2025 Global Sustainable Fund Report

Morningstar released 2025 Global Sustainable Fund Report, which aims to summarize the asset size and cash flow of sustainable funds.

As of the fourth quarter of 2025, there are a total of 7064 sustainable funds worldwide, with Europe having the highest number at 5231, accounting for 74%.

Related Post: Morningstar Releases 2025 Q3 Global Sustainable Fund Report

Global Sustainable Fund Asset

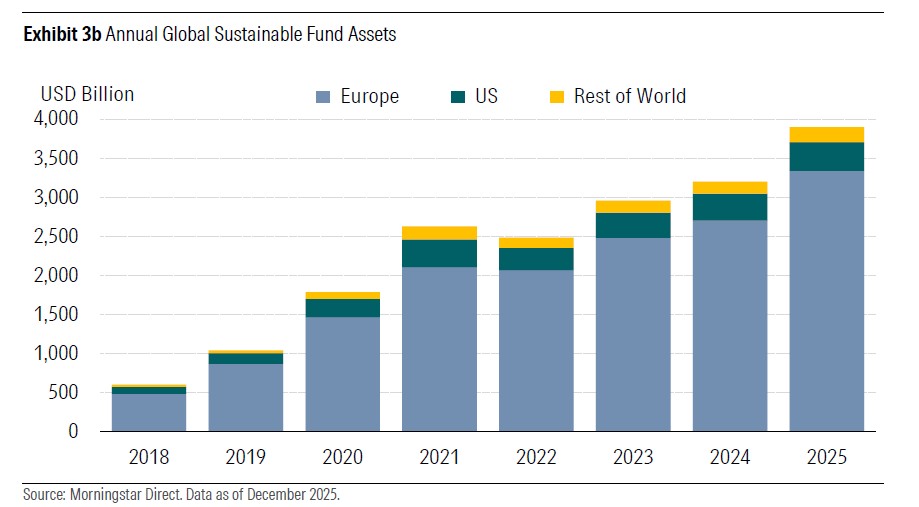

In the fourth quarter of 2025, the global sustainable development fund grows by 4%, with a total size of 3.9 trillion US dollars, mainly due to market growth. The total assets of sustainable funds in Europe and the United States are relatively high, reaching $3.3 trillion and $368 billion respectively. Since 2018, the total assets of global sustainable development funds have increased more than six times, with Europe and the United States accounting for 86% and 9% respectively. In the fourth quarter of 2025, there were 40 new sustainable funds added globally, the lowest among the twelve quarters since 2023, with 22 new funds added in Europe and 1 new fund added in the United States.

In terms of asset categories, the main components of global sustainable funds are equity funds and bond funds. For example, in the European Sustainable Fund, equity funds account for 63% and bond funds account for 24%. Equity funds account for 84% and bond funds account for 14% of sustainable funds in the United States. In the fourth quarter of 2025, 117 sustainable funds were closed in Europe because funds need to provide competitive returns to attract capital inflows. Morningstar believes that only sustainable fund strategies with better performance can continue to exist in the future.

Global Sustainable Fund Flow

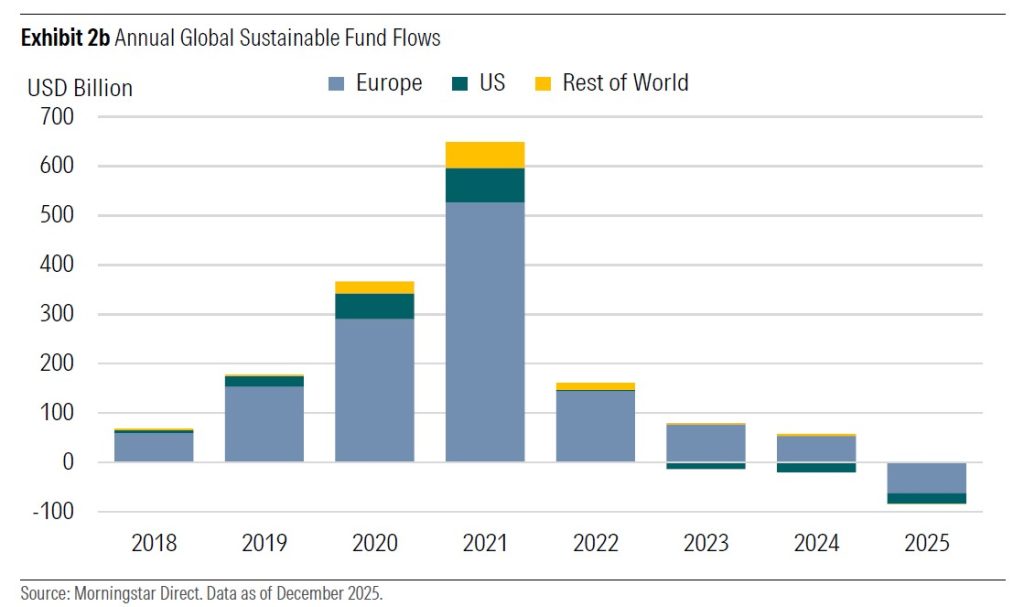

In 2025, the total outflow of global sustainable funds is $84 billion, while a net inflow of $38 billion recorded in 2024, marking the first annual outflow of funds since 2018. In the first year of the European Sustainable Fund, there was a capital outflow, and in the United States, there has been a capital outflow for the third consecutive year. From the analysis of fund categories, passive managed sustainable development funds recorded a capital outflow of $35 billion, while active managed funds recorded a capital outflow of $49 billion. By contrast, the global fund market recorded a total inflow of $1.7 trillion in 2025, significantly higher than that of sustainable development funds.

The main reasons for the outflow of funds recorded by the Sustainable Fund in 2025 include policy tightening and poor fund performance. In Europe and the United States, regulatory agencies have relaxed ESG policies and reduced the burden of corporate information disclosure. In 2025, 26% of ESG indices outperform non ESG indices, while in 2024, 45% of ESG indices outperform non ESG indices. Although many surveys indicate that investors are very interested in sustainable investment, the strong returns of carbon intensive industries have attracted more funds.

Global Sustainable Fund Regulatory Policy

As of the fourth quarter of 2025, global sustainable fund regulations include:

- Europe: The EU plans to revise the Sustainable Finance Disclosure Regulation (SFDR), dividing sustainable funds into three categories: transition, ESG basis, and sustainable development.

- Asia: The Hong Kong Monetary Authority has released FAQs on green and sustainable investment products, clarifying the obligations of asset management companies in product due diligence, suitability assessment, and information disclosure.

Reference:

Global Sustainable Fund Flows: Q4 and Full-Year 2025 in Review