Global Biodiversity Finance Report

Bloomberg releases a global biodiversity finance report aimed at analyzing the latest developments in global biodiversity funding flows, investment needs, and financing deployments.

Bloomberg believes that the current global biodiversity finance gap has widened to $942 billion, far below the financing scale required to achieve the goals of the Global Biodiversity Framework.

Related Post: UNEP FI Releases Recommendations for Financing Nature-based Solutions

The Importance of Biodiversity Finance

Global economic activity is based on natural resources and ecosystem services, with a GDP of $58 trillion moderately or highly dependent on nature, which is $14 trillion higher than in 2020. However, the rate of global biodiversity loss has reached an all-time high, and there is a synergistic effect between biodiversity loss, climate change, and land degradation. Biodiversity loss may lead to greenhouse gas emissions and weaken climate adaptation capabilities.

According to the Intergovernmental Science Policy Platform on Biodiversity and Ecosystem Services, the global trend of biodiversity loss has only been reversed in Southern Africa and Western Europe. The World Economic Forum has identified biodiversity loss and ecosystem collapse as one of the most serious potential risks for the next decade. Enterprises may face physical and transition risks caused by biodiversity loss, which can affect their financial performance.

Current Status of Global Biodiversity Finance

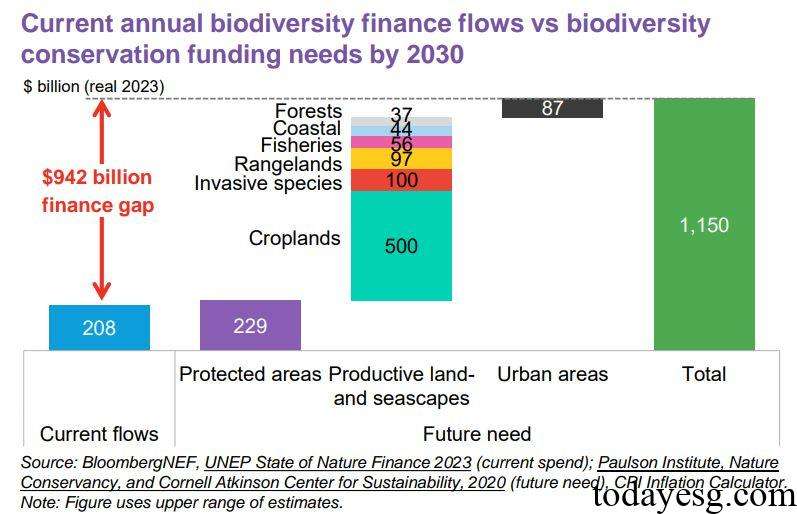

The current global biodiversity finance scale is $208 billion, higher than the $166 billion in 2021, with the public sector contributing 83% of the funding and the private sector contributing 17%. The market expects the global biodiversity finance scale to reach $1.15 trillion by 2030, equivalent to 1% of the global GDP in 2022. Based on the above prediction, the global biodiversity financing gap is $942 billion, which continues to widen compared to Bloomberg’s previous forecast of $830 billion.

The current scale of biodiversity finance is only one tenth of climate finance. To achieve the net zero goal, the world needs to invest $8 trillion annually, and to achieve the biodiversity conservation goal, the world needs to invest $1.2 trillion annually. More than half of the funds are invested in biodiversity conservation projects, while the rest are invested in projects aimed at mitigating biodiversity loss. Most biodiversity financing relies on public institutions, with 99% of funds invested domestically and only 1% invested overseas.

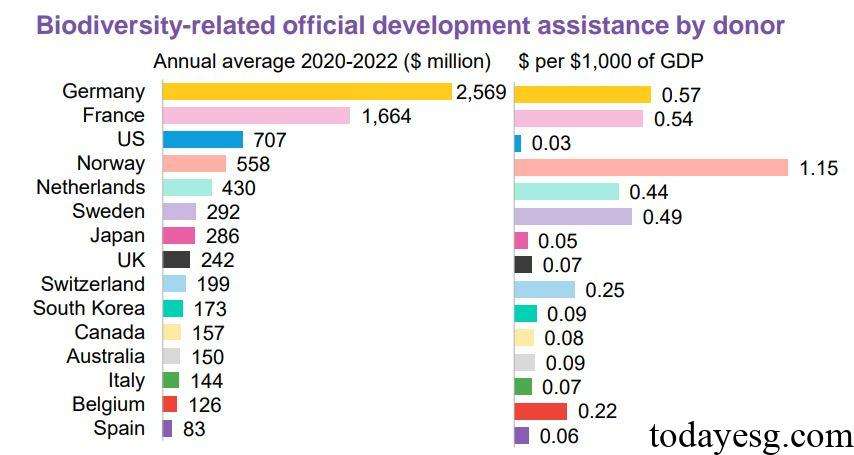

In terms of international financing for biodiversity, from 2020 to 2022, Germany ($2.6 billion), France ($1.7 billion), the United States ($700 million), Norway ($600 million), and the Netherlands ($400 million) provided the most funding support, which was invested in 149 countries. The current global harmful subsidy to biodiversity has reached $2.6 trillion. The COP15 agreement stipulates a reduction of $500 billion in environmentally harmful subsidies annually by 2030.

In terms of biodiversity financial instruments, the global debt-for-nature swap in 2023 is $2.3 billion, allowing emerging market economies to restructure their debt at lower interest rates or longer maturities and invest the raised funds in biodiversity projects. As of August 2024, the global issuance of sustainable bonds reached $235 billion, of which approximately 3.7% were directly invested in biodiversity projects (based on historical data from 2021 to 2022).

Priority for Biodiversity Finance

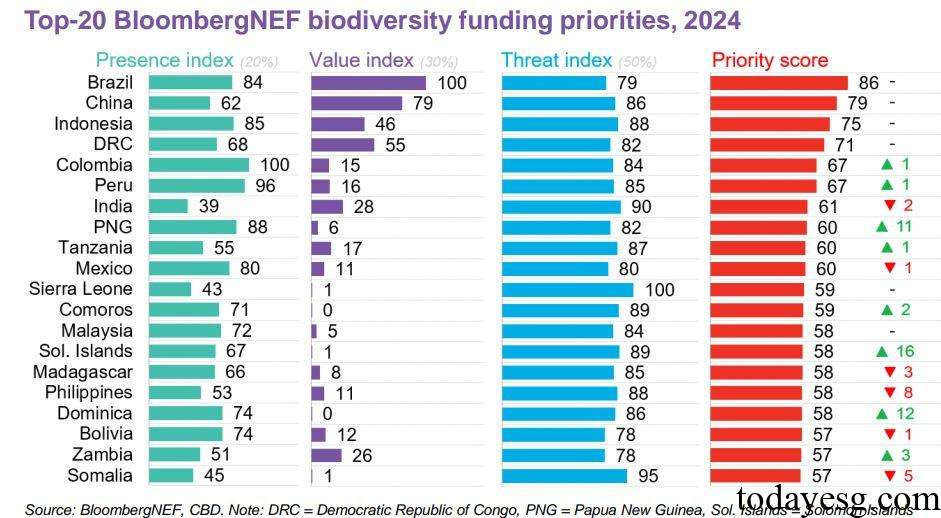

Bloomberg believes that biodiversity finance should prioritize regions with the richest, most valuable, and most vulnerable biodiversity. Bloomberg has developed a weighted framework that assigns weights of 20%, 30%, and 50% to three dimensions to measure which countries need priority access to biodiversity finance.

Bloomberg develops the Biodiversity Presence Index, Value of Ecosystem Services Index, and Biodiversity Threat Index based on the UK Biodiversity Intactness Index. Based on the weighted calculation results of the above three indices, Brazil (86), China (79), and Indonesia (75) are the three countries that should be prioritized for biodiversity finance.

Reference:

Gap Between Current Biodiversity Finance and Future Funding Needs Widens to $942 Billion