2024 Annual Report

The Asia Investor Group on Climate Change (AIGCC) releases its 2024 annual report, aimed at summarizing the progress of Asian asset managers and owners in climate action.

The members of the AIGCC manage over $28 trillion assets, with a focus on global climate change and the transition to a net zero economy, addressing climate related risks and opportunities.

Related Post: Asian Investor Group on Climate Change Releases Net Zero Investment Report

Asian Investors Climate Action

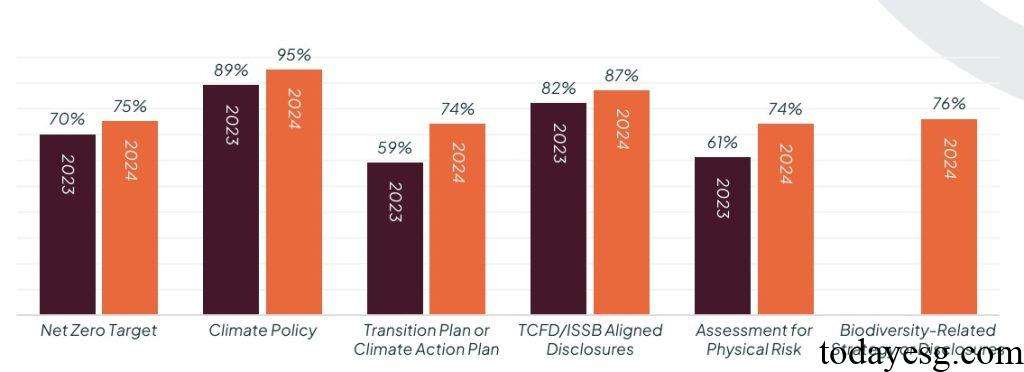

The AIGCC conducted a survey of its members to compare their progress in climate action over the past two years. This year, members have made progress in net zero targets, climate policies, transition plans, information disclosure, risk assessment, and other areas, with 95% of members already incorporating climate policies into their investment portfolios. The biggest progress in 2024 comes from the biodiversity strategy and disclosure. Last year, none of the members achieved results in this area, but this year over 70% of the members have already acted.

To help members decarbonize their investment portfolios in 2024, the AIGCC released the Net Zero Investment Framework 2.0, providing guidance for members to set climate goals and transition plans. In addition, the Net Zero Asset Managers and the Paris Aligned Investment and Asset Owners have exchanged ideas with their members to share their experience in net zero investment.

In 2024, the AIGCC established the AIGCC Asset Owner Working Group, which includes sovereign wealth funds, pension funds, and insurance companies in the net zero investment scope. At present, the working group has 30 asset owners with an asset management scale of 7.7 trillion US dollars. The working group will focus on net zero investment in emerging market economies in Asia, as well as research on renewable energy.

Asian Investors Net Zero Action

Asia is the region with the highest carbon emissions in the world, accounting for half of the world’s energy demand. Six out of the top ten countries with the highest carbon emissions are in Asia. The AIGCC mainly carries out net zero actions from two aspects, namely:

- Asian Utilities Engagement Program aims to collaborate with Asian utility companies to strengthen climate governance and information disclosure. Although the cost of applying clean energy has decreased, achieving climate goals still requires investor participation. In 2024, 20 members participated in this plan, with a cumulative asset management scale of $11 trillion.

- Climate Action 100+aims to provide net zero solutions for businesses across different industries. Many Asian companies invest in solutions such as renewable energy and disclose more detailed climate scenario analysis results. Investors have already helped these companies make progress in decarbonization and transition and will collaborate with stakeholders in the future to develop transition plans for companies from different backgrounds.

AIGCC Key Themes in 2024

The 2024 AIGCC acted on the following key themes:

- Nature, Forests, and Land Use: The AIGCC has released a report on natural tipping points, outlining the Asia Pacific region’s economic dependence on nature and providing guidance for investors to assess and manage natural risks. The group also collaborated with the World Wildlife Fund to launch training modules for analysts to help them understand natural issues.

- Physical Risk, Adaptation, and Resilience: AIGCC evaluates the transition plans and policies of nine Asian countries, recommends accurate and actionable climate data to regulatory agencies, and encourages private sector participation in transition planning. The group will collaborate with regulatory agencies to develop resilience plans in the future.

- Just Transition: The AIGCC has launched a Just Transition Working Group to encourage members to incorporate fair transition into investment decisions and collaborate with Climate Action 100+to promote just climate action.

Reference: