Sustainable Investment Taxonomy

Canada plans to introduce a sustainable investment taxonomy aimed at helping stakeholders identify green and transition economic activities, accelerating private capital investment in sustainable activities, and promoting Canada’s achievement of its net zero goal by 2050.

The Canadian government has committed in the Fall Economic Statement of 2023 to developing a sustainable investment taxonomy to meet the net zero investment requirement of CAD 125 billion to CAD 140 billion annually.

Related Post: Responsible Investment Association Releases Responsible Investment Trends Report

Background of Canadian Sustainable Investment Taxonomy

In May 2021, Canadian banks, insurance companies, and pension funds established the Sustainable Finance Action Council (SFAC) with the aim of developing sustainable finance standards for Canada. The Sustainable Finance Action Council has referred to taxonomies developed by other jurisdictions around the world and summarized the following guiding principles:

- Usable: Classification can mobilize capital to achieve net zero transition.

- Credible: The taxonomy needs to have clear, rigorous, and credible scientific standards that are consistent with the global 1.5 degree Celsius warming target.

- Comprehensive: The taxonomy needs to cover transition and green activities that play an important role in mitigating climate change, including high carbon emission industries.

- Interoperable: Taxonomies need to be compatible and interoperable with other taxonomies, while reflecting their own economic situation.

- Transparent: Taxonomies need to remain transparent, efficient, and collaborate with key stakeholders like market participants.

- Dynamic: The taxonomy needs to have a built-in review process to ensure that it can continuously update in the future.

- Holistic: The taxonomy needs to address environmental and social goals without causing significant harm (Do No Significant Harm).

Introduction to Canadian Sustainable Investment Taxonomy

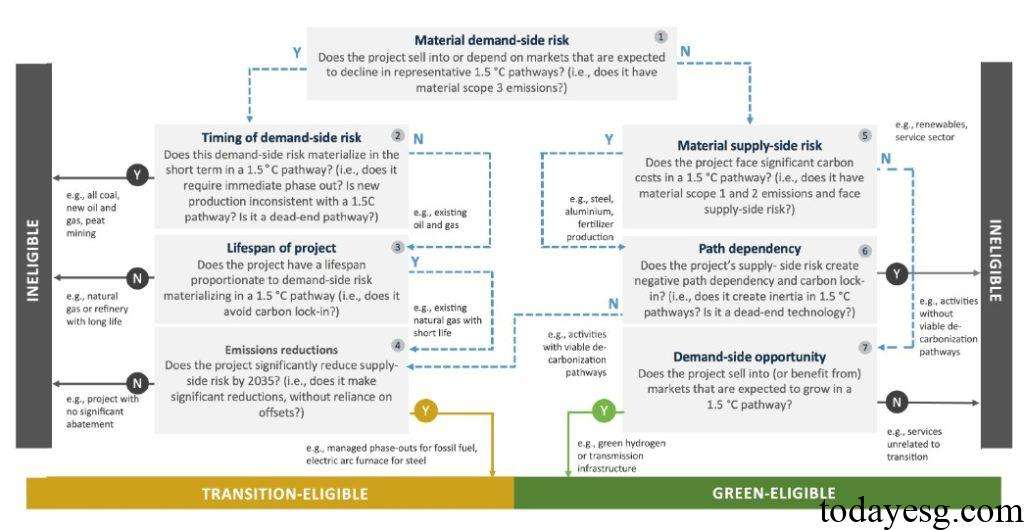

The Canadian Sustainable Investment Taxonomy defines green and transition economic activities as follows:

- Green: Activities with low or zero emissions, such as green hydrogen, solar, and wind power generation, as well as their supporting activities. Green activities do not have material Scope 1 and Scope 2 carbon emissions, but have low or zero Scope 3 carbon emissions and will benefit from the development of global net zero economy.

- Transition: Decarbonize carbon intensive activities that align with the net zero transition path. The transition activities have material Scope 1 and Scope 2 carbon emissions (but are significantly decreasing), without generating carbon lock-in and path dependence, or facing direct demand side risks.

The Canadian Sustainable Investment Taxonomy will prioritize some high carbon emitting industries, including:

- Electricity: Low emission and zero emission power generation, power storage, and grid infrastructure improvement activities.

- Transportation: Low emission and zero emission activities for various modes of transportation and infrastructure.

- Architecture: Construction, operation, and renovation of low-carbon buildings.

- Agriculture: Sustainable agricultural production, decarbonization activities in agricultural production, and sustainable forest management.

- Heavy industry: Manufacture of renewable energy equipment and technology, sustainable mining and processing of minerals, sustainable operations in cement and steel industry.

For companies, while complying with the sustainable investment taxonomy, they also need to consider setting net zero targets, formulating transition plans, and disclosing climate-related information. These actions are key to building a sustainable financial market, helping investors reduce portfolio carbon emissions and increase transparency in decision-making. The Canadian government plans to revise the Canada Business Corporations Act to impose climate related financial disclosure requirements on large private companies.

Economic activities that comply with the sustainable investment taxonomy will be eligible for green or transition labels, which can be used to label bonds. The development, implementation, and maintenance of the sustainable investment taxonomy will be the responsibility of external government organizations, in collaboration with stakeholders such as financial market participants, industries, and regulators, to maintain the scientific credibility and good practices of the taxonomy.

Reference:

Government Advances Made-in-Canada Sustainable Investment Guidelines