Amending Sustainable Finance Disclosure Regulation

Three European financial regulatory authorities releases documents proposing amendments to the Sustainable Finance Disclosure Regulation (SFDR) to improve transparency in information disclosure and reduce the risk of greenwashing.

The three regulatory authorities that proposed this proposal are European Banking Authority, European Securities and Markets Authority, and European Insurance and Pension Authority. Last December, they released documents amending the definition, methodology of Principal Adverse Impact (PAI) in Sustainable Finance Disclosure Regulation.

Related Post: European Financial Regulators Revise SFDR Regulatory Technical Standards

Analysis of Current Sustainable Finance Disclosure Regulation

In previous tests, three financial regulatory authorities found that many investors found information based on Sustainable Finance Disclosure Regulations to be very complex and difficult to read and understand. Meanwhile, asset management companies have begun to use Article 8 and Article 9 for marketing and sales activities and classify their financial products. Regulatory authorities believe that in the absence of a clear classification method for sustainable funds, these classifications may lead to greenwashing risks and it does not align with their intents.

To address the current problems, regulatory authorities plan to introduce a new product classification system and a new sustainability indicator system to simplify information disclosure and provide investors with clearer sustainable information. At the same time, the application scope and information disclosure process also need to be modified to simplify the actions of participants.

For Companies: A New Product Classification System

The regulatory authorities initially plans to use the Sustainable Finance Disclosure Regulation as a regulation for information disclosure, but currently market participants have applied Article 8 and Article 9 as sustainability labels to products. Article 8 states that the promotion of environmental or social characteristics is very broad, making it difficult for investors to have a clear understanding of the sustainability of the product. Meanwhile, market participants have different understandings of the definition of sustainable investment, leading to problems with fund disclosure in Article 9.

Regulatory authorities suggest introducing a product classification system with sustainable features to replace the existing Article 8 and Article 9 fund classification methods. The new product classification system will include two categories, namely:

Sustainable product category: Investing in assets that already possess environmental and social sustainability characteristics. In the future, regulators can consider designing the environmental and social categories separately or merging them into one category. Products needs to meet the minimum sustainable investment threshold, which will be calculated based on the economic activity definition of the EU Taxonomy. The other parts that do not comply within the threshold must at least comply with the Do Not Significant Harm (DNSH) principle.

Transition product category: Investing in assets that are currently unsustainable but will develop into sustainable assets in the future. These products can be based on key performance indicators of the EU Taxonomy, reflecting the gradual improvement of sustainable characteristics and the mitigation of major adverse effects (PAI) at the product level, and disclosing the decarbonization trajectory and transition plan of the products. Such products need to provide investors with a clear understanding of their short-term and long-term sustainability goals and performance.

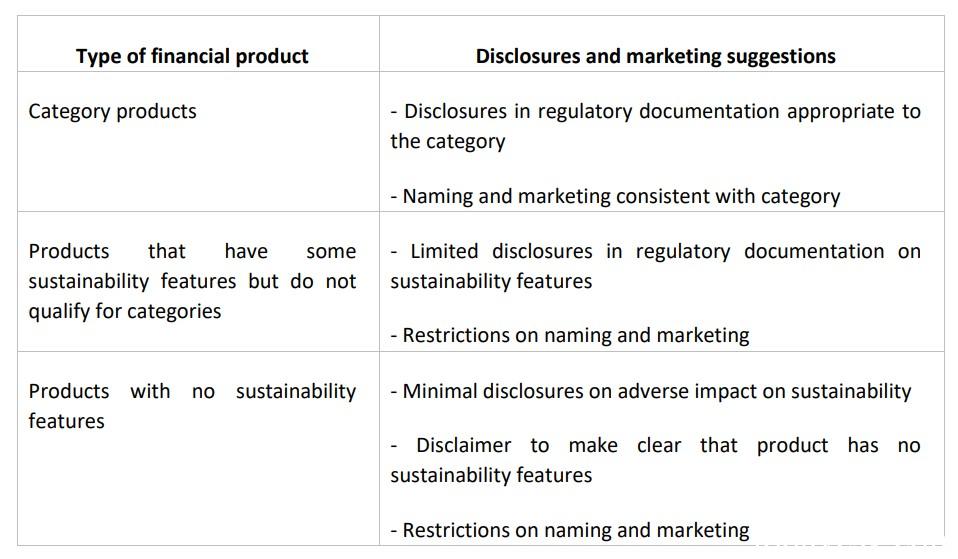

Under the new product classification system, funds can belong to either the sustainable product category or the transitional product category, or they can neither belongs to the two categories. In cases of non-compliance, funds can also be divided into funds with sustainable characteristics and funds without sustainable characteristics at all. Funds with sustainable characteristics need to disclose their sustainable characteristics in documents, but restrict the use of ESG or sustainable terminology in naming and marketing. Funds that do not have sustainable characteristics should clearly disclose that they do not have sustainable characteristics and cannot use ESG or sustainable terminology in naming and marketing. However, these products can disclose some negative impacts on sustainability to distinguish them from similar products.

For Investors: A New Sustainability Indicator System

Regulatory authorities believe that investors find it difficult to understand the sustainable goals and characteristics of different products when reading information disclosures. However, using sustainable indicators to measure financial products and using different letters and colors can help investors identify the sustainable characteristics of the products. At the same time, the EU already has numerous documents that can serve as methods for calculating sustainability indicators, ensuring that the sustainability indicator system does not conflict with existing regulations.

Regulatory authorities suggest setting up a new sustainable indicator system to provide investors with an intuitive introduction to sustainable characteristics. These sustainability indicators can appear separately in each product category or be reused in different product categories. The new sustainable indicator system also simplify communication between participants and investors.

Reference:

Joint ESAs Opinion on the Assessment of the Sustainable Finance Disclosure Regulation (SFDR)