of companies that need to be excluded. Asset management companies typically compile their own lists or use lists provided by third-party organizations. Funds that typically use social or governance terminology should apply to Climate Transition Benchmarks, while funds that use environmental, impact, or sustainable development terminology should apply to Paris-aligned Benchmarks.

Prior to the release of ESG fund naming rules, approximately 4900 funds in the European Union used ESG terminology in their names. These funds usually have two options after the rules are released. Option one: change the fund name and no longer use ESG terminology. Option 2: update fund investment policies, increase ESG screening criteria or increase the proportion of sustainable investment assets; For funds, changing the fund name may result in investor redemptions and may also face greenwashing risks. Updating fund investment policies may reduce the range of investable assets, affecting investment returns and volatility.

ESG Fund Naming Rules Impact Analysis

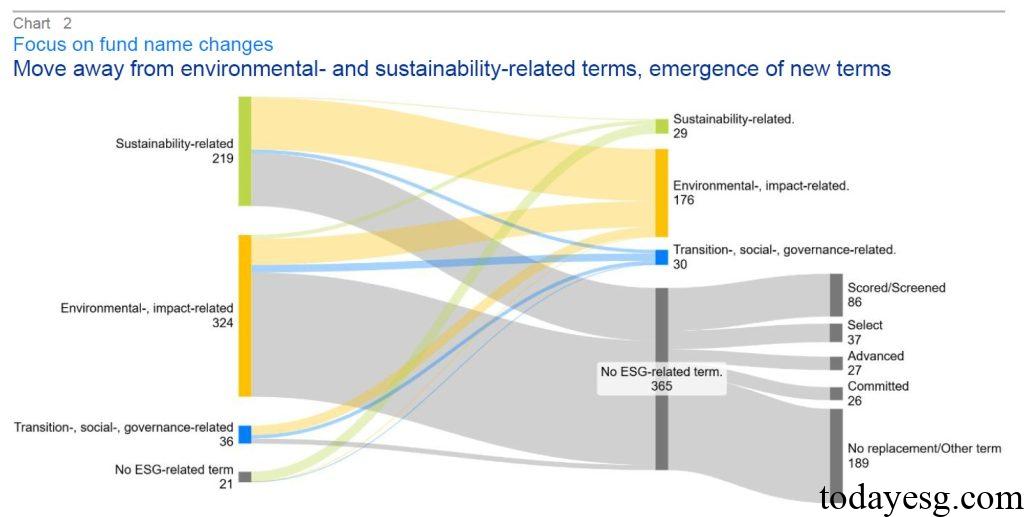

The European Securities and Markets Authority has collected information on 924 funds from 25 asset management companies, with a total asset management scale of 840 billion euros. Among these funds, 600 have changed their names and 530 have updated their investment policies. One third of the funds that changed their names also updated their investment policies.

The actions taken by funds changing their names include removing ESG terminology (61%) or using more lenient sustainability terminology (21%). Passive management funds mainly choose the former, while active management funds mainly choose the latter. After removing ESG terminology, new terms added to the fund include scoring, screening, selection, etc. The actions of updating investment policies for funds include explicitly mentioning negative screening clauses, stating that 80% of investment portfolios must comply with environmental or social characteristics, and 50% of investment portfolios must comply with sustainable investment characteristics. Some funds have also modified their calculation methods for sustainable investment.

Reference:

Impact of ESMA Guidelines on the Use of ESG or Sustainability-related Terms in Fund Names