Correspondence Mapping for Sustainable Disclosure Standards

The European Financial Reporting Advisory Group (EFRAG) and the Task Force on Nature-related Financial Disclosures (TNFD) publishes a correspondence mapping for sustainable disclosure standards, aiming to illustrate the relationship between European Sustainability Reporting Standards (ESRS) and TNFD recommendations.

The European Sustainability Reporting Standards is the core of the European disclosure framework, and the European Financial Reporting Advisory Group has previously released implementation guidelines to provide guidance for enterprises to implement sustainable disclosure. EFRAG is also committed to improving the interoperability between ESRS and other international standards. The correspondence mapping will improve the alignment of natural and biodiversity disclosure.

Related Post: EFRAG Releases Implementation Guidance for European Sustainability Reporting Standards

Contents of Correspondence Mapping for Sustainable Disclosure Standards

The European Financial Reporting Advisory Group and the Task Force on Nature-related Financial Disclosures have summarized the correspondence mapping from five dimensions, including concepts and definitions, approach to materiality, LEAP approach, reporting pillars, and recommended disclosures and metrics.

In terms of concepts and definitions, both the European Financial Reporting Advisory Group and the Task Force on Nature-related Financial Disclosures believe that nature, ecosystems, and biodiversity have a clear impact on stakeholders. Both of them include the four natural domains of land, ocean, freshwater, and atmosphere in sustainable information disclosure standards, and use the United Nations Convention on Biological Diversity to define biodiversity and ecosystems. Both of them suggest that enterprises need to consider their dependence and impact on natural resources before implementing materiality assessments, and measure the opportunities and risks generated by natural resources based on the expected financial impact. These risks include physical risks (acture and chronic risks), transition risks, and systemic risks.

In terms of approach to materiality, the European Financial Reporting Advisory Group believes that double materiality is the foundation of the European Sustainability Reporting Standards, and companies should identify information based on two dimensions: financial materiality and impact materiality when making sustainable disclosures. The Task Force on Nature-related Financial Disclosures has not established specific materiality measurement methods. It is recommended that companies identify and disclose information based on different sustainable preferences and specific requirements of jurisdictions, and companies are not mandatory to use double materiality methods.

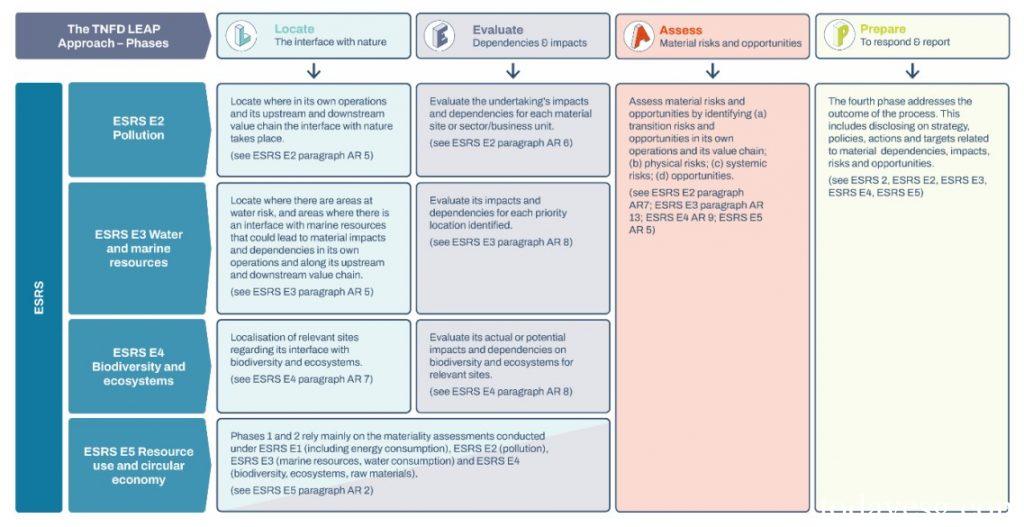

In terms of the LEAP approach, the Task Force on Nature-related Financial Disclosures recommends that companies adopt LEAP approach to identify, evaluate, manage, and disclose information, which includes four steps: locate, evaluate, assess, and prepare. The European Sustainability Reporting Standards considers the LEAP method as a tool that can be used for materiality assessment by businesses, and mentions LEAP approach in ESRS E2 pollution, ESRS E3 water and marine resources, ESRS E4 biodiversity and ecosystems, and ESRS E5 resource use and circular economy.

In terms of reporting pillars, both the Task Force on Nature-related Financial Disclosures and the European Financial Reporting Advisory Group adopt pillars designed by the Task Force on Climate-related Financial Disclosures (TCFD), which include governance, strategy, metrics and targets. In terms of risk management, the European Sustainability Reporting Standards applies Risk and Opportunity Management, while the Task Force on Nature-related Financial Disclosures applies Risk and Impact Management. Both also take into account the sustainable disclosure guidelines by International Sustainability Standards Board (ISSB).

In terms of recommended disclosures and metrics, the Task Force on Nature-related Financial Disclosures and the European Financial Reporting Advisory Group have provided detailed mapping tables for sustainable disclosure standards. The 14 recommendations provided by the Task Force on Nature-related Financial Disclosures have all been mapped to the European Sustainability Reporting Standards. In addition to these suggestions, EFRAG and TNFD recommends that companies can also disclose other relevant indicators based on actual situations.

Reference: