2024 H1 Sustainable Bond Market Report

The Climate Bonds Initiative (CBI) releases 2024 H1 Sustainable Bond Market Report, aimed at analyzing the latest trends in the global sustainable bond market.

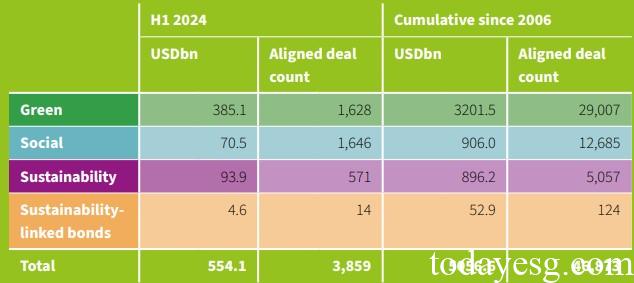

As of June 30, 2024, the total amount of global sustainable bond issuance has reached $5.1 trillion, of which $554 billion was issued in the first half of 2024, a year-on-year increase of 7% compared to the first half of 2023.

Related Post: S&P Releases Global Sustainable Bond Report

Overview of 2024 H1 Sustainable Bond Market

The total global bond issuance in the first half of 2024 is $13.2 trillion, of which sustainable bond issuance accounts for 4.2%. EUR, USD, and CNY are the main currencies for sustainable bonds, with sizes of 246 billion USD, 159 billion USD, and 26 billion USD, respectively. According to the categories of sustainable bonds, green bonds, sustainable development bonds, and social bonds rank among the top three, with issuance scales of $385.1 billion, $93.9 billion, and $70.5 billion.

In the first half of 2024, the EU had the highest total issuance of sustainable bonds, reaching $291.1 billion. The total issuance of sustainable bonds in Africa has grown the fastest, reaching $6.6 billion, an increase of 412% compared to the first half of 2023. The number of sovereign bonds issued by various jurisdictions has reached a historic high of 104 billion US dollars, an increase of 12% compared to the first half of 2023.

Overview of Green Bond, Social Bond, and Sovereign Bond Markets

As of the first half of 2024, the total issuance volume of the global green bond market reached 3.2 trillion US dollars, of which the issuance scale in the first half of the year was 385.1 billion US dollars, an increase of 14% compared to the first half of 2023. Europe is the region with the largest issuance of green bonds, reaching $237 billion, accounting for 62%. Among all issuers of green bonds, non-financial enterprises, sovereign states, and financial enterprises account for a relatively high proportion, reaching 34%, 24%, and 18% respectively. The EU is the largest single issuer of green bonds.

As of the first half of 2024, the total issuance of the global social bond market reached $906 billion, of which the issuance scale was $70.5 billion, a decrease of 21% compared to the first half of 2023. Europe, Asia Pacific, and North America have relatively high circulation volumes, with $32.4 billion, $17.8 billion, and $11.7 billion, respectively. 37% of social bond issuers are supranational institutions.

As of the first half of 2024, the total issuance volume of the global sovereign sustainable bond market reached 590.7 billion US dollars, of which the issuance scale in the first half of the year was 104 billion US dollars, an increase of 12% compared to the first half of 2023. The focus of sovereign sustainable bonds is green (81%), sustainable development (12%), and social (5%). Japan, Italy, and France have relatively high issuance scales of 10.6 million US dollars, 9.7 million US dollars, and 8.7 million US dollars, respectively.

Overview of Sustainable Development Bond and Sustainable Development Linked Bond Market

As of the first half of 2024, the total issuance volume of the global sustainable development bond market reached 896.2 billion US dollars, of which the issuance scale in the first half of the year was 93.9 billion US dollars, an increase of 8% compared to the first half of 2023. The proportion of supranational institutions, Asia Pacific and European regions is relatively high, accounting for 37%, 23% and 21% respectively. The World Bank is the largest issuer of sustainable bond markets, accounting for 34%.

As of the first half of 2024, the total issuance of sustainable development linked bonds in the global market reached 52.9 billion US dollars, of which the issuance scale in the first half of the year was 4.6 billion US dollars, a decrease of 45% compared to the first half of 2023. Europe, Latin America, and Asia Pacific regions have a relatively high proportion, accounting for 3.2 billion US dollars, 800 million US dollars, and 500 million US dollars respectively. The Netherlands is the largest issuer in the sustainable linked bond market, accounting for 25%.

Reference: