2025 Q1 Global Sustainable Bond Report

The Climate Bonds Initiative (CBI) releases 2025 Q1 Global Sustainable Bond Report, which aims to summarize the development trends of the sustainable bond market.

As of the first quarter of 2025, the total issuance scale of global green, social, and sustainable development bonds has reached 5.9 trillion US dollars.

Related Post: Climate Bonds Initiative Releases 2024 China Sustainable Bond Market Report

Global Sustainable Bond Market Development

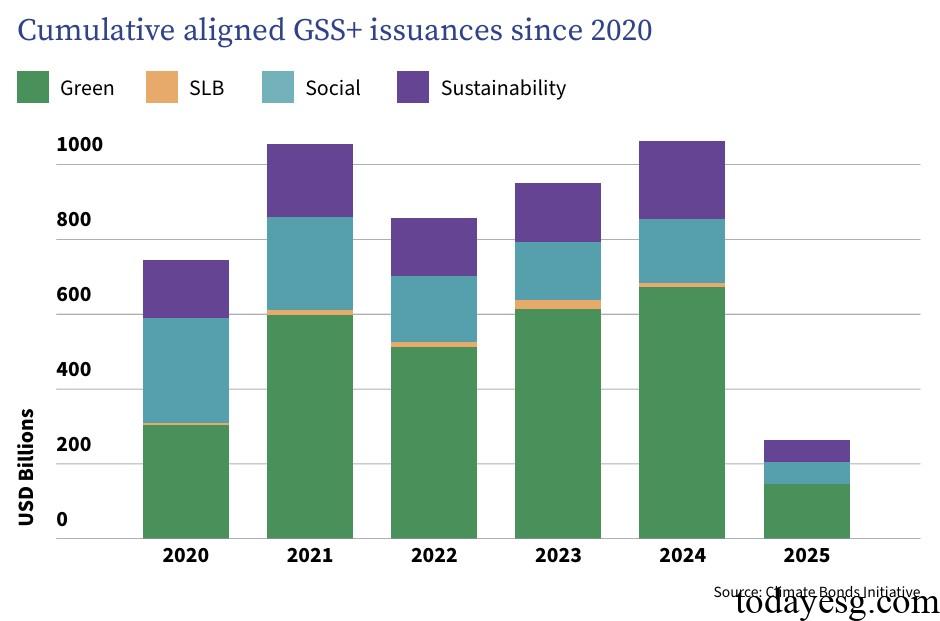

The issuance scale of the global sustainable bond market in the first quarter of 2025 was $262.3 billion, a year-on-year decrease of 17%. The reason for the decrease was a 52% reduction in non-financial corporate bond issuance and a 41% reduction in sovereign bond issuance. The issuers of sustainable bonds include government agencies (74.6 billion US dollars), development banks (63.6 billion US dollars), financial institutions (46.7 billion US dollars), non-financial institutions (37.3 billion US dollars), and sovereign states (34.2 billion US dollars), with currencies mainly in EUR (102.7 billion US dollars) and USD (81 billion US dollars).

Global Green Bond Market Development

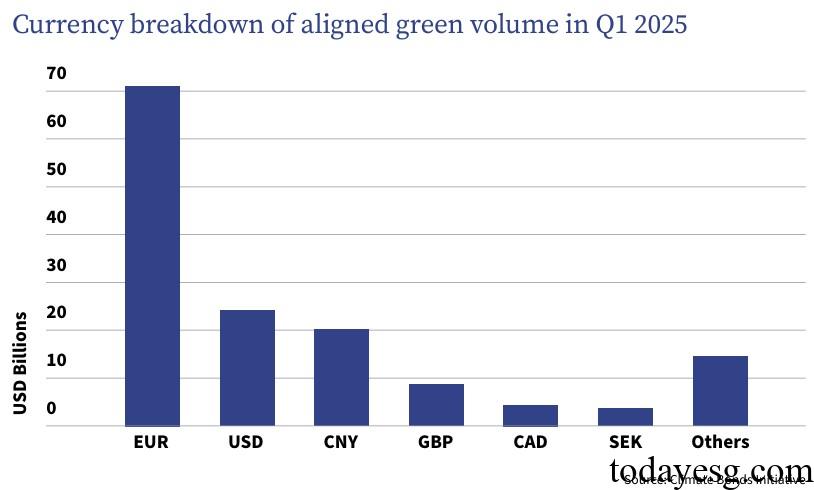

The global green bond issuance scale in the first quarter of 2025 is $146.6 billion, accounting for 56% of the total market size. The main currencies of green bonds are EUR (49%), USD (17%), and CNY (14%). As of the end of the first quarter of 2025, the total scale of global green bond issuance was $3.7 trillion, accounting for 62% of the total market size. China, Germany, and the United States ranked among the top three in terms of issuance size this quarter, with $20.7 billion, $15.8 billion, and $14.1 billion, respectively. The European Investment Bank (EIB) has the largest issuance scale (5 bonds totaling $9.9 billion).

Global Social Bond Market Development

The global social bond issuance scale in the first quarter of 2025 was 56.6 billion US dollars, accounting for 22% of the total market size, a year-on-year increase of 17%, reaching the highest level since 2021, with a total scale of 1.2 trillion US dollars. Social bond issuers include government agencies ($40.8 billion), development banks ($6.8 billion), and financial institutions ($6.2 billion). The International Finance Corporation (IFC) issued the largest social bond of the quarter ($2 billion).

Global Sustainable Development Bond Market Development

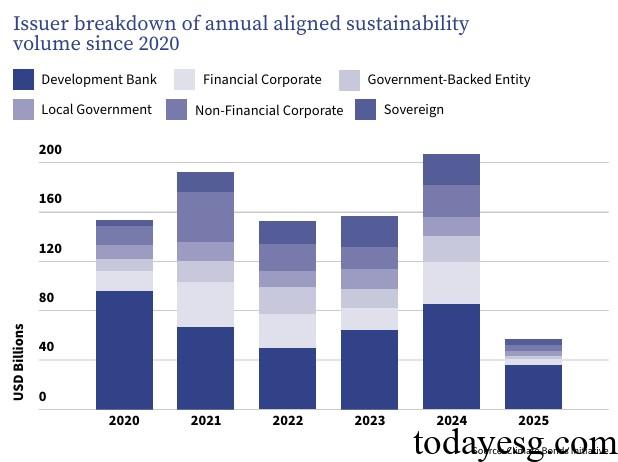

The global issuance scale of sustainable development bonds in the first quarter of 2025 is 58.2 billion US dollars, accounting for 22% of the total market size. The total issuance scale of sustainable development bonds has exceeded 1 trillion US dollars for the first time, reaching 1.1 trillion US dollars. Since 2020, the issuance scale of Development Bank has exceeded 50%, with $37.3 billion issued in this quarter. The World Bank issued the largest amount of bonds this quarter (87 bonds totaling $26.4 billion), mainly through the International Bank for Reconstruction and Development and the International Development Association.

Reference: