Voluntary Carbon Market Report

The CFA Institute Research & Policy Center releases a report on voluntary carbon market, aimed at analyzing the development of global voluntary carbon markets and proposing corresponding solutions.

The CFA Institute believes that voluntary carbon markets are important climate financing tools, but they also face challenges in terms of standards, trading, pricing, and risk management. Effectively addressing these issues can improve the effectiveness of voluntary carbon markets.

Related Post: CFA Institute Releases Global Carbon Market Report

Introduction to Voluntary Carbon Market

There are two main types of global carbon markets, namely compliance carbon markets and voluntary carbon markets. The mandatory carbon market sets emission limits for regulated enterprises through a quota and trading mechanism and provides quotas through auction or allocation. The voluntary carbon market allows companies to purchase carbon credits to offset their carbon emissions. Currently, regions such as California, China, and Singapore allow companies to use voluntary carbon credits to offset their emission obligations under mandatory carbon markets or carbon tax systems.

The voluntary carbon market serves as a bridge connecting enterprises, financial institutions, and investors. Voluntary carbon credit comes from carbon projects jointly invested, developed, and operated by banks, investors, and enterprises. Exchanges provide venues for the trading and transfer of carbon credits, and investors and banks use carbon credits to offset the carbon emissions of their investment portfolios. It is expected that the size of the global voluntary carbon market will grow from $2 billion in 2022 to $100 billion in 2030 and reach $250 billion in 2050.

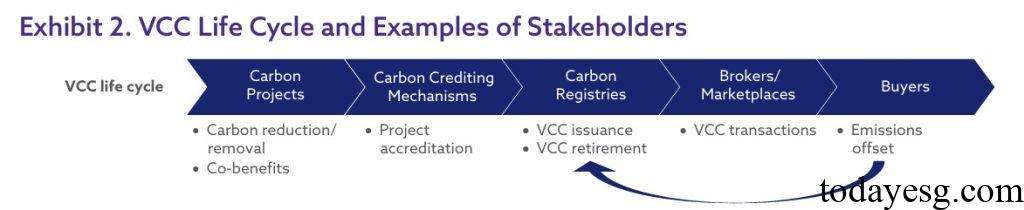

Voluntary carbon credits are an important component of the voluntary carbon market, with a total of 170 carbon credit projects worldwide. These projects are divided into two categories: carbon reduction and carbon removal, with carbon reduction accounting for 90%. Carbon credit projects require independent auditing and registration in the voluntary carbon market for buyers to purchase. After selling carbon credits, the seller needs to cancel the corresponding credits to cancel their circulation.

Challenges in Voluntary Carbon Market

The CFA Institute believes that there are challenges in the development of voluntary carbon markets, including:

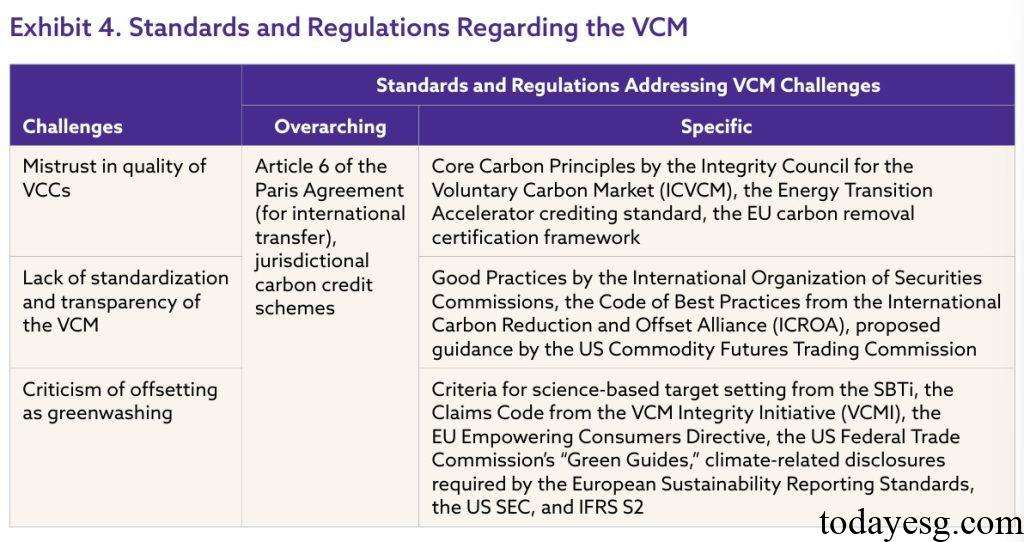

- Quality of voluntary carbon credits: The buyer of carbon credits believes that there is uncertainty in the calculation of carbon credits and there may be cases of double counting. Some projects still have the possibility of carbon credit reversal, resulting in some carbon credits needing to be used as a buffer and not sold in full. The implementation of some carbon credit projects may lead to an increase in carbon emissions outside their boundaries.

- Standardization of the voluntary carbon market: There is no consistent regulation in the voluntary carbon market, and there are challenges to its standardization and transparency. Two thirds of voluntary carbon credit trading take place in over-the-counter markets, which lack more details. 90% of intermediary agencies have not disclosed the fees for carbon credit trading, making it difficult to accurately measure the efficiency of the carbon market.

- Greenwashing of carbon offset: Some stakeholders believe that purchasing carbon credits to achieve carbon offset may lead to greenwashing, and the EU Empowering Consumers Directive requires the prohibition of disclosing climate marketing for goods or services based on carbon offset. The European Sustainability Reporting Standards (ESRS) require companies to disclose in more detail their use of voluntary carbon markets. The Science Based Targets Initiative (SBTI) believes that voluntary carbon credits cannot be included in a company’s net zero target.

Solution to Voluntary Carbon Market

To address the above challenges, CFA Institute proposes the following solutions:

- Enhance the transparency of voluntary carbon market: Strengthen the disclosure of price information and improve price transparency. For example, Australia transfers the voluntary carbon market over-the-counter trading clearing process to a public exchange.

- Coordinate voluntary carbon credit quota standards: Improve measurement, reporting, and verification methods to provide consistent standards for voluntary carbon credits trading by multinational corporations worldwide.

- Generate effective price signals: Expand the scale of carbon removal technologies and address the price gap between mandatory and voluntary carbon markets.

- Develop a market volatility adjustment mechanism: Carbon pricing can reflect the external costs of emissions, and establishing a market-based pricing mechanism can provide additional incentives for enterprises to achieve decarbonization goals.

Reference: