Sustainability Disclosure and Financial Performance Report

The Global Reporting Initiative (GRI) releases sustainability disclosure and financial performance Report, aimed at analyzing the relationship between sustainability reporting and corporate financial performance.

The Global Reporting Initiative summarizes 30 empirical studies and finds that there is a positive correlation between most sustainable disclosures and financial performance, but differences in research background, methods, and indicators can lead to significant differences in results.

Related Post: Relationship between Corporate Climate Disclosure and Financial Statements

Theory of Sustainability Disclosure and Financial Performance

The report suggests that the transmission mechanism between sustainability disclosure and financial performance includes:

- Reputation advantage and ability to obtain funding: Companies that engage in sustainable disclosure are more likely to obtain funding, have higher levels of stakeholder trust, and face fewer funding constraints. Some studies have found that the equity cost of companies that disclose climate risks is lower than that of undisclosed companies, which may be due to investors increasing the climate risk premium for undisclosed companies.

- Improvement in operating costs and efficiency: Companies that engage in sustainable disclosure can better respond to environmental and policy challenges, optimize data utilization, reduce waste, thereby reducing operating costs and improving profitability. Some studies suggest that these companies can better adapt to changes in the legal and regulatory environment, avoid fines, and gain an advantage in industry competition.

- Business resilience and risk mitigation: Sustainable disclosure can help businesses identify and reduce business risks. Research has found that companies with higher ESG ratings have lower financial volatility, while companies with higher levels of sustainable disclosure are able to achieve more stable returns. This characteristic is more pronounced in industries with significant environmental impact.

Relationship between Sustainability Disclosure and Financial Performance

This report analyzes the relationship between sustainability disclosure and financial performance based on two types of financial indicators:

- Accounting related profit indicators: Return on Assets (ROA) and Return on Equity (ROE). The return on assets reflects the efficiency of a company in creating profits using its total assets, while the return on net assets reflects the return on investment of shareholders.

- Stock market performance indicators: Valuation-based indicators, such as Tobin’s Q value. Tobin’s Q value refers to the ratio of a company’s market value to its asset replacement cost. Return-based indicators such as stock returns, earnings per share, and abnormal returns. These return indicators reflect the overall valuation of a company by the market and can also reflect the difference between actual and expected stock returns.

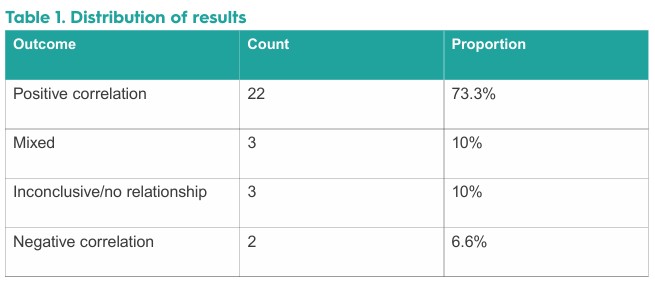

In 30 empirical studies on sustainability disclosure and financial performance, 73% believe that there was a positive correlation between the two, while 10% believe that the relationship could be either positive or negative. Another 6% believe that there is a negative correlation between the two. Specific factors can also affect the relationship between sustainability disclosure and financial performance. Industries with higher environmental and social risks have more significant financial benefits for their companies from sustainability reports. In jurisdictions with more comprehensive regulatory policies, companies can obtain greater financial benefits from sustainable reporting. In addition, differences in data sources, disclosure methods, and scoring frameworks among different studies can also affect the conclusions.

Some studies have found that there may be an inverted U-shaped relationship between sustainability disclosure and financial performance, where high-quality sustainable reporting in the early stages can improve a company’s financial performance, but beyond a certain critical point, the benefits of continued improvement in sustainable reporting quality will decrease. This indicates that although sustainable disclosure can increase stakeholder trust, excessive reporting can lead to increased resource investment, offsetting the benefits it brings. Therefore, companies need to balance the sustainable information needs of stakeholders.

Reference:

From Impact to Income How Sustainability Reporting Affects the Bottom Line