2024 Global Sustainable Bond Market Report

The Climate Bonds Initiative (CBI) releases 2024 Global Sustainable Bond Market Report, which aims to summarize the global situation of green bonds, social bonds, sustainable development bonds, and sustainable development linked bonds.

As of December 31, 2024, the Climate Bond Initiative has recorded $5.7 trillion in sustainable bonds worldwide, involving over 54000 types of bonds.

Related Post: Climate Bond Initiative Releases 2025 Sustainable Bond Market Outlook

Overview of the Global Sustainable Bond Market

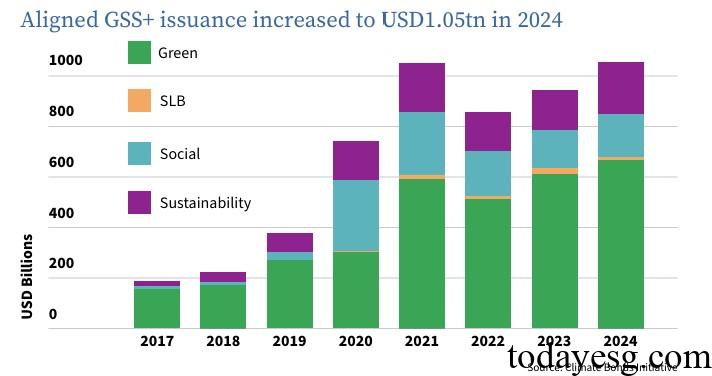

The global issuance scale of sustainable bonds in 2024 is $1.05 trillion, a year-on-year increase of 11%. The issuance scale of green bonds accounted for two-thirds of the total issuance scale, reaching 671.7 billion US dollars, a year-on-year increase of 9%. The issuance of social bonds and sustainable development bonds increased by 9% and 32% respectively, while the issuance of sustainable development linked bonds decreased by 65%.

Europe is the world’s largest sustainable bond market, with an issuance size of $475 billion in 2024, accounting for 45% of the total size. Asia Pacific (26%) and North America (16%) occupy second and third place respectively. The main currencies for global sustainable bonds are EUR (39%) and USD (30%), accounting for nearly 70% of the total. The CNY (7%) and the GBP (4%) also rank high.

Overview of the Global Green Bond Market

The global issuance scale of green bonds in 2024 is 671.7 billion US dollars, of which the issuance scale in the European market is 388.4 billion US dollars, a year-on-year increase of 16.8%. The largest issuer of green bonds is the European Union, with an issuance scale of $20.9 billion, followed by the European Investment Bank. In terms of issuer types, non-financial enterprises have an issuance scale of $202 billion, followed by financial enterprises ($142 billion) and sovereign states ($134 billion).

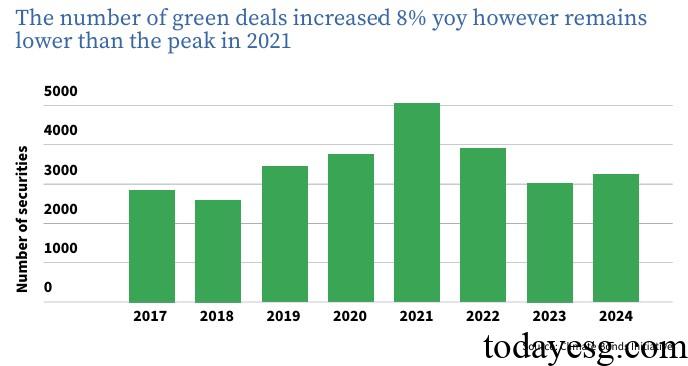

The number of global green bond issuances in 2024 is 3242, a year-on-year increase of 7.5%, but still lower than the peak in 2021. In terms of external review of green bonds, the number of Second Party Opinions (SPO) has increased by 10%, indicating an increase in investors’ attention to the qualifications of green bonds and a decrease in market greenwashing risk.

Overview of the Global Social Bond Market

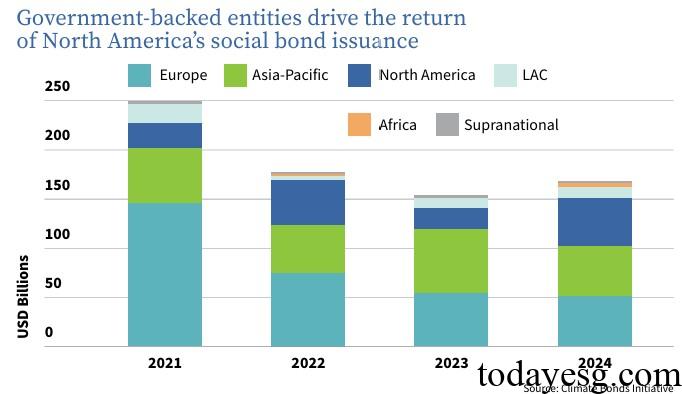

The global social bond issuance scale in 2024 is $167.6 billion, a year-on-year increase of 9.1%. Europe is the largest issuing region, with an issuance scale of 51.8 billion US dollars, accounting for 31%, a decrease of 3 billion US dollars year-on-year. The issuance scale in the Asia Pacific region was 50.3 billion US dollars, a year-on-year decrease. The scale of social bond issuance in North America was $49.4 billion, a year-on-year increase of 147%. Among them, the United States issued $48.9 billion, making it the world’s largest social bond issuing country. The scale of social bonds denominated in US dollars increased by 56% year-on-year.

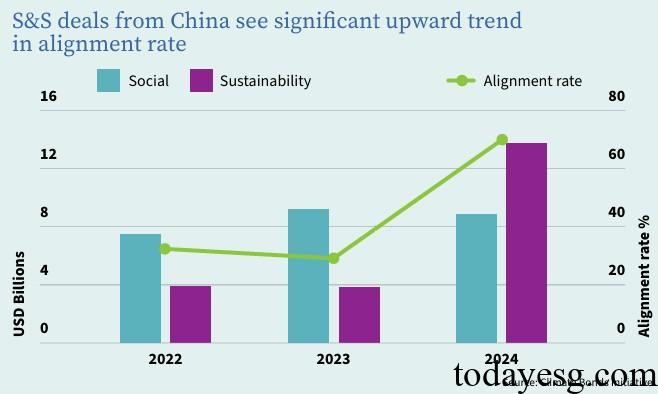

Overview of the Global Sustainable Development Bond Market

The global issuance scale of sustainable bonds in 2024 is $206.3 billion, an increase of 31% compared to the previous year. This growth mainly comes from development banks in various countries, with an issuance scale of 86.2 billion US dollars, accounting for 42%. The World Bank is the world’s largest issuer of sustainable bonds, with a total issuance size of $54.3 billion and a cumulative issuance size exceeding $300 billion.

The issuance scale of global sustainable development linked bonds in 2024 is $7.9 billion, a year-on-year decrease of 65%. The main reason for these decreases is the lack of greenhouse gas emission reduction targets for newly issued bonds and the limited coverage of greenhouse gases. The EU has the largest sustainable development linked bond market that meets the standards, reaching $5 billion.

Reference: