Climate Transition Toolkit

Morningstar releases a new version of its climate transition toolkit, aimed at providing investors with climate transition related data, tools, and analysis to meet the growing demand for sustainable information.

Morningstar believes that the climate transition toolkit can help investors assess a company’s readiness for transition and make clearer investment decisions.

Related Post: OECD Releases Report on Climate Transition Bond Market

Background of Climate Transition Toolkit

The total asset size of global climate related funds in the first half of 2025 is approximately $650 billion. Morningstar’s research in November 2025 found that more than half of these funds’ assets are invested in climate transition. Despite the pressure on global ESG development, investors are still concerned about the impact of climate on potential investment returns and actively managing climate risks. Many investors hope to acquire advanced tools that meet information disclosure requirements and enhance competitiveness.

Morningstar believes that investors are shifting their focus from carbon reduction to investing in companies suitable for low-carbon transition, which requires research and evaluation of key indicators of companies, while measuring their actions based on the commitments they have made. With the development of climate transition investments, climate transition toolkits can prepare for the constantly changing market.

Introduction to Climate Transition Toolkit

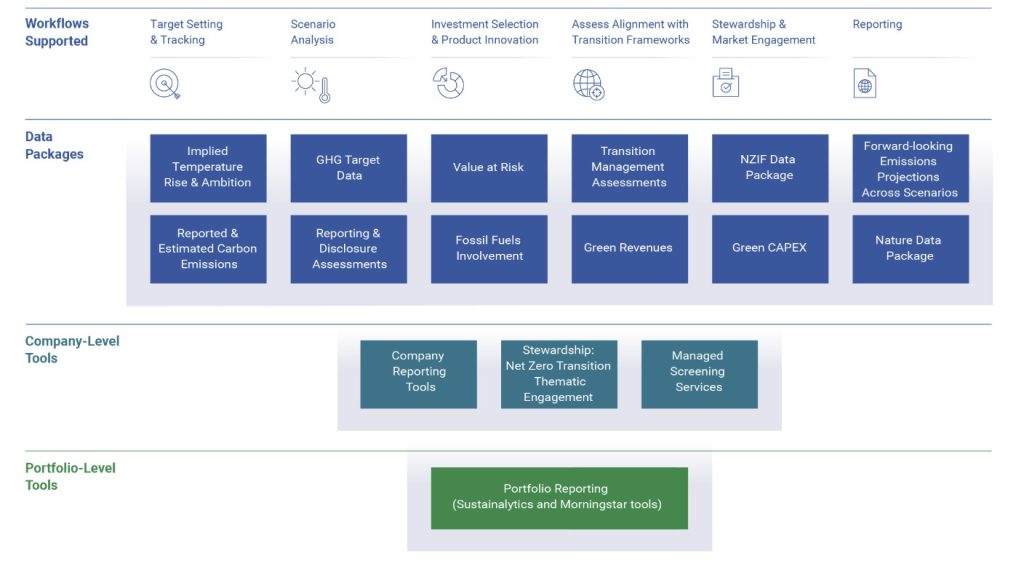

The Climate Transition Toolkit aims to help investors at every stage of climate transition investment, including:

- Target Setting and Tracking: Develop credible decarbonization targets, measure portfolio carbon emissions, and consider the degree to which the targets match multiple transition scenarios. The tools include implicit temperature rise, transition management scoring, annual and cumulative emission forecasts, and carbon emission data.

- Scenario Analysis: Measure portfolio resilience in different climate scenarios through carbon emission budgeting, assess asset transition risks, and conduct stress tests. Tools include Value at Risk, annual and cumulative emission forecasts, and carbon emission data.

- Investment Selection and Product Innovation: Identify and select companies with robust climate strategies to help investors screen, compare, and build investment portfolios that can manage transitional risks. Tools include implicit temperature rise, value at risk, transition management score, carbon emission data, green income, green expenditure, and natural data.

- Assessment Alignment with Transition Frameworks: Use standardized data to evaluate the differences between investment portfolios and climate transition frameworks. Tools include net zero investment data solutions and implicit temperature rise.

- Stewardship and Market Engagement: Support effective proactive management and measure key performance indicators. Tools include implicit temperature rise, value at risk, carbon emission data, and net zero plan.

- Reporting: Complete climate information disclosure, provide portfolio analysis, and meet regulatory requirements. Tools include implicit temperature rise, transition management score, carbon emission data, and value at risk.

In addition to this basic data, Morningstar also provides tools at the company and portfolio levels:

- At the company level: Corporate disclosure tools, engagement and screening services for net zero transition.

- Portfolio level: Morningstar’s proprietary portfolio disclosure tool.

Reference:

Morningstar Sustainalytics Launches Updated Climate Transition Toolkit