Central Bank Green Monetary Policy Report

The Network for Greening the Financial System (NGFS) releases a report on central bank green monetary policy, aiming to build a comprehensive framework for green monetary policy operations.

The NGFS believes that extending green monetary policies to the asset and liability ends of central banks can reduce climate related financial risks and accelerate the allocation of funds related to climate transition.

Related Post: NGFS Releases Second Edition of Guide on Climate-related Disclosure for Central Banks

Background of Central Bank Green Monetary Policy

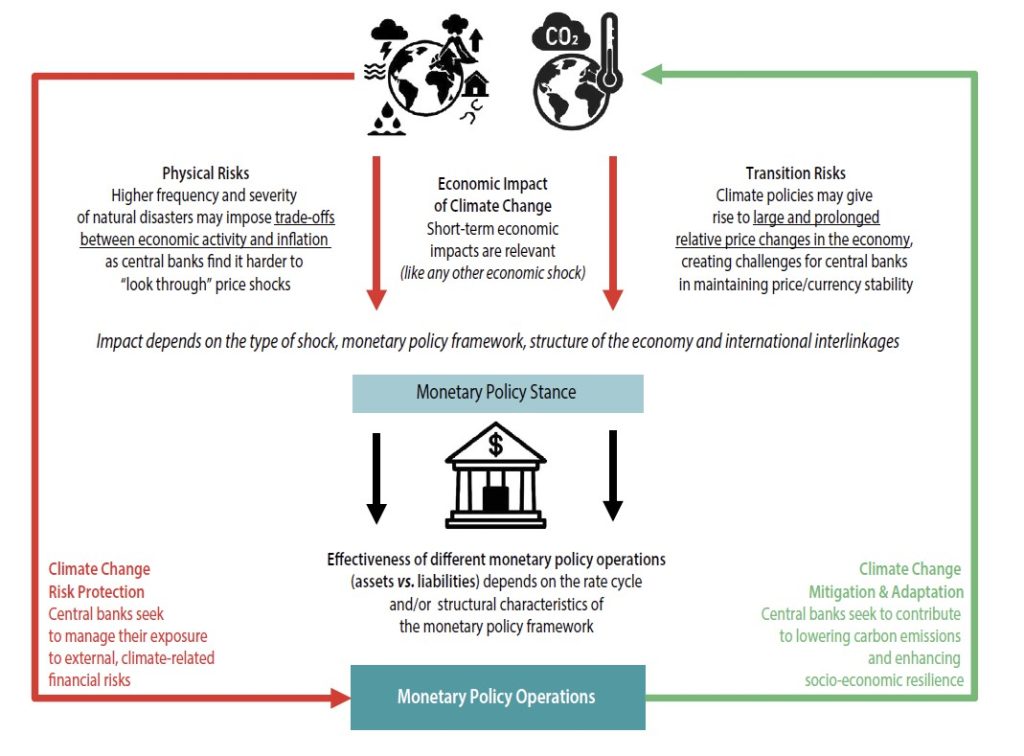

Climate change has an impact on economic activity, monetary policy transmission, and financial stability. Central banks need to consider the impact of climate related financial risks and bear the responsibility for both climate change mitigation and adaptation. The impact of climate change on central bank monetary policy includes:

- Physical risk: The frequency and severity of natural disasters increase the challenge for central banks to respond to price shocks.

- Economic impact: Climate change may have short-term effects on the economy.

- Transition risk: Climate action may lead to long-term price changes, disrupting central bank policies to maintain price stability.

The factors that central banks consider when facing climate change include:

- Climate change risk protection: Managing external climate-related financial risks.

- Climate change mitigation and adaptation: Supporting low-carbon transition to enhance economic resilience.

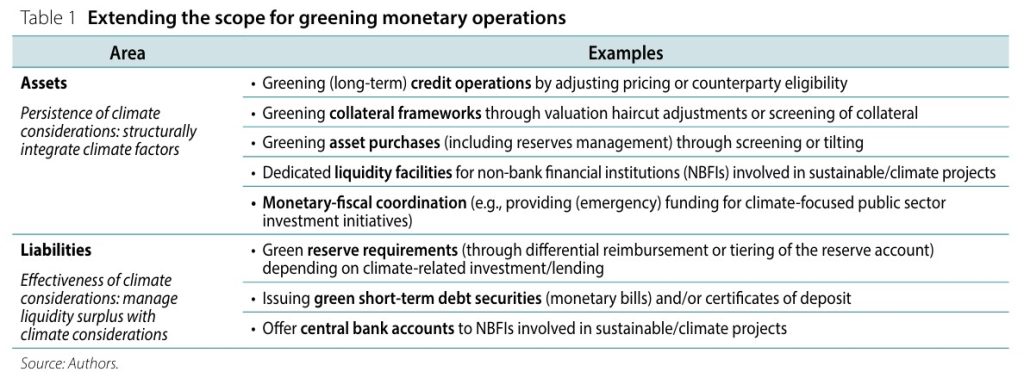

At present, the central bank’s efforts to address climate change are focused on the asset side, for example, the central bank can prioritize climate resilient bonds in its asset purchase actions. The central bank can also issue green collateral policies to increase the financial market’s preference for green products. However, these operations by the central bank are cyclical, and the effectiveness of these policies may vary over time. The NGFS believes that the central bank can consider implementing a green monetary policy to address climate change from the debt side.

Introduction to Central Bank Green Monetary Policy

The green monetary policy of the central bank can be classified from the asset side and liability side, where the asset side includes:

- Green credit business: Adjust the pricing or counter party qualifications of credit business.

- Green collateral framework: Adjust the discount of collateral or screen green collateral.

- Green asset purchase: Purchase green financial assets.

- Policy coordination: Provide funding for climate related public sectors.

The NGFS focuses on debt side monetary policies, which include:

- Green reserve: Central banks typically use the reserve requirement ratio as a key policy tool to manage liquidity. Raising the reserve requirement ratio will reduce liquidity, while lowering the reserve requirement ratio will increase liquidity. Green reserve refers to adjusting the reserve ratio for sustainable development financing, providing more liquidity for sustainable financing banking business. For example, for green financing, central banks can lower reserve requirements while ensuring that these funds are used for sustainable projects.

- Green central bank short-term bonds: Short term bonds issued by the central bank are a market-based liquidity management tool, and the central bank can issue short-term bonds through open market operations to absorb excess liquidity. The central bank can incorporate climate factors into short-term bonds, such as stipulating that bond funds are used for green projects and establishing impact tracking mechanisms. The central bank can finance long-term assets by issuing these short-term bonds and incorporate climate factors into investment portfolio management.

Reference:

Greening Monetary Policy Operations: Exploring Additional Options