Global Climate Related Financing Development

This article introduces the development of global climate related financing based on real economy.

The Organization for Economic Co-operation and Development (OECD) released the Review on Aligning Finance with Climate Goals, which measures global climate related financing development from multiple dimensions, and real economy is an important dimension.

Related Post: Global Sustainable Investment Alliance Releases Report on Climate Action Financing

Global Climate Related Financing Based on Real Economy

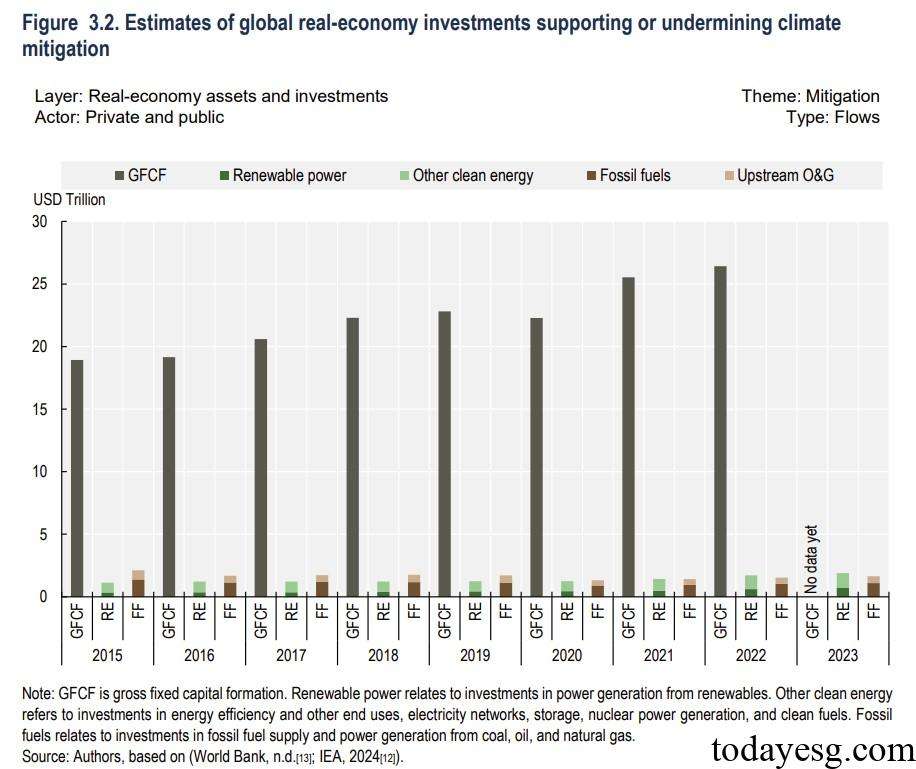

The OECD believes that current climate related financing analysis for the real economy is mainly based on the industry level, where gross fixed capital formation can be considered as an estimate of real economy investment. Due to the difficulty in obtaining data on climate change adaptation activities, climate related financing mainly focuses on climate change mitigation activities.

The global fixed capital formation in 2022 is $26.4 trillion, of which investment in clean energy is about $1.7 trillion, accounting for 6% of the total, and investment in fossil fuels is about $1.5 trillion. Since 2015, global climate related financing in the real economy has increased by 45%, while the proportion of fossil fuel investment in energy investment has decreased from 80% to 60%. Due to differences in statistical methods from different data sources, it is estimated that the global climate related financing of the real economy is between $1.3 trillion and $1.7 trillion.

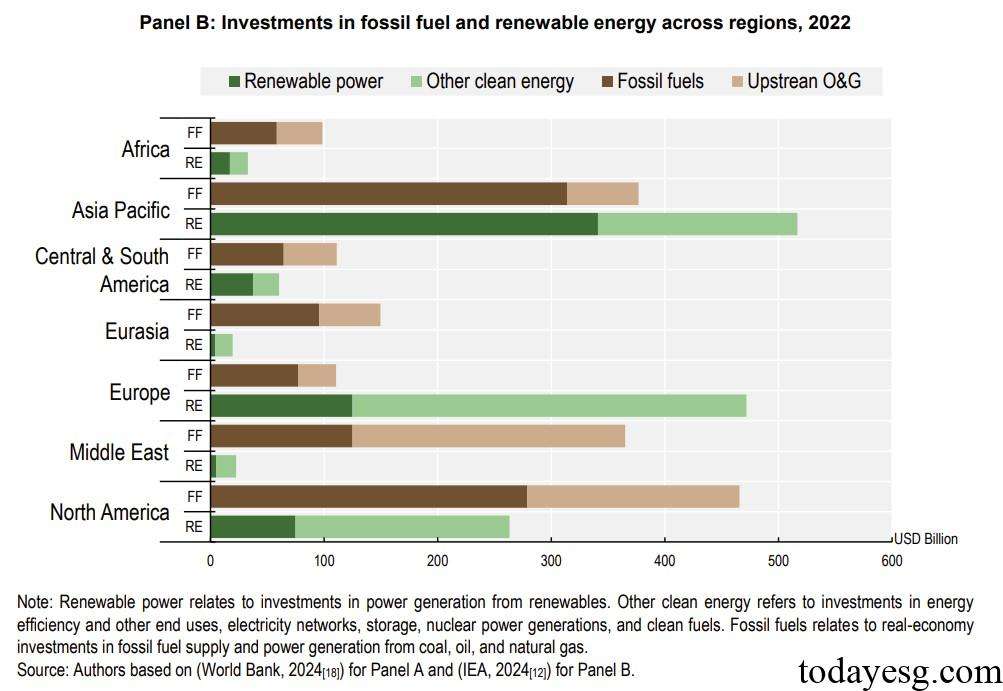

There are differences in the scale of climate related financing across different industries. For example, in the fossil fuel industry, low-carbon investment began to emerge in 2021, while in 2022, these activities accounted for only 1%. Industry data from Europe shows that in 2023, the proportion of green capital investment in the transportation and steel industries is higher than that in the chemical and food and beverage industries. From a regional perspective, clean energy investment in Asia Pacific, Europe, and North America is relatively large, while Asia Pacific and North America also have relatively large investments in fossil fuels.

From national perspective, high-income countries (85 in total, accounting for 39% of the global population) account for 54% of global climate related financing, middle-income countries (105 in total, accounting for 49% of the global population) account for 45% of global climate related financing, and low-income countries (26 in total, accounting for 12% of the global population) account for 0.40% of global climate related financing. Therefore, climate action in low-income countries needs to rely on international climate financing, which is set at $100 billion per year by the United Nations Framework Convention on Climate Change (UNFCCC).

Global climate related financing based on the real economy is jointly completed by the public and private sectors, and in terms of investment scale, the two are almost the same (640 billion US dollars and 625 billion US dollars), with the private sector in North America and Europe accounting for nearly 80% of the climate investment scale. There are significant differences in the specific direction of climate investment. The public sector provides 99.7% of funding support for renewable energy research and development, while the private sector provides 75% of funding support for renewable energy investment.

Reference: