Government Climate Tilted Bond Indices

Bloomberg launches the Government Climate Tilted Bond Indices, aiming to provide government bond investors with new benchmarks for the low-carbon transition.

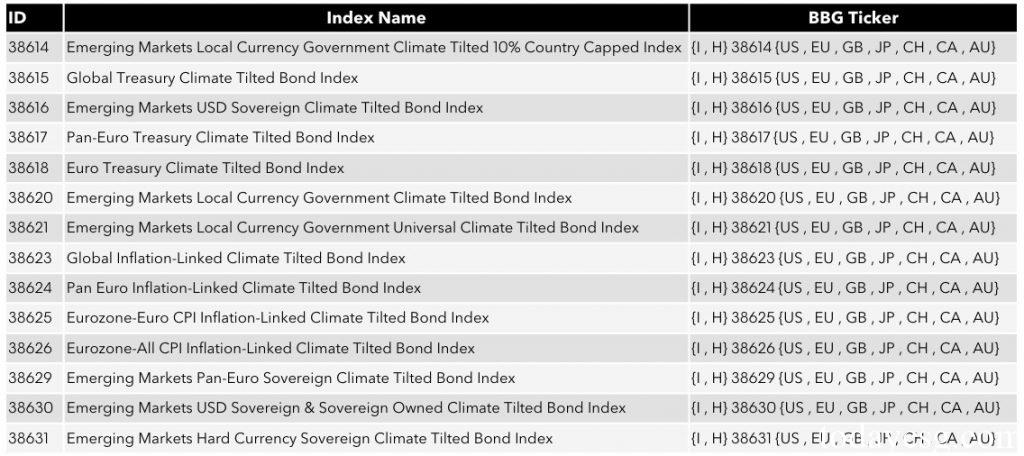

The Bloomberg Government Climate Tilted Bond Indices include a total of 14 indices, focusing on countries that have made progress in climate transition, and considering climate-related risks and opportunities.

Related Post: S&P Releases the First Climate Aware Index for Commodities

Introduction to the Government Climate Tilted Bond Indices

Bloomberg uses Sustainable Finance Solutions (SFS) to adjust the weights of the Bloomberg Government Bond Indices to reflect the Government Climate Score (GOVS) of different countries. These climate scores assess progress towards different governments’ climate goals and are weighted by three categories:

- Carbon Transition: Based on the difference between the Nationally Determined Contributions (NDC) and the Network for Greening the Financial System (NGFS) scenarios, Bloomberg measures a country’s historical, current, and future carbon emission performance.

- Power Transition: Measures a country’s performance in decarbonizing its power sector. On the one hand, it focuses on the application of fossil fuels and renewable energy, and on the other hand, it focuses on clean energy investment (wind energy, solar energy investment data, etc.).

- Climate Policy: Measures a country’s progress between net zero commitments, renewable energy policies and green bond issuance.

After calculating the Government Climate Score (GOVS) for 134 countries, Bloomberg applied it to different government bond indices to calculate new climate-tilted indices. As the Government Climate Score is updated, Bloomberg will adjust the weights of the new index at the end of each quarter. In addition to the 14 indices, users can also apply other climate tilt methods to obtain personalized result.

Reference: