Mapping between CDP Question Bank and European Sustainability Reporting Standard E1

The CDP and the European Financial Reporting Advisory Group (EFRAG) release a mapping document aimed at establishing a link between CDP Question Bank and ESRS E1.

The European Financial Reporting Advisory Group has previously released a sustainability disclosure standard mapping with the Taskforce on Nature-related Financial Disclosures (TNFD), aimed at strengthening the interoperability between international sustainability disclosure standards and European sustainability disclosure standards.

Related Post: TNFD and EFRAG Publishes Correspondence Mapping for Sustainable Disclosure Standards

Background of Mapping between CDP Question Bank and ESRS E1

CDP and the European Financial Reporting Advisory Group believe that the CDP question bank has a high degree of interoperability with the European Sustainability Reporting Standard E1 in terms of carbon emissions, internal carbon pricing, climate change targets, climate transition plans, etc. Therefore, mapping documents can be established to improve the efficiency of corporate information disclosure and help stakeholders in using sustainable information. This approach can also help businesses apply the EU Corporate Sustainability Reporting Directive (CSRD).

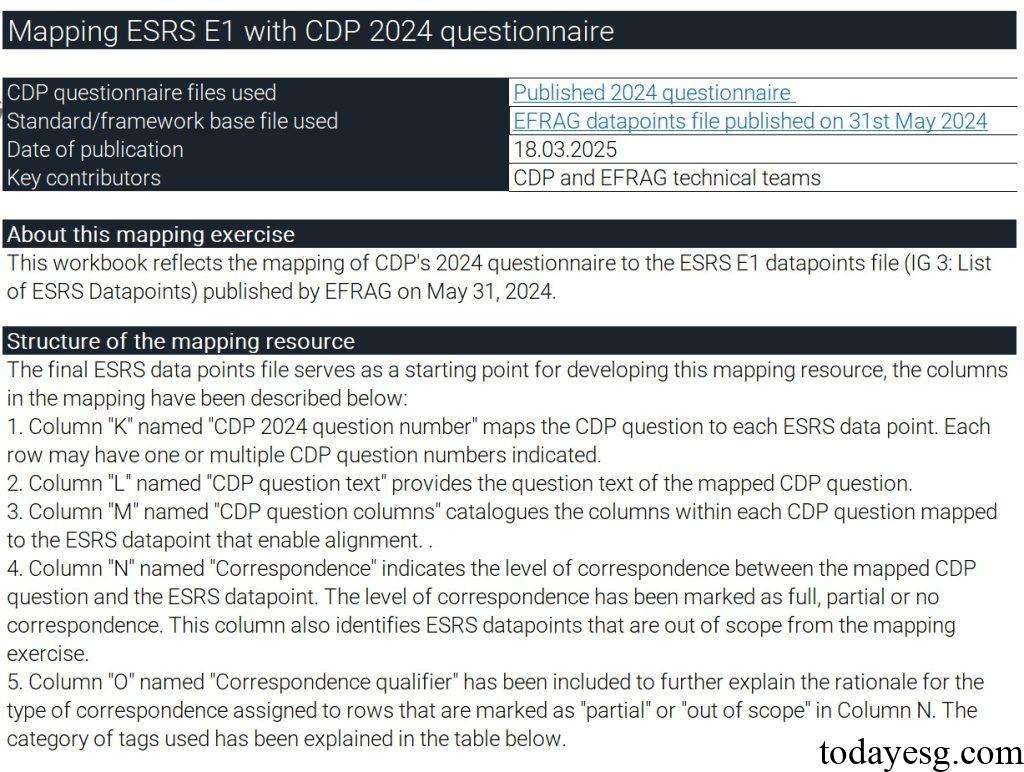

This mapping is based on the question bank released by CDP in 2024, as well as the Implementation Guidelines Three: European Sustainability Disclosure Standard Data Points released by the European Financial Reporting Advisory Group in May 2024. The mapping file does not include industry related data points from the CDP question bank, nor does it include European sustainability disclosure standard data points not covered by the CSRD.

Introduction to Background of Mapping between CDP Question Bank and ESRS E1

The mapping between the CDP question bank and the European Sustainability Reporting Standard E1 is based on a spreadsheet, where each row includes the question number, information, and options of the CDP question bank, as well as the data point number, name, and type of the European Sustainability Reporting Standard E1. There are several types of mappings, including Full, Partial, No Correspondence, and Out of Scope. According to statistics, the proportion of data points that meet Full, Partial, Unrelated, and Out of Scope criteria are 43%, 32%, 16%, and 9%, respectively. The reasons given in the document include:

- Additional ESRS requirement: Additional data points in E1.

- Difference in approach and scope: Differences between CDP question bank and E1.

- Difference in semantics: Differences between CDP question bank and E1.

- EU specific requirement: E1 requirements under other EU regulatory rules.

- Sector specific requirement: Industry requirements in E1.

For the convenience of stakeholders, the mapping file provides Extensible Business Reporting Language (XBRL), which allows direct access to data point information. CDP and the European Financial Reporting Advisory Group plan to continue working together to strengthen the interoperability of information disclosure standards.

Reference:

CDP and EFRAG Publish Correspondence Mapping between CDP Question Bank and ESRS E1